Getting to know CBA’s new Chief Economist

Since joining Commonwealth Bank as Chief Economist in March, Luke Yeaman has stepped into the role during a time of heightened global uncertainty. ...

23 April 2025

Anzac Day: From the home front to the frontline

Supporting our service people overseas was a matter of pride and honour for CBA staff during World War Two while not forgetting those most in need ...

22 April 2025

Anzac Day at Commonwealth Bank

Every year, on 25 April, Australians come together to commemorate those who have served the nation in time of war, conflict and on peacekeeping ope...

22 April 2025

CommBank builds a brighter future for Bendigo

CBA backs Bendigo for the win on the back of strong regional growth.

17 April 2025

CBA warns small business customers to be extra vigilant this Easter: SMEs step up battle against scams

More businesses are taking proactive steps to protect themselves from scams but criminals are likely to ramp up their activity over Easter.

15 April 2025

Household spending lifts in March but consumers remain cautious

Interest rate cuts are expected to fuel a consumer recovery in 2025, however rising global uncertainty could weigh on sentiment.

11 April 2025

CBA Emergency Assistance for flood affected areas in Queensland and NSW

Special arrangements are in place to assist customers who may need additional support in flood affected areas in Queensland and NSW.

1 April 2025

CommBank establishes Seattle Tech Hub to further accelerate its AI capability

Recognising the role of technology and innovation in delivering excellent customer experiences.

27 March 2025

Less than 10% of Aussies would discuss their scam experience with family

The research also reveals people’s confidence in spotting a scam decreases with age.

24 March 2025

Beyond the belt: New hotspots emerge as movers migrate past commuter communities

Regional living prevails as CommBank and the Regional Australia Institute’s latest Regional Movers Index reveals Australians are migrating further ...

19 March 2025

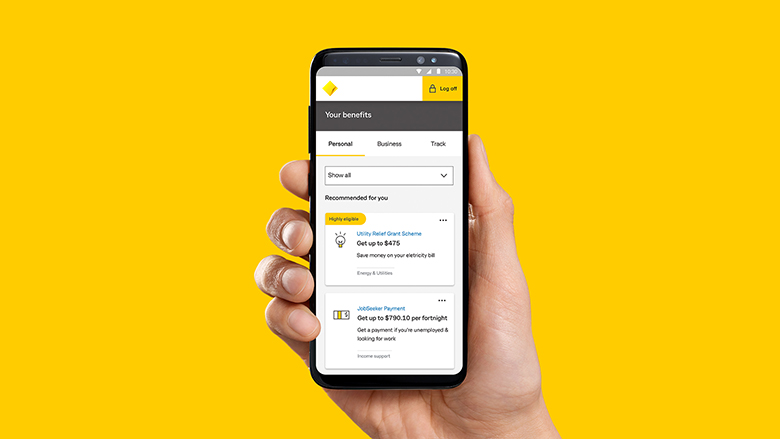

Helping Australia’s small businesses unlock value and reduce costs with CommBank Yello for Business

CBA Business Bank’s customer recognition program is now available to more than 340,000 small business customers.

18 March 2025

Board renewal

Chair of the Commonwealth Bank of Australia (CBA), Paul O’Malley, today announced the appointment of Alistair Currie to CBA’s Board as an Independe...

17 March 2025

CommBank expands strategic partnership with generative AI company, Anthropic

Partnership to further CBA’s ambition to reimagine customer experiences.

14 March 2025

Stories from the frontline: ex-Tropical Cyclone Alfred

CBA’s frontline teams in southern QLD and northern NSW stepped up support in the lead up to landfall.

14 March 2025

No love this Valentine’s Day as spending falls in February

Constrained consumers continue to cut back on discretionary spending in 2025.

13 March 2025

Courage and community: Ingham stands strong after floods

How the Ingham branch team showed up for their customers and community, as floods devastated the North Queensland town

6 March 2025

CBA Emergency Assistance for areas affected by Tropical Cyclone Alfred on the east coast of Australia

Special arrangements are in place to assist customers who may need additional support across south-east Queensland and northern New South Wales.

5 March 2025

CBA completes divestment of remaining shareholding in VIB

Commonwealth Bank of Australia (CBA) today announces that it has completed the sale of its remaining 4.4% shareholding in Vietnam International Com...

5 March 2025

CommBank strengthens online security

CommBank introduces NetBank multi-factor authentication to help protect customers from common cybercrime threats, including online banking fraud.

4 March 2025

One million reasons to smile: CommBank and Clown Doctors celebrate a joyful milestone

To help sick kids across the country, CommBank branches kick off a month of fundraising for the Clown Doctors – with all donations in March matched...

3 March 2025

Lifeblood and CBA employees’ gift of life to Australians in need

CommBank’s first dedicated team donation day sees a record-breaking number of team donations in a single day, to support the Australian Red Cross L...

28 February 2025

x15ventures names Gable as Xccelerate winner

The Seattle startup secures investment from CommBank’s venture-scaling arm as part of Xccelerate24, which received applications from global data an...

19 February 2025

CBA announces interest rate reductions - February 2025

The Commonwealth Bank has responded to the Reserve Bank of Australia’s cash rate decision.

18 February 2025

CBA reduces interest rates on business loans - February 2025

The Commonwealth Bank has responded to the Reserve Bank of Australia’s cash rate decision, reducing rates on eligible business lending products.

18 February 2025

CBA partners with NSW Government to deliver banking services, building a brighter future for people, businesses and communities

CBA to deliver innovative payments and transaction banking services at scale, to shape the State’s digital future.

14 February 2025

CBA Emergency Assistance for Tropical Cyclone Zelia affected areas in WA

Commonwealth Bank is providing Emergency Assistance to Tropical Cyclone Zelia affected areas across the Pilbara region of Western Australia.

14 February 2025

Household spending flat in January as Aussies take a break after stronger fourth quarter

Spending stalled at 153.4 in January, following a strong sales spending to finish 2024.

13 February 2025

Telstra and CommBank expand collaboration to increase fraud detection rates

New ‘Fraud Indicator’ technology launched to help protect Australians as government data confirms close to 200,000 people experienced identity thef...

10 February 2025

Shining a light on Hidden Disabilities

CommBank teams step up to proactively help more customers access banking with dignity and ease.

6 February 2025

CommBank and AWS expand collaboration to deliver global best cloud and AI capabilities, enabling idea to production in six weeks

CommBank has entered a five-year strategic collaboration with Amazon Web Services (AWS) to continue as the bank’s preferred cloud provider. This ag...

4 February 2025

CBA Emergency Assistance for flood affected areas in North and Far North Queensland

Commonwealth Bank is providing Emergency Assistance to flood-affected areas across North and Far North Queensland.

3 February 2025

CBA backs prefabricated construction industry to boost housing supply

An industry-leading collaboration aims to help off-site construction reach scale, while lending changes will support customers buying prefabricated...

31 January 2025

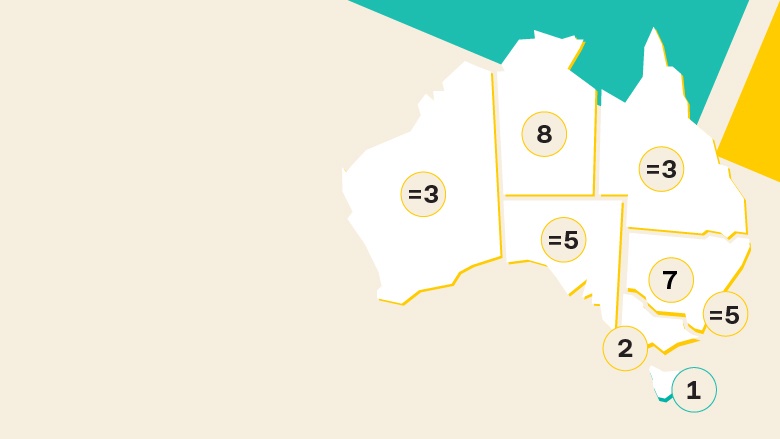

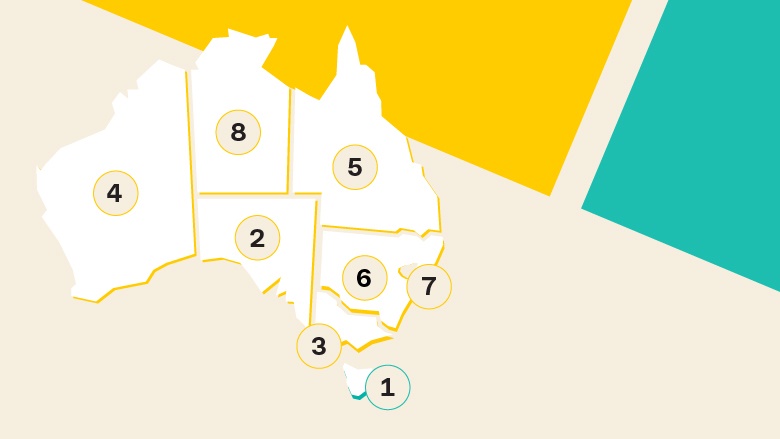

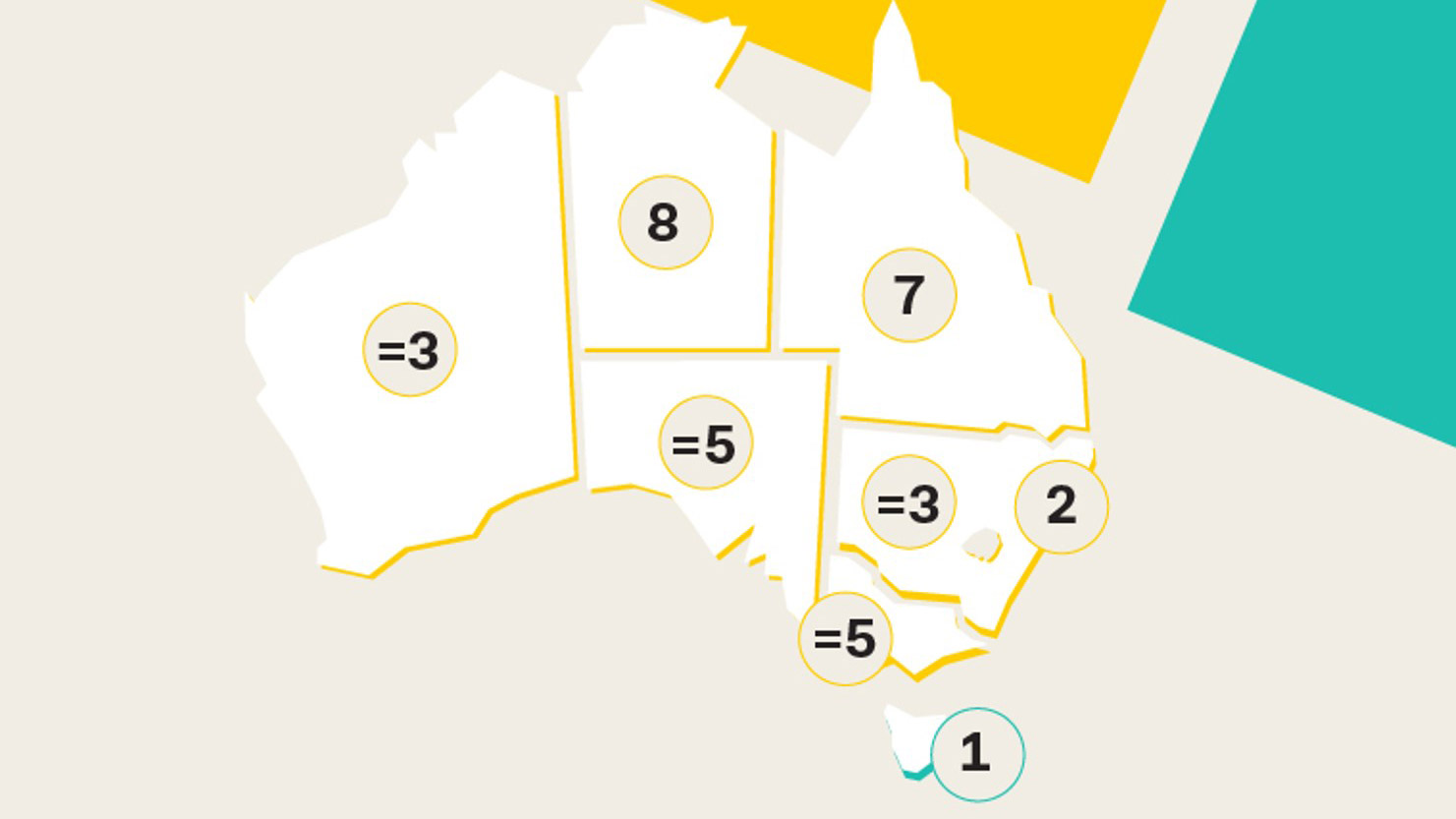

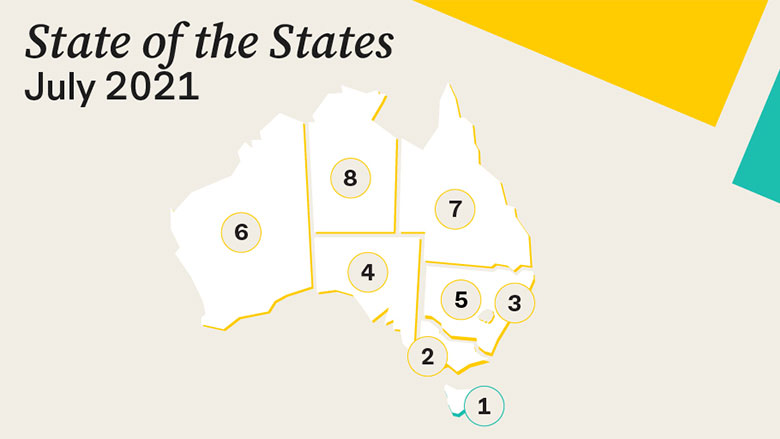

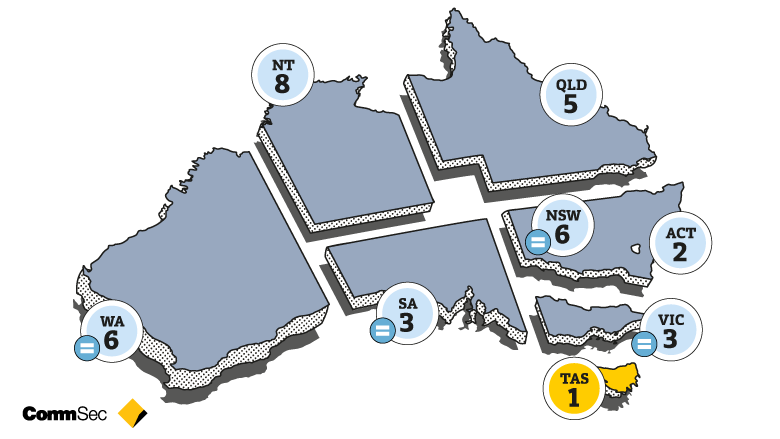

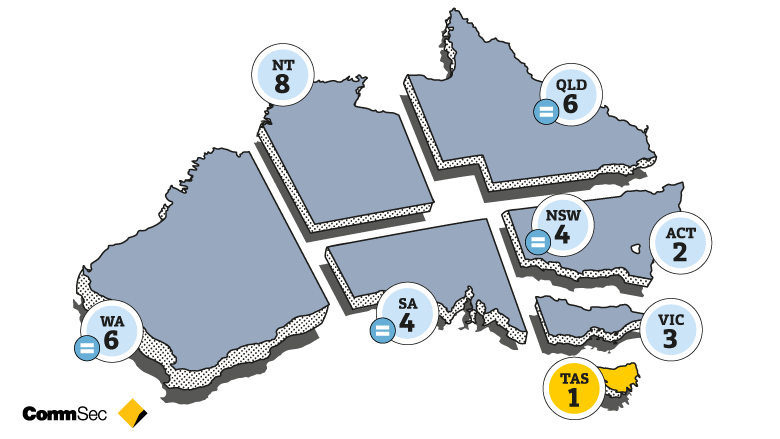

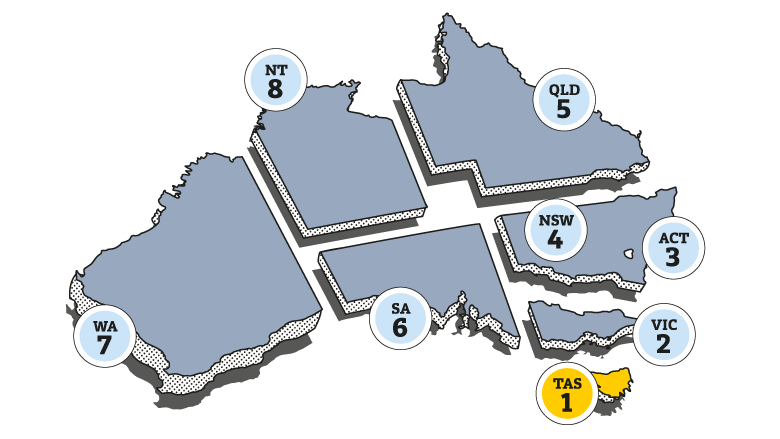

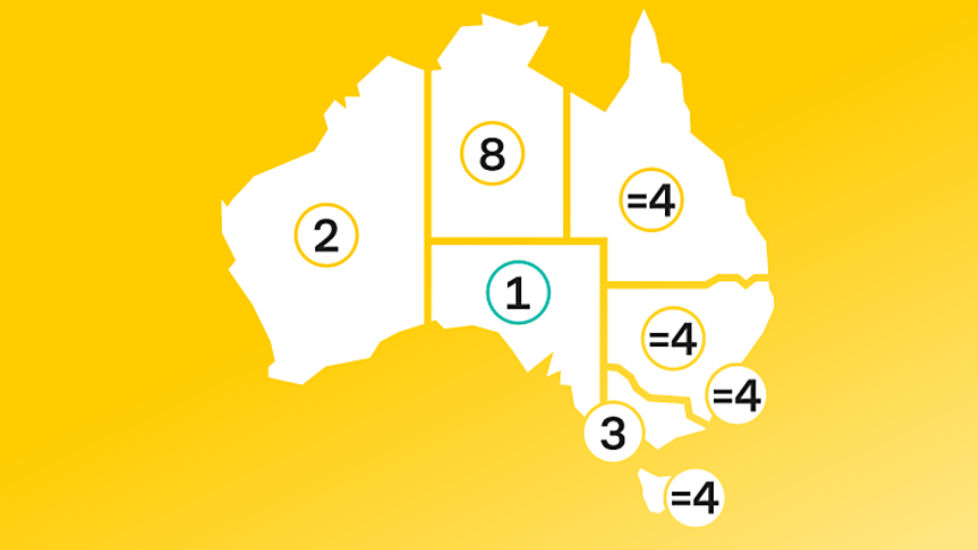

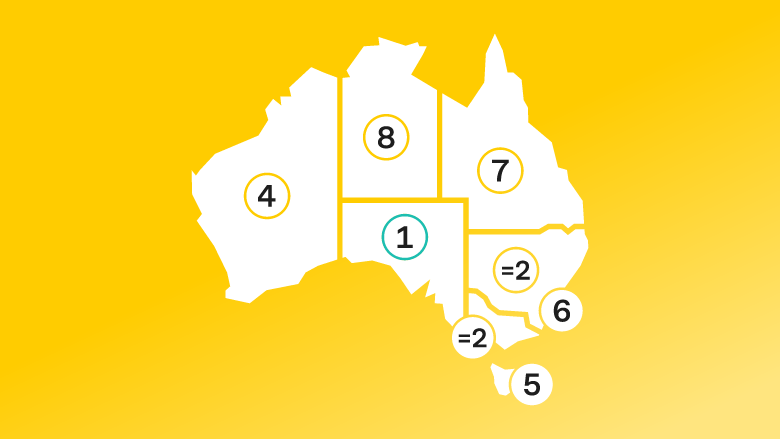

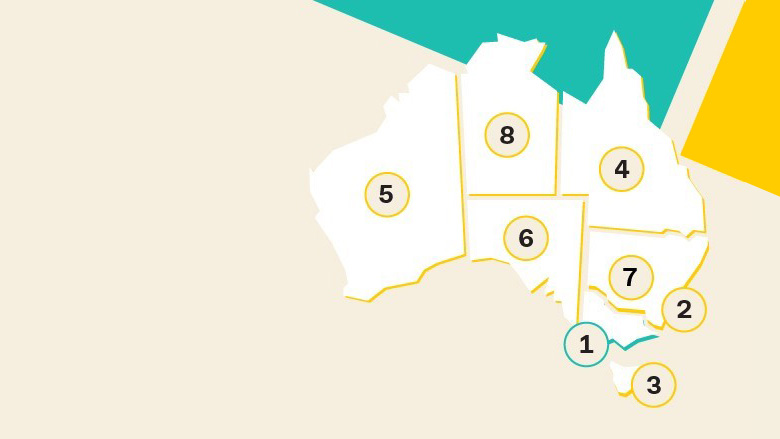

WA tops economic leaderboard as Queensland rises up the ranks: CommSec State of the States

WA leads on five of eight economic indicators as Australian state economies remain resilient in the face of higher interest rates and inflation pre...

28 January 2025

24 January 2025

Salter Brothers expands luxury retreat portfolio with Sustainability-Linked Loan from CommBank

Sustainable finance supports environmental and social outcomes for leading investment manager.

23 January 2025

Australian football star Mary Fowler joins CommBank as brand ambassador

CommBank Matildas forward Mary Fowler partners with CommBank to inspire Australians to get financially fit and drive further growth in women’s spor...

23 January 2025

80 per cent of Aussie small businesses experience cash flow challenges

As small to medium businesses brace for continued economic challenges in 2025, CommBank is partnering with AGSM @ UNSW Business School to offer a f...

16 January 2025

Spending drops in December after Black Friday sales boost

CommBank Household Spending Insights Index fell 1.8 per cent to 163.2 in December.

15 January 2025

31 December 2024

Electric vehicles now more affordable for Aussie essential workers

CommBank offers its lowest advertised car loan interest rate for new and used electric and hybrid vehicles to help essential workers and those earn...

19 December 2024

Black Friday bargain hunters boost November spending

Aussie shoppers splurge at clothing stores during the Black Friday sales.

12 December 2024

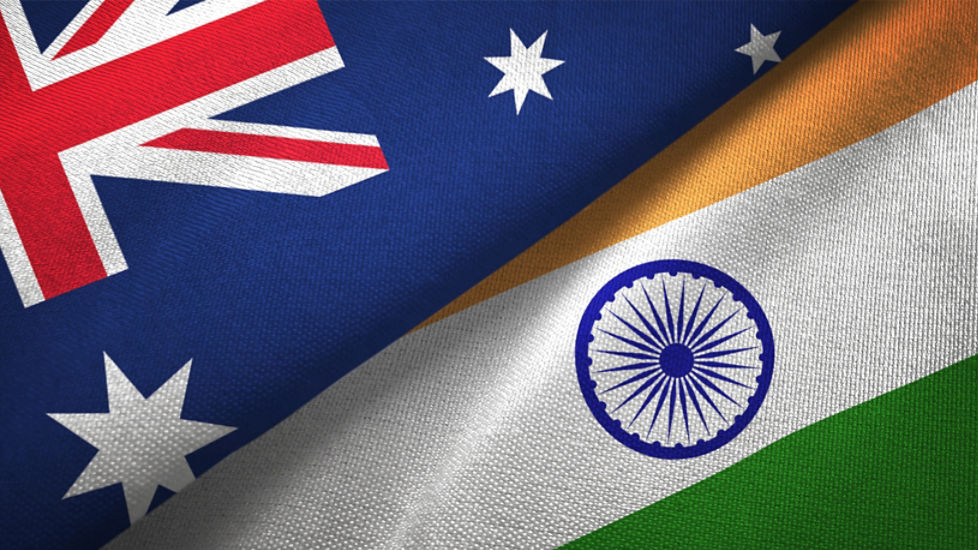

Commonwealth Bank signs Memorandum of Understanding with ICICI Bank

Leading financial institutions collaborate to support customers and accelerate growth across Australia-India corridor.

11 December 2024

Supporting banking services in Nauru

Commonwealth Bank has committed to providing banking services for the Republic of Nauru.

9 December 2024

Statement on account changes

Group Executive Retail Banking Services Angus Sullivan provides an update on some recently communicated changes relating to a legacy transaction ac...

4 December 2024

Regional Australia: The nation’s destination of choice

CommBank and the Regional Australia Institute release the latest quarterly Regional Movers Index revealing the continued appeal of country towns an...

4 December 2024

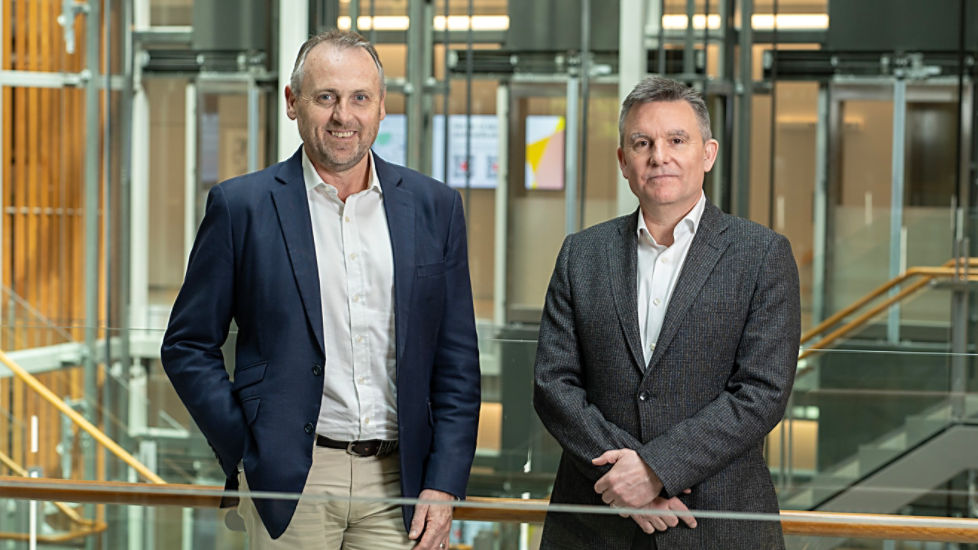

CBA appoints new Chief Economist

Treasury Deputy Secretary and Macro Economist Yeaman to succeed Stephen Halmarick.

4 December 2024

Customer safety, convenience and recognition boosted by early implementation of Gen AI

Commonwealth Bank is one of only a few banks globally to provide customer-facing messaging services powered by generative artificial intelligence (...

28 November 2024

Australian small businesses set to win big as many brace for a bumper holiday season

As Black Friday and Cyber Monday sales heat up, new data from CommBank indicates an expected boost in sales for small businesses, with amusement pa...

27 November 2024

Spending on essentials slows as Aussies under 40 grapple with cost-of-living

• CommBank iQ Cost of Living Insights Report reveals consumer spending continues to trail inflation.

• Discretionary spending focused on value and...

19 November 2024

CommBank announces second cohort of Next Chapter Innovation partners

CBA’s two new Next Chapter Innovation Partners will focus on driving innovative responses to domestic and family violence and financial abuse in Fi...

19 November 2024

CommBank helps customers plug into home energy savings

One third of Australian homeowners want to install battery solutions but are deterred by the upfront cost. CommBank offers customers $1,300 off Tes...

18 November 2024

CommBank leads with new anti-scam security features

Australians have now added CommBank payment details to more than 7 million digital wallets on mobile phones and tablets. New anti-scam security hel...

14 November 2024

CBA maintains support for customers facing ongoing cost of living pressures

While interest rates are helping to bring inflation down, momentum has slowed which means consumers are still dealing with price challenges says CE...

13 November 2024

Pop stars and fast cars: Tickets and online shopping inch spending higher in October

Petrol prices, income tax cuts and lower utility bills help lift spending from September fall.

12 November 2024

Empowering communities: $3.5 million awarded to Aussie organisations driving positive change

The CommBank Staff Foundation doubles its impact with 175 organisations each receiving $20,000 through the 2024 Community Grants program.

11 November 2024

Remembrance Day 2024: 80 years on from the dawn of hope in WWII

As World War Two entered what proved to be its final year, CBA’s leaders expressed optimism that the fighting might soon be over. But they also kne...

7 November 2024

CBA launches owned media network: CommBank Connect

CommBank’s growing owned media, channel and content ecosystem will deliver an improved customer experience with engaging and relevant content.

4 November 2024

CBA Emergency Assistance for power outage-affected areas in Broken Hill

Commonwealth Bank is providing Emergency Assistance to areas across Broken Hill affected by power outages.

1 November 2024

Use of AI and renewable energy and water

CBA clarifies comments made at the company’s annual general meeting about the source of power and water used to support artificial intelligence com...

31 October 2024

Partial divestment of CBA's shareholding in VIB

Commonwealth Bank of Australia (CBA) today announces that it has sold approximately 10% of the shares on issue in Vietnam International Commercial ...

29 October 2024

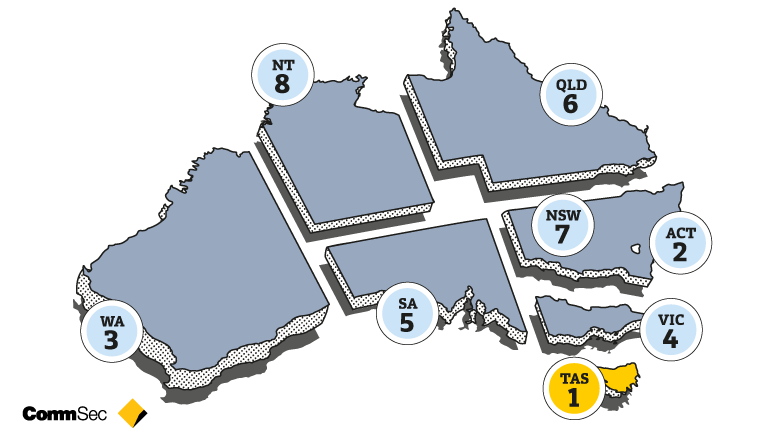

WA reclaims economic crown after a decade: CommSec State of the States

A strong job market and population growth helped drive the state to the top position for the first time in 10 years, dethroning South Australia.

28 October 2024

Young Aussies helping drive hybrid and EV adoption

CommBank loans for these types of vehicles have soared 117 per cent for drivers under 35.

25 October 2024

Commonwealth Bank lifts ranking on global Evident AI Index

Commonwealth Bank has been recognised in the top five banks globally for artificial intelligence (AI) maturity, moving up one place, and maintained...

18 October 2024

CBA enters into an Enforceable Undertaking with the ACMA

CBA has entered into an amended Enforceable Undertaking (EU) with the Australian Communications and Media Authority (the ACMA) and paid a $7.5m fin...

17 October 2024

2024 Commonwealth Bank AGM: CEO's address

Address by Matt Comyn, CEO and Managing Director of the Commonwealth Bank of Australia, at the Bank’s 2024 Annual General Meeting.

16 October 2024

2024 Commonwealth Bank AGM: Chair's address

Address by Paul O’Malley, Chair of the Commonwealth Bank of Australia, at the Bank’s 2024 Annual General Meeting.

16 October 2024

Footy finals not enough to boost September spending

CommBank’s Household Spending Insights Index dipped in September, as consumers refrain from spending extra cash from income tax cuts.

15 October 2024

Let’s TALK about financial abuse: equipping Australians to start the conversation

New CommBank and Future Women educational series launches, as research shows one third of Aussies don’t feel confident in knowing how to help.

15 October 2024

Newcastle Airport lands sustainability funding

CommBank supports growing gateway to the Hunter with $235m Green Sustainability-Linked Loan.

11 October 2024

CommSec nudges 3 million users as mobile and international trading takes off

Nearly half of CommSec customers and 75 per cent of CommSec Pocket users are under 40.

9 October 2024

CBA doubles Career Comeback program for 2025

The expanded program offers a wider range of opportunities across both Institutional Banking & Markets and the bank’s Chief Operations Office to su...

8 October 2024

CommBank hosts visionary technology conference, BrighterTech

Innovation, GenAI and customer obsession were some of the themes at this year’s CommBank BrighterTech, a two-day annual event designed to inspire C...

3 October 2024

CBA announces changes to Executive Leadership Team

Chief Executive Officer of the Commonwealth Bank, Matt Comyn, has today announced changes to the Bank’s Executive Leadership Team.

2 October 2024

CBA cautions small business against “too good to be true” investment opportunities

With more than half of the money Aussie small businesses lose to scams going to fake investments, CBA Executive General Manager Rebecca Warren prov...

30 September 2024

Everybody - especially economists - wants to change the world

Economics governs everything from our supermarket bills, the taxes we pay and climate change, but fewer young people are choosing to learn the subj...

30 September 2024

That’s a grand, final CBA dividend

Following the announcement at the Bank’s FY24 annual results last month, shareholders will receive a fully franked $2.50 a share pay-out this Frida...

26 September 2024

Women leading the charge on investing growth

CBA launches new partnerships to support women investors to grow and manage their money.

25 September 2024

Partial divestment of CBA’s shareholding in Vietnam International Commercial Joint Stock Bank

Commonwealth Bank of Australia today announces that it has sold approximately 5% of the shares on issue in Vietnam International Commercial Joint S...

24 September 2024

Geelong a beacon for growth in regional Australia

On a visit to the fast-growing south-west region of Victoria, CBA CEO Matt Comyn got a first-hand look at the businesses helping to provide local j...

24 September 2024

CommBank Matildas on loan to Aussie businesses

Fifty CommBank business customers will have the opportunity to have the CommBank Matildas promote their business as the bank launches marketing sup...

20 September 2024

Five-year partnership to boost foundational AI research in Australia

The University of Adelaide and Commonwealth Bank will establish the CommBank Centre for Foundational AI to keep Australia at the forefront of found...

19 September 2024

CommBank revolutionises banking by activating AI Factory with AWS

CommBank, in collaboration with Amazon Web Services, activates its state-of-the-art AI Factory to accelerate Gen AI innovation.

17 September 2024

Businesses increase asset investment despite economic uncertainty

CBA data shows small and medium-sized businesses are taking a long view on the economy, investing in their productive capacity.

13 September 2024

Tools, ties and taverns: early Father’s Day boosts household spending in August

The CommBank Household Spending Insights Index saw the impact of energy rebates lower spending on Utilities, while university and school fees drove...

12 September 2024

Careers of the future: from graduate to data science leader

To be successful in STEM and future-proof your career, keep learning, explore the unknown, raise your hand to pave the path forward in your field a...

11 September 2024

Chrysos Corporation sets gold standard in Australian innovation

CommBank supports environmentally-friendly assaying technology with $95m Green Loan.

9 September 2024

Technology graduates roll into cyber, engineering and data science careers at CommBank

The class of 2023 officially graduated from CommBank’s Technology Graduate Program after 18 months of hands-on learning. The majority transitioned ...

9 September 2024

Mental health suffers as small businesses grapple with economic climate and unexpected expenses

CommBank launches additional features and support as small to medium business owners face continued economic challenges.

5 September 2024

CBA appoints Kate Howitt as non-executive director

Ms Howitt to join the CommBank board on 1 October 2024 as Anne Templeman-Jones announces her retirement as a non-executive director at the conclusi...

3 September 2024

Home buyers shift borrowing strategies as cost of living pressures bite

A growing number of first home buyers are going it alone or seeking government assistance to get their foot onto the property ladder, new CommBank ...

3 September 2024

Opening remarks to the House of Representatives Standing Committee on Economics

Commonwealth Bank Chief Executive Officer Matt Comyn appeared before the House of Representatives Standing Committee on Economics on Thursday, 29 A...

29 August 2024

Expanded anti-scam technology helping protect elderly customers from phone call scams

CommBank and Telstra expand ‘Scam Indicator’ technology to cover landlines – providing additional protection to joint customers.

28 August 2024

Dads can buy themselves flowers: Father’s Day spend trends revealed

Dads can expect a ticket to a music gig, homewares and lottery tickets as CommBank reveals spend trends for Australian small businesses in the lead...

27 August 2024

A beacon of hope: CommBank goes purple to show support for 'rainbow' communities

Bradley Marsden (he/him) and Dominique Fox (she/her), from CommBank’s LGBTQIA+ employee network Unity, spoke to Wear it Purple’s previous co-presid...

27 August 2024

Regional manufacturers turn to tech investment and sustainability to support next productivity wave

Most manufacturers and distributors across Australia’s regions have an optimistic outlook, a new CommBank report shows.

23 August 2024

CBA and BNY deliver near real-time cross-border payments

International commercial payments now settled 24/7.

22 August 2024

Doubling down on safety in the bush

CommBank doubles the number of free seminars to help more regional Australians stay safe from scams and fraud.

21 August 2024

Southern states prove the sweetest, as new era of regionality dawns

Australia has entered a new era of internal migration according to the newly released Regional Movers Index (RMI), with data indicating the nation’...

19 August 2024

Vogue Codes: Career advice from female leaders in tech

In the lead-up to Vogue Codes Con, four leaders from CommBank share their advice for young women considering a career in technology, as they reflec...

16 August 2024

Household spending flat in July as consumers look for discount options

The CommBank Household Spending Insights Index was flat in July as significant spending gap between renters, mortgage owners and homeowners remains.

15 August 2024

CommBank‘s strong financial position provides extended support to customers

Cost of living assistance and anti-scam and fraud measures expanded as CBA announces annual profit that also delivers sustainable returns to shareh...

14 August 2024

CommBank’s data science module drives engagement in Virtual Work Experience program

Over 2,500 unique users engage with Tech Council of Australia and Year13 Virtual Work Experience program.

9 August 2024

CommBank equipping employees with AI education

Employees show strong interest in the bank’s tailor-made AI microlearning series.

7 August 2024

Charging woes: Is it really a hassle to charge an EV?

Get to the bottom of the EV charging reality. What are your options and costs?

1 August 2024

Four home renovations that can help improve your energy efficiency

Planning an energy-efficient home renovation? You could reduce your power bills by going all-electric and adding solar. Here’s how.

1 August 2024

Anti-scam measures cut scam losses for CommBank customers in half

An increased focus on protecting customers from scams is working but CommBank says there is more to do across big tech, telcos and banks.

1 August 2024

CBA and Farming for the Future bolster the benefits of natural capital

Commonwealth Bank provides funding for research to enhance the resilience and profitability of livestock farming in Australia.

31 July 2024

South Australia makes it three-in-a-row as best performing economy: CommSec State of the States

Western Australia a close second, leading on relative population growth and housing finance.

29 July 2024

Skills of the future: Igniting a passion for tech

Through community skilling initiatives, CommBank is helping to build a brighter future for Australians ensuring we have the digital skills for the ...

26 July 2024

June household spending inches higher as renters fall behind

The CommBank Household Spending Insights Index rose 0.6 per cent in June, but the annual growth rate continues to point to soft consumer spending e...

11 July 2024

CommBank’s x15ventures is on the hunt for AI innovators with partnership potential

Xccelerate24 will focus on AI and data startups looking to explore pathways to partnership with CommBank. Founders have until 20 August 2024 to app...

10 July 2024

Vogue Codes: Switching careers to a woman in tech

As part of Vogue Codes, Holly Takos shares her story of transitioning from a career in cycling to cyber security and finding a supportive workplace...

4 July 2024

CommBank launches Travel Booking via the CommBank app

In an Australian banking first, CommBank offers access to a secure Travel Booking service via the CommBank app – integrating the Bank’s customer re...

4 July 2024

Digital engagement rises as the CommBank app boasts new features

New Travel Booking and car buying services are now available through Australia’s most popular banking app.

4 July 2024

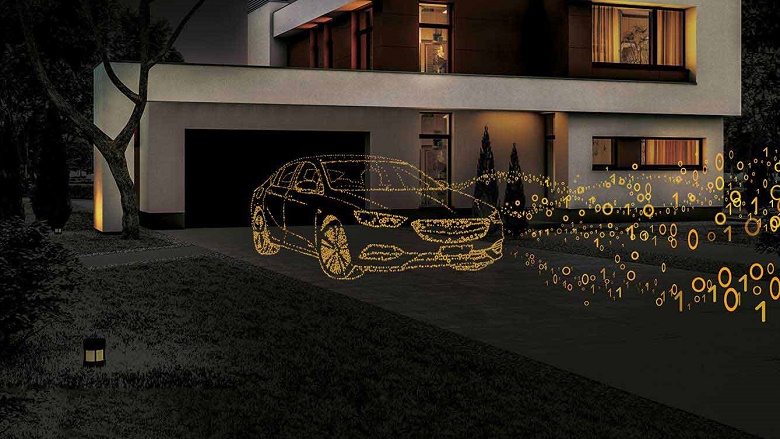

CommBank launches car buying service via the CommBank app

CommBank is streamlining the car buying process to help personal and business customers understand their potential repayments, source a deal, and e...

4 July 2024

CommBank announces sponsorship of SXSW Sydney ® 2024

CommBank is again partnering with South by Southwest Sydney to bring the world’s leading festival for creativity, progressive thinking, technology ...

2 July 2024

Inspiring women in STEM: insights from Vogue Codes Summit

Discover how the CommBank-sponsored Vogue Codes Summit helps pave the way for an inclusive and diverse future for tech, including groundbreaking di...

1 July 2024

Upgrading Australia’s largest branch network

CommBank invests over $60 million on bank branches in FY24.

28 June 2024

CBA backs long-term growth prospects for mid-north coast region of NSW

In a visit to Port Macquarie, Commonwealth Bank CEO Matt Comyn underscored the benefits of the area’s economic focus on tourism, manufacturing, hea...

20 June 2024

CBA appoints Gaven Morris as Executive General Manager of Corporate Affairs

Former ABC Director of News, Analysis and Investigations will join Commonwealth Bank to lead its corporate affairs team.

20 June 2024

Women in tech: Vicky Ledda shares her career lessons

Female mentorship empowered Vicky Ledda to find her voice and propel her career from software engineer to Executive General Manager of Retail Techn...

20 June 2024

CBA and MRI Software to deliver market-leading solution for residential real estate sector

Strategic collaboration to deliver reimagined payments for real estate agents, property managers and tenants.

17 June 2024

CBA reimagines banking for Australian businesses, introduces loyalty program

Australia’s leading business bank has announced a range of new products and services designed to meet more customers’ banking needs.

17 June 2024

New Australian anti-scam sharing technology unveiled

CBA is the first bank to integrate and share information into a new ‘anti-scam intelligence loop’ making it faster to report and remove scams acros...

13 June 2024

Consumers reluctant to open wallets despite bump in May household spending

Despite a lift in CBA’s monthly Household Spending Index, growth in consumer spending has risen just 0.1 per cent per month on average since Januar...

13 June 2024

Collaboration delivers innovative new digital training program for internal auditors

A partnership between Institute of Internal Auditors Australia and CBA.

11 June 2024

New research reveals almost one in three fail to spot a tax scam

Despite nine in 10 Aussies being confident they can identify a scam, CBA urges extra vigilance as tax season brings heightened risk.

11 June 2024

Revolutionising Remote Banking: The Trailblazing Team of CBA’s First Nations Reach program

In the vast expanse of remote Australia, where the red dust settles and local First Nations communities reside against the backdrop of rugged lands...

7 June 2024

Building the technology team of the future

206 new graduates join CommBank’s Technology division, while a quarter of last year’s graduates receive early promotion into full-time technology r...

6 June 2024

CommBank data shows tourism in Cairns and Far North Queensland is on the up

CBA reaffirms its commitment to regional Australia as new data indicates growth in tourism spending and associated industries.

6 June 2024

Supporting the transition of Australia’s transport sector

CBA has led a $190m refinance for Team Global Express with key institutional investors, accelerating the firm’s fleet replacement program and susta...

6 June 2024

CBA offers free financial wellbeing seminars

More than half to focus on educating customers about fraud and scams.

5 June 2024

Commonwealth Bank launches new AI data-led insights, as Australian small-to-medium businesses turn to new technology to drive growth

Small businesses are embracing artificial intelligence (AI) with new research revealing 59 per cent have or will invest in AI within the next five ...

3 June 2024

Metro to regional movers multiply

The number of city-dwellers choosing a life in the regions has hit a 12-month high, with the latest Regional Movers Index (RMI) showing metro to re...

31 May 2024

CBA to pilot international use of NameCheck technology on Liink by J.P.MorganSM

CBA’s industry-leading NameCheck technology becomes part of effort to combat international scams and mistaken payments.

29 May 2024

Thanks to Visa, CommBank brought together the best in sport and business to the regions by partnering with Australian Olympians to showcase the business of winning

In a year where many Australians will be going for gold, thanks to Visa, a worldwide partner of the Olympic and Paralympic Games, Commonwealth Bank...

27 May 2024

Aussie businesses boost investment in assets

New CBA data shows small and medium-sized businesses are investing in equipment and vehicles, particularly “green” fleets despite uncertain economi...

27 May 2024

Spending gap widens between younger and older Australians

Younger Australians in their mid-to-late-twenties have pulled back on spending more than any other age group, while those over 65 continue to spend...

23 May 2024

Orange and Central West a popular destination for regional movers

CBA reaffirms its commitment to regional Australia as new data shows the Mid-Western region is the third fastest growing regional LGA in NSW based ...

23 May 2024

CBA’s Business Bank accepts Coposit to help more people get into the housing market

CBA is the first major Australian bank to accept Coposit-secured deposits as pre-sales, in a move aimed to help fast-track home ownership.

22 May 2024

CBA warns small businesses against tax time scams

Small businesses should be on the look-out for phishing scams targeting their taxation portal credentials.

21 May 2024

Australian manufacturers and distributors set to expand production, looking past headwinds

Industry expects production output and financial performance to lift in 2024 while labour shortages and competitive pressures weigh on productivity...

17 May 2024

CBA enhances small business Sustainability Tool with Aussie-owned businesses

CBA is working with BioPak and EnergyFlex to help more small businesses achieve their sustainability goals.

17 May 2024

CommBank partners with Vogue Codes 2024 to inspire more women into technology careers

CommBank is pleased to announce that it’s the presenting partner for Vogue Codes 2024.

16 May 2024

Household spending slows as consumers pump the brakes on discretionary spending

April Household Spending Index features new Home Ownership Insights revealing renters pulling back most on spending.

13 May 2024

Judgment in shareholder class actions

Commonwealth Bank of Australia (CBA) notes the judgment delivered in its favour today by the Federal Court of Australia in the long-running Zonia a...

10 May 2024

CBA remains well positioned to provide on-going support for customers

Consistent third quarter performance assists CommBank’s ability to help Australians impacted by the higher cost of living while providing stability...

9 May 2024

Queensland banks on CBA

Commonwealth Bank partners with Queensland Government to deliver Whole of Government banking and payment services, building on a 30-year partnership.

7 May 2024

CommBank powers The Brighter Side TV series

CommBank launches The Brighter Side, a new television series with bright ideas and helpful tips on making your money go further, airing on 10 and 1...

6 May 2024

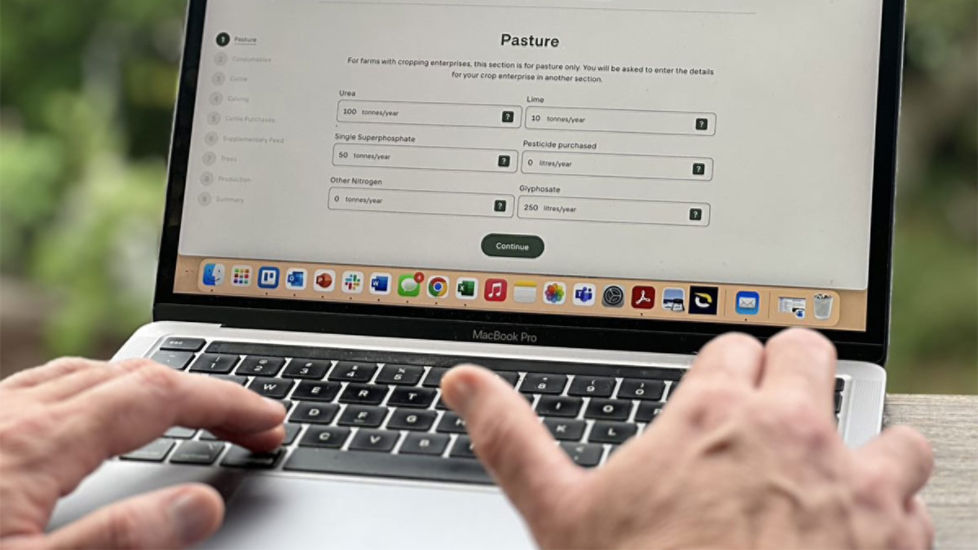

CBA enters new strategic partnership to support the future of Australian farming

Commonwealth Bank deepens relationship with leading emissions ag tech platform, Ruminati, to support producers as they adapt their farming business...

6 May 2024

CBA completes sale of PT Bank Commonwealth

The divestment of Commonwealth Bank’s 99% shareholding in its Indonesian banking subsidiary to OCBC Indonesia has been completed.

2 May 2024

Patient cost-cutting brings technology and healthcare payments into greater focus

New CommBank Health research reveals affordability concerns among patients are putting the spotlight on digital solutions, with opportunities for p...

2 May 2024

CommBank and Jimmy Rees celebrate 25 years of the Clown Doctors

CommBank and The Humour Foundation launch Smile Month, raising funds for the Clown Doctors so they can continue to deliver laughter to sick kids, c...

1 May 2024

Building a nation: how Commonwealth Bank helped to house the Anzacs after World War One

Rising house and rental prices, high construction costs and materials shortages were as big a problem in post-WW1 Australia as they are today. A ce...

22 April 2024

South Australia pips rivals to take economic crown: CommSec State of the States

Western Australia and Victoria close behind on economic performance indicators.

21 April 2024

Commonwealth Bank grows Indigenous Business Banking team

Commonwealth Bank continues to expand its Indigenous Business Banking team with the appointment of an Executive Manager, Indigenous Business Products.

16 April 2024

Household spending soft in March despite Easter bump

CommBank Household Spending Insights Index rose 0.2 per cent in March, however the Index is still below November 2023 as spending on household good...

11 April 2024

Millennials the most active property investors: CommBank data

New data from CommBank has revealed the nation’s top investment suburbs, the average age of property investors, and who Aussies are most likely to ...

10 April 2024

CommBank opens new Hobart office

After more than 70 years at 81 Elizabeth Street, CommBank’s Hobart headquarters shift to the waterfront.

8 April 2024

Girls in Tech: inspiring the next generation of STEM talent

Collaboration, resilience and authenticity are some of the key takeaways shared with 200 high school students who gathered at Commonwealth Bank’s S...

3 April 2024

Australian dentists respond to impact of cost of living pressures

Dental practices to offset the expected impact of cost-of-living pressures on the demand for dental services by optimising operations, new CommBank...

3 April 2024

The great divide: small business and perceptions of online safety

New research suggests Australian small businesses regard cyber security as either a high priority, or not a priority at all, potentially making the...

27 March 2024

Climate change requires behavioural change – nudging for better, more sustainable choices

CommBank’s Behavioural Science Centre of Excellence and its partner, Harvard Sustainability Transparency Accountability Research (STAR) Lab, have s...

27 March 2024

CBA invests in international transaction screening technology company

New RegTech investment with the potential to boost sanctions compliance and make global payments more efficient for customers.

25 March 2024

Commonwealth Bank Executive Leadership Team update

Stuart Munro, currently the Group Head of Strategy, has been promoted to Group Executive Group Strategy, effective 25 March 2024.

22 March 2024

Can4Cancer pedals towards $20 million raised for cancer research

In celebration of a ten 10-year partnership with Tour de Cure, CommBank’s Can4Cancer has set an ambitious target to reach a total of $20 million ra...

22 March 2024

Sustaining families and farms: Succession planning in the spotlight

A significant increase in Australian agricultural land values highlights the importance for agribusiness owners to start planning for the next gene...

22 March 2024

CommBank and Smartgroup collaborate for smarter benefits

Helping Australians get more of their pay by leveraging financial tools and benefits.

18 March 2024

Collaboration the way to achieving energy superpower status

Australia could be the energy superpower in a net-zero world, but financing the transition will require capital coordination, and the key to achiev...

15 March 2024

CommBank data shows electric vehicle adoption up 37 per cent in the last six months

CommBank launches electric vehicle cost comparison calculator as its EV car loan customer base grows significantly.

14 March 2024

‘Face into the storm’ to tackle climate change, urges Erin Brockovich

With “stick-to-it-iveness" always front of mind, the world-renowned environmental advocate continued to advocate for change at Commonwealth Bank’s ...

13 March 2024

Household spending falls in February despite the Taylor effect

CommBank Household Spending Insights Index fell -0.3 per cent in February but consumers still managed to spend big on music festivals.

13 March 2024

Optimism, electrification and AI: Top takeaways from Momentum, CommBank’s sustainability conference

Sharing ideas and solutions that can help power the nation’s transition to a more sustainable and vibrant future.

13 March 2024

At CommBank’s sustainability conference, CEOs share how they’re leading the way to net zero

The leaders of three Australian companies opened Momentum – CommBank’s sustainability conference – by discussing the challenges and opportunities o...

12 March 2024

CBA launches Business Green Loan

Supporting Australian businesses to transition to a more sustainable economy.

12 March 2024

CBA and Microsoft deepens Gen AI partnership

Generative AI and cyber security initiatives to deliver more for customers.

11 March 2024

CBA support for Bankwest’s transition to a fully digital bank

Range of measures announced to help customers in Western Australia to continue to do their everyday banking with additional investment in new roles...

7 March 2024

Australia's transition to net zero gathers Momentum at CBA's third sustainability conference

CBA’s third sustainability conference, Momentum: Accelerating Australia’s Transition, brings together business, political and science leaders to sh...

7 March 2024

28 February 2024

Opening pathways to tech jobs for more young Australians

CBA takes part as a program partner for virtual work experience program.

22 February 2024

Travel and fitness boost household spending in January

CommBank Household Spending Insights Index rose 3.1 per cent to 141.9 in January 2024, but the bounce did not fully offset weakness in December 20...

15 February 2024

CBA helps farmers to measure emissions and model abatement options

CBA and leading emissions platform Ruminati have announced a pilot that allows CommBank's agri customers to baseline and model different options to...

15 February 2024

CBA Emergency Assistance for storms and bushfires in Victoria

Commonwealth Bank is providing Emergency Assistance to storm and bushfire-affected areas across Victoria.

14 February 2024

CommBank continues to support our customers and the Australian economy

Commonwealth Bank will maintain and increase where necessary its support for customers after a challenging 2023 caused by cost-of-living pressures ...

14 February 2024

Valentine’s Day season sees rise in romance scams

CBA reminds customers to ‘Stop. Check. Reject.’ as a growing number of unsuspecting Aussies are being tricked into sending money to fake admirers.

13 February 2024

A guide to converting to an all-electric home

As Australia makes its transition to Net Zero by 2050, electrification of homes is one of the strategies to get us there. Here’s why and how to go ...

9 February 2024

When to replace hot water, heating and cooling appliances | CommBank

Hot water, space heating and cooling make up the a large portion of your home’s energy usage. So here’s what to look out for when it’s time to repl...

9 February 2024

Debunking 3 common electric vehicle myths

Alternative technologies are the way of the future, with electric vehicles leading the charge on the transportation front. Here we debunk three com...

9 February 2024

GoZero Group kickstarts GreenSchools1000 initiative with $80m CBA facility

GoZero is leading the transition to electric buses servicing schools, with plans for rapid expansion of its electric bus charter services in 2024.

8 February 2024

7 cost-effective upgrades for a more energy efficient home | CommBank

Living a more sustainable life is both good for the planet and your wallet. Here are seven effective ways to make your home more energy efficient– ...

1 February 2024

Small and medium businesses considering investments for growth in 2024

Small and medium-sized businesses are focusing on strengthening their customer proposition, with 80 per cent planning to use one or more strategies...

30 January 2024

South Australia is best performing economy for first time: CommSec State of the States

South Australia makes history, taking top spot on the State of the States leader board.

29 January 2024

CBA Emergency Assistance for Tropical Cyclone Kirrily affected areas in North Queensland

Commonwealth Bank is providing Emergency Assistance to Tropical Cyclone Kirrily affected areas in North Queensland.

26 January 2024

Millennials and Gen Z take at least as many photos of their pets as they do of their families

New research from CBA reveals notable generational differences when it comes to pet owners.

24 January 2024

Commonwealth Bank and Supply Nation join forces to launch a new business banking, education and training solution to support the growth of Indigenous businesses

Commonwealth Bank announces an agreement with Supply Nation to offer a dedicated business banking package and education series for Indigenous busin...

22 January 2024

Risky Business: New research reveals top five everyday habits making small businesses a target for cyber crime.

New research reveals the top 5 everyday habits that make small businesses more vulnerable to cyber-attacks and easy steps to avoid them in 2024.

15 January 2024

Rate rises and pre-Christmas sales saw household spending drop sharply in December

CommBank Household Spending Insights Index fell 3.9 per cent to 137 in December.

15 January 2024

New year, new budget: how behavioural science can help achieve money resolutions

New research from CBA shows most Aussies will look to make their money work harder this New Year, as CBA’s Chief Behavioural Scientist shares some ...

21 December 2023

Australian economy remains in ‘relatively good shape’ going into 2024: CBA Chief Economist

As 2023 draws to a close the debate in global markets remains focused on the success, or otherwise, of the major central banks returning inflation ...

21 December 2023

CBA’s 2024 John Monash Scholar hopes to improve Australia’s maths literacy

The scholarship will fund a PhD in Mathematics at the University of Oxford for Georgina Ryan, who hopes to encourage more female representation in ...

20 December 2023

Australians plan to spend over $4.6 billion in this year’s Boxing Day sales

1.4 million more Australians are planning to shop the Boxing Day sales this year, but are also planning to spend less than previous years.

20 December 2023

Hello CommBank Yello! CommBank makes banking brighter with new campaign

Commonwealth Bank has unveiled a new campaign to celebrate CommBank Yello, the bank’s customer recognition program.

19 December 2023

CBA will provide Emergency Assistance to communities impacted by Tropical Cyclone Jasper and the unfolding flooding emergency

CBA will provide Emergency Assistance to customers and communities impacted by flooding caused by Tropical Cyclone Jasper in Far North Queensland.

18 December 2023

Consumers bring forward Christmas spend to take advantage of sales

CommBank Household Spending Insights Index rose 1.8 per cent to 142.8 in November.

13 December 2023

'The gift that keeps on giving': Investing for your kids or grandkids for Christmas

New research shows three in five Australian parents plan on investing in the stock market on behalf of their children but many don’t know where to ...

7 December 2023

New scam intelligence sharing helps CBA and Vodafone combat SMS scams

Vodafone and CBA are now sharing SMS scams intelligence in near real-time to help disrupt, detect and proactively block fraudulent payments, as par...

6 December 2023

CBA speeds up business lending

Speed of financing is the most important factor for businesses when choosing a lender, according to new industry data.

5 December 2023

‘Dignity by Design’ underpins Commonwealth Bank’s new Accessibility and Inclusion strategy

The Accessibility and Inclusion Strategy 2024–2026 was launched at an event celebrating International Day of People with Disability on 3 December.

4 December 2023

New CSIRO research on pathways to net-zero emissions in Australia

Funded by CommBank, new scientific research to help inform the transition to a net zero economy.

1 December 2023

Australia’s agriculture sector is helping to solve one of the world’s complex problems: how to safeguard food security and the environment

Innovation, building resilient communities and embracing emerging opportunities are key strategies to tackle the complex challenge of global food d...

30 November 2023

Commonwealth Bank update on reimagined banking services

CommBank app v5 is delivering innovation and new benefits for retail and business customers as usage and numbers grow.

29 November 2023

Commonwealth Bank reimagines products and services for Business Banking customers

CBA announces new investments in tailored propositions for the agricultural and real estate sectors at the Reimagined Banking Briefing.

29 November 2023

'CommBank Yello' becomes one of Australia’s largest customer recognition programs

A new AI-powered recognition program launched this month builds on how CBA provides value to its customers.

29 November 2023

CBA recognised in global rankings for its maturity in using Artificial Intelligence

A leading global index this month ranked CBA as the #1 Asia Pacific bank and #6 bank globally for maturity in using AI.

29 November 2023

Season 2 of Anatomy of a Scam podcast to focus on cutting-edge technology used by cybercriminals

Voice cloning, deep fakes and AI are among the new cutting-edge technologies being used by scammers explored in the second season of Anatomy of a S...

28 November 2023

CBA rolls out NameCheck availability to leading industry names

Bendigo Bank and Satori are piloting CBA’s industry leading NameCheck technology to help combat scams and mistaken payments.

27 November 2023

The dynamic duo: Solar plus battery for a more sustainable home

Maximise the power of solar and reduce your energy bills by combining a solar panel system with battery storage – all the while making your home mo...

27 November 2023

Young owners drive a surge in Australian entrepreneurialism

New CBA research shows millennials and Gen Z accounted for 63.3 per cent of business transaction account openings in the 2023 financial year.

27 November 2023

CBA welcomes new Scam-Safe Accord to disrupt, detect and respond to scams

Commonwealth Bank of Australia supports new anti-scam measures from Australian Banking Association, announced today.

24 November 2023

Australians looking to Black Friday and Cyber Monday for deals on essential purchases

New CommBank research highlights how Australians are looking to deals and discounts to help with the cost of living.

23 November 2023

Commonwealth Bank Executive Leadership Team update

Chief Executive Officer of the Commonwealth Bank, Matt Comyn, has today announced that David Cohen will finish his role as Deputy CEO on 31 Decembe...

22 November 2023

Consumers cut back discretionary spend but leave room for travel and entertainment

Latest CommBank iQ Cost of Living Insights Report shows spending falling for younger Australians with those in their twenties hardest hit.

21 November 2023

Commonwealth Bank underscores support of Federal Government’s voluntary financial counselling model

The industry-wide initiative will help the government deliver support to people struggling financially.

21 November 2023

Divestment of PT Bank Commonwealth

Commonwealth Bank of Australia (CBA) today announced that it has entered into a binding agreement to sell its 99% shareholding in its Indonesian b...

16 November 2023

Preparing your small business for the holiday season

The festive season is a critical time of year for small businesses, with CBA data showing almost a quarter of all small business owners deriving up...

16 November 2023

CBA delivers solid first quarter result after strong focus on customer outcomes

Consistent operational and strategic execution reflected in CommBank’s performance aimed at delivering sustainable long-term returns for all stakeh...

14 November 2023

Household spending drops in October as ongoing effect of rate hikes slows consumer spending

CommBank Household Spending Insights Index fell 1.0 per cent to 139.8 in October.

13 November 2023

CBA announces interest rate changes - November 2023

The Commonwealth Bank has responded to the Reserve Bank of Australia's cash rate decision.

9 November 2023

In a world first, CBA shares its artificial intelligence model to help reduce technology-facilitated abuse

This announcement builds on the bank’s bid to reduce technology-facilitated abuse in light of research1 showing 1 in 4 Australian adults have exper...

8 November 2023

CommBank unveils its inaugural Next Chapter Innovation think tank

CommBank announces its five Next Chapter Innovation partners helping to support the long-term recovery for victim-survivors of financial abuse and ...

8 November 2023

CommBank grants much-needed funding to community organisations across Australia

CommBank supports over 200 organisations across Australia as part of the 2023 Community Grants program

7 November 2023

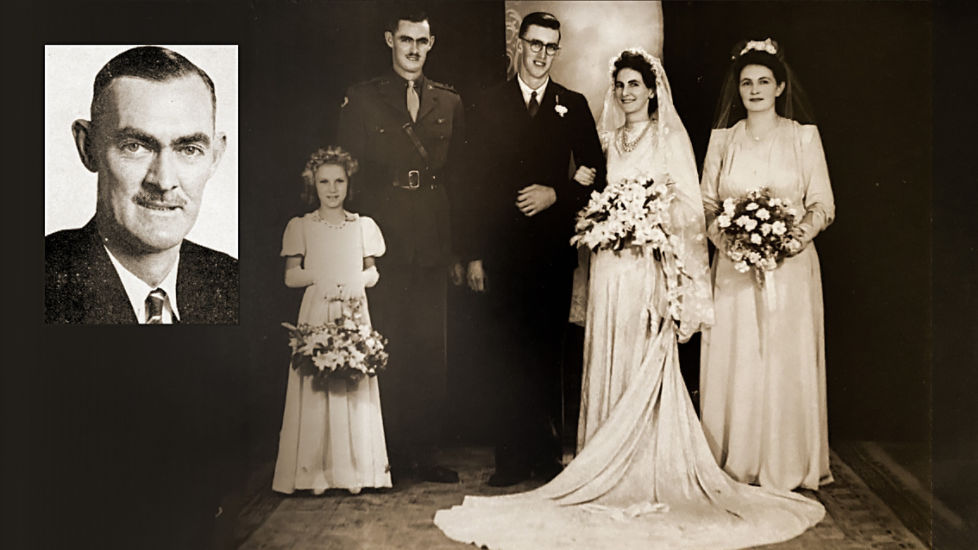

Remembering the CBA staffers who served and fought for their country

A decades-old family picture holds the secrets of Bert Phillips, a quiet but dedicated CommBank employee who fought at the battle of Singapore in W...

7 November 2023

Research shows 7 in 10 Australians believe energy efficiency a way to increase property value

New research indicates majority of homeowners plan to install clean energy products.

6 November 2023

Inside the ‘grandest, most opulent’ Commonwealth Bank vault hidden under Sydney

“Once this door is clicked, nothing will be able to get you out – not even dynamite.”

3 November 2023

CBA joins global digital preservation foundation

In a first for corporate Australia, the Commonwealth Bank of Australia signs up as an Associate Member of the Digital Preservation Coalition.

1 November 2023

Sydney exodus sees NSW pass Queensland as regional relocation destination of choice

Australia continues to have a highly mobile population, with the overall number of movers this quarter at its third highest level since March 2018....

1 November 2023

CommBank offers interest-free finance for solar and battery systems

Solar and battery provider UPowr first to offer CommBank’s new product InstalPay

31 October 2023

CommBank and Football Australia grow commitment to increase participation in women’s football

Commonwealth Bank and Football Australia launch the Growing Football Fund; an investment in coaches and the Matildas of tomorrow

30 October 2023

Victoria now Australia’s best performing economy: CommSec State of the States

Victoria jumps ahead of the states and territories to top the leader board.

30 October 2023

CBA extends scam disruption technologies as part of ‘whole-of-ecosystem' national approach

CBA collaborates with Telstra to switch on ‘Scam Indicator’ nationally and will extend ‘NameCheck’ technology to other organisations who process pa...

26 October 2023

Michele Bullock delivers first speech as RBA Governor to CBA’s Global Markets Conference

New RBA Governor outlines to CommBank-hosted audience the importance of keeping inflation low, maintaining full employment while ensuring financial...

25 October 2023

CBA unveils new GenAI experiment at South by Southwest Sydney 2023

CBA investigates the effectiveness of generative AI as a safe and early experimentation tool to complement customer research and build better custo...

23 October 2023

CBA leverages AI to combat cybercrime with exponential increase in online activity

CBA’s cyber security experts working with AI to monitor billions of online activities every day.

17 October 2023

Climate tech poised for boom as Aussie businesses take action

Three out of five Aussie businesses already taking sustainability action, with climate tech set play a critical role.

16 October 2023

Victoria had strongest spending among states in September driven by AFL Finals

CommBank Household Spending Insights Index rose 0.5 per cent in September, led by increased hospitality and food & beverage spending during school ...

11 October 2023

2023 Commonwealth Bank AGM: Chair's address

Address by Paul O’Malley, Chair of the Commonwealth Bank of Australia, at the Bank’s 2023 Annual General Meeting.

11 October 2023

2023 Commonwealth Bank AGM: CEO's address

Address by Matt Comyn, CEO and Managing Director of the Commonwealth Bank of Australia, at the Bank’s 2023 Annual General Meeting.

11 October 2023

CBA announces executive appointment to Small Business Banking

CBA has appointed a new executive general manager to lead its Small Business Banking team.

5 October 2023

CBA backs NSW Small Business Month

CBA celebrates NSW Small Business Month, with fresh data showing 10,000 merchants have switched on a smarter solution for payments on-the-go.

3 October 2023

Genevieve Bell retiring from Commonwealth Bank board

Commonwealth Bank chair Paul O’Malley thanks Genevieve Bell AO for her contribution following her decision to retire from the Board effective 31 Oc...

26 September 2023

Kit ups its game with new in-app world designed to help kids become confident money managers

Built by an in-house gaming team, ‘Money Quests’ marks Kit’s move into gamified learning, with customisable avatars, rewards, and in-app quests des...

26 September 2023

Research shows Australians are more scam-aware than 12 months ago as losses fall

Over the last year CommBank protected customers from more than $228 million scam attempts through its prevention and detection program.

25 September 2023

Hallett aims to decarbonise cement, with sustainable finance support from CBA

Hallett is the largest supplier of building and construction materials in South Australia and its $51 million Green Loan, supported by CBA, will ad...

25 September 2023

CBA opening statement to regional branches inquiry

Remarks by Commonwealth Bank of Australia CEO Matt Comyn to Senate Committee hearing

20 September 2023

Supporting a tobacco-free future

Commonwealth Bank recognises that banks and financial institutions have a role to play in addressing the health, societal and environmental impacts...

20 September 2023

CBA and Tesla Australia team up to support the transition to electric vehicles

Electric vehicles (EVs) were the fastest growing vehicle purchase in Australia last financial year.

20 September 2023

Surge in international students, higher petrol prices and FIFA World Cup drove increased household spending in August

CommBank Household Spending Insights Index rose 0.7 per cent in August, with strongest monthly gain in Queensland. However annual spending growth r...

13 September 2023

Celebrating the outstanding teachers inspiring Australia’s future generations

Education Minister Hon Jason Clare MP co-hosts the 2023 Commonwealth Bank Teaching Awards presented by Schools Plus, to recognise 22 of Australia’s...

11 September 2023

Consumers opt for convenience and money-saving technologies amidst higher cost of living

Budget-conscious Australians are redirecting funds towards essential goods and services or savings, and changing their shopping and spending habits...

8 September 2023

CBA strengthens digital lending capabilities with acquisition of Waddle

CBA accelerates drive to provide businesses with faster and more flexible cash flow by acquiring innovative business lending platform via x15ventures.

6 September 2023

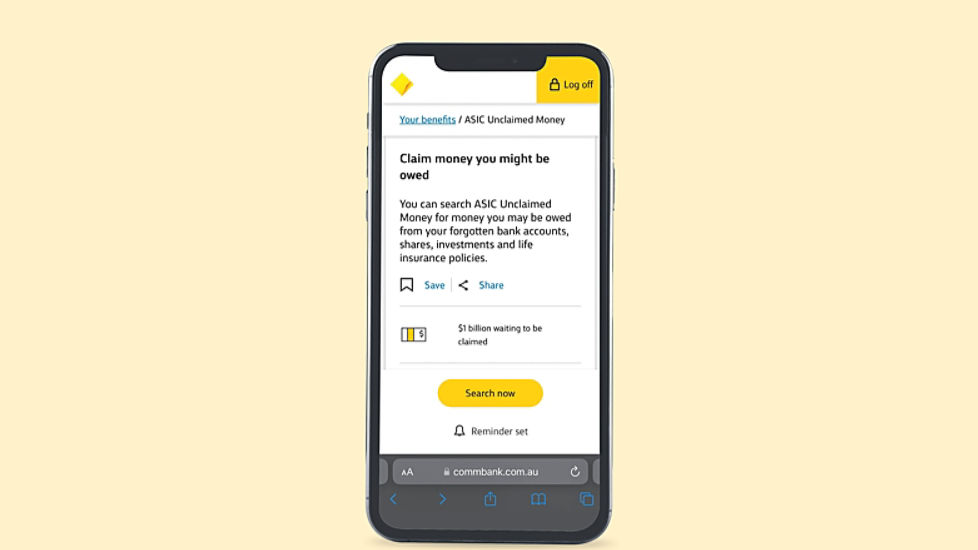

CommBank digital feature helps businesses to claim millions

Small and medium sized business owners are taking advantage of Commonwealth Bank’s unique Benefits finder tool to find ways to offset rising cost o...

28 August 2023

CBA records strongest asset finance growth on record

New CBA data reveals record number of businesses financing new transport and equipment in the past financial year, with electric vehicles and techn...

25 August 2023

Veterans turning small business dreams into reality

CommBank for Veterans is giving more veterans opportunities to pursue their business goals.

24 August 2023

A moment in history to be marked in history

Commonwealth Bank of Australia’s collection of historical banking items will now be rotated on display in a brand new purpose-built archive and rea...

23 August 2023

CBA sustainable finance supporting AgQuip innovation towards a lower emissions future

CBA shines a light at AgQuip 2023 on how more farmers are turning to sustainable finance solutions such as our Agri Green Loan to invest in innovat...

23 August 2023

CBA brings contactless transit payments to Victorians

Victoria’s new public transport ticketing system, underpinned by CBA’s contactless transit ticketing capability, will enable commuters to tap on an...

18 August 2023

Pharmacies innovate in response to 60-day dispensing

Pharmacies are turning to digital technology to reduce costs while expand services in response to the challenges of 60-day dispensing, new CommBank...

17 August 2023

New CommBank Household Spending Insights Index shows consumers continued to tighten belts in July

Monthly CommBank HSI Index is based on de-identified transaction data of CBA customers and 12 spending categories. Shows Western Australia had the ...

15 August 2023

CBA delivers improved financial outcomes through continued focus on customers

The result demonstrates continued focus on supporting customers, investing in communities, and providing strength and stability for the broader eco...

9 August 2023

Updated Environmental and Social Framework

Environmental and social issues are evolving rapidly as science, community expectations and stakeholder perspectives continue to change. Our Group ...

9 August 2023

Our 2023 Climate Report

Commonwealth Bank’s second Climate Report outlines progress against its roadmap.

9 August 2023

CBA to launch police referral pilot in NSW to address technology-facilitated abuse

Extending CBA’s support for customers experiencing financial abuse

6 August 2023

Improving experiences for CommBank’s customers and its people with AI

CBA’s Chief Data & Analytics Officer sat down with the AFR in a conversation about the revolutionary technology.

2 August 2023

A brigade of cyber wardens set to transform small business cybersecurity landscape

The ultimate line of defence against cyber criminals is about to march in, and they mean business.

1 August 2023

Regional Western Australia emerges as growth hotspot

Regional areas in Western Australia have emerged as favourites with both city slickers and regional residents in the year to June 2023, the latest ...

31 July 2023

Australian homeowners want simpler and faster refinancing

CommBank makes online home loan refinance application faster.

31 July 2023

CommBank’s new Green Buildings Tool to help commercial building owners advance sustainability efforts

CommBank is the first Australian bank to offer an interactive digital tool to help commercial property customers identify building sustainability i...

31 July 2023

CommSec launches new international share trading platform

New platform provides fast account set-up, easy online access to 13 international equity markets and brokerage rates from USD$5. CommSec has also r...

31 July 2023

CommBank extends commitment to help end financial abuse

CommBank launches Next Chapter Innovation to support programs for long-term recovery for victim-survivors.

27 July 2023

CBA supports innovation in soil carbon sequestration

CBA prepays for carbon credits in strategic alliance with RLF AgTech.

27 July 2023

Tasmania edges NSW as best performing economy: CommSec State of the States

Tasmania holds off a challenge from NSW to stay on top of the leader board.

24 July 2023

The wait is over with the CommBank Matildas ready for a World Cup on home soil

The 2023 FIFA Women’s World Cup kicks off two years after Commonwealth Bank and Football Australia announced their historic partnership.

20 July 2023

Macquarie University’s sustainability-linked loan to benefit disadvantaged students, with CBA support

Margin adjustments from the University’s inaugural sustainability-linked loan will be reinvested in scholarships for disadvantaged students.

19 July 2023

CommBank’s x15ventures seeks solutions working towards net-zero future

Xccelerate23 will focus on climate tech startups interested in exploring pathways to a corporate partnership.

17 July 2023

CBA backs tradies with new partnership

CBA launches new partnership with Total Tools to deliver more value for tradies, with new data showing a boom in the number of them joining the bank.

13 July 2023

Opening remarks to the House of Representatives Standing Committee on Economics

Commonwealth Bank Chief Executive Officer Matt Comyn appeared before the House of Representatives Standing Committee on Economics on Thursday, 13 J...

13 July 2023

Award-winning podcast returns, to ask: Would you notice the red flags of an abusive relationship?

The award-winning podcast There’s No Place Like Home, produced by CommBank in partnership with Future Women, returns for a second season to uncover...

11 July 2023

CommBank HSI Index drops 1.7% in June, as discretionary spending weakens further

Decline led by reduced spending on home buying, health & fitness, entertainment and travel, with utilities spending increasing at its highest rate ...

11 July 2023

CBA invests in global climate specialist Wollemi Capital

The bank joins Wollemi's Series A capital raising as major strategic investor.

10 July 2023

CBA strengthens commitment to regional Australia

CBA maintains the largest branch network and keeps regional branches open.

7 July 2023

Research shows one in four Aussies have been exposed to EOFY scams

CommBank urges customers to stay alert to scammers taking advantage of end of financial year with tax scams.

5 July 2023

CBA top ranked for economic and markets research in KangaNews investor poll

CBA rated #1 in four of seven categories, including Best Overall Research on Australian Fixed Income.

5 July 2023

CBA welcomes new National Anti-Scam Centre's first fusion cell

Commonwealth Bank of Australia has welcomed the investment scam fusion cell to combat the growing problem of investment scams, announced today.

3 July 2023

How to help your teen find (and keep) their first job

Getting paid work can be an exciting moment for a teen but it can be a minefield for parents to navigate. To help, we’ve put together this guide wi...

1 July 2023

How CommBank Next Chapter is helping to end the devastating consequences of financial abuse

So far the initiative has helped more than 4000 victim-survivors of financial abuse move forward and rebuild their financial independence.

1 July 2023

Fair shares: Ten investing questions with CommSec’s Tom Piotrowski

The economist and CommSec market analyst explains why the people who grow wealth by investing actually do very little.

1 July 2023

The 7 steps to negotiating a better price (hint: haggle!)

In Australia, we tend to shy away from asking for a good deal but learning how to haggle saves you cash and delivers a healthy dose of satisfaction...

1 July 2023

New places available with CBA through the Australian Government’s Home Guarantee Scheme

Eligibility criteria for the Home Guarantee Scheme has expanded providing more opportunities for home ownership.

1 July 2023

3 mindset changes to make to boost your savings

If you struggle to set money aside for savings, challenging these ways of thinking could make all the difference.

1 July 2023

How to save on food costs with cookbook author Lucy Tweed

She shares her tips for keeping the food on her table delicious and affordable.

1 July 2023

12 simple savings ideas to reduce costs

We asked readers to share their secrets to shaving costs and saving some coin.

1 July 2023

Introducing 'Ask Jess', our new column by CommBank’s personal finance expert Jess Irvine

Got a question about how to alleviate the pressure on your hip pocket and tackle tricky financial situations? Jess is here to help.

1 July 2023

Thinking of starting a veggie garden? An expert shares his tips

Ever wanted to serve a plate of food that came straight from your backyard? When Ben Shaw created an edible garden, he had no idea how much it woul...

1 July 2023

How to use the Benefits Finder to discover some hidden cash

Rent assistance? Tech trade-ins? This digital tool will help you find grants, rebates and concessions.

1 July 2023

CBA supports Downer’s Queensland Train Manufacturing Program with its first Green Bank Guarantee Facility

Downer taps into CBA’s sustainable finance expertise to enable the delivery of a critical infrastructure asset that will support the future low-car...

30 June 2023

"Banking a world in flux"

Speech by Andrew Hinchliff, Commonwealth Bank Group Executive Institutional Banking and Markets, at the Trans-Tasman Business Circle in Sydney on T...

30 June 2023

Research from CommBank reveals why Gen Z aren’t answering your call

New CommBank research reveals the lengths young Australians would go to in order to avoid a phone conversation

29 June 2023

Executive Leadership Team update

Commonwealth Bank appoints a new Group General Counsel and Group Executive Legal & Group Secretariat.

27 June 2023

CBA recruits EssenceMediacom’s Pat Crowley

Appointment of industry veteran is designed to drive best possible customer experience through an expanded focus on paid and owned media.

20 June 2023

1 in 4 Aussies over 65 have experienced financial abuse or know someone who has

CommBank Safe & Savvy guide helps older Australians protect themselves from financial abuse and scams, and to plan for the future.

15 June 2023

Discretionary spending weak again in May and signs of parents needing to work more hours

Increased number of trading days in May sees CommBank HSI Index reverse April’s decline, with higher childcare spending suggesting parents are need...

13 June 2023

CBA announces interest rate changes - June 2023

The Commonwealth Bank has responded to the Reserve Bank of Australia's cash rate decision.

9 June 2023

CBA targets scams with new holds, declines and limits on payments to cryptocurrency exchanges

Protecting customers as scammers exploit the rising popularity of cryptocurrency purchases

8 June 2023

CBA enters Enforceable Undertaking with ACMA

The EU has a term of three years and arises from past issues with CBA’s unsubscribe mechanisms.

7 June 2023

CBA launches $0 fee International Money Transfers using NetBank, CommBank App or CommBiz

Transaction fees waived on IMTs transacted via CBA digital banking platforms for Australian retail and business banking customers.

6 June 2023

Sir Denison Miller: The banker for all Australians

Banking defined every aspect of Denison Miller’s adult working life but it was as much as a surprise to him as it was to the country that he emerge...

5 June 2023

Sir Denison Miller: Laying the foundations of the common wealth of Australia

How a little-known banker from a country town in NSW created the Commonwealth Bank and helped build modern-day Australia from the ground up.

5 June 2023

Employment opportunities drive mobility across Australia to its highest point in five years

Mobility across Australia is at its highest point since March 2018, driven by employment opportunities, business and industry growth, the latest Re...

31 May 2023

CBA partners with Greening Australia to expand native seed production for land restoration & carbon sequestration projects

Investment in Nindethana, Greening Australia’s native seed supply subsidiary, will support Australia’s ambition to be a global provider of carbon a...

30 May 2023

CBA steps up national battle against scams

Industry-leading NameCheck anti-fraud technology to be offered to government, financial services firms as CommBiz customers get use of new service ...

30 May 2023

Smoking ceremony marks support of reconciliation at CommBank

The welcome ceremony, held during National Reconciliation Week, reaffirmed Commonwealth Bank’s support of reconciliation, and an Indigenous Voice t...

30 May 2023

Maintain strong connections, listen and learn: CommBank’s Indigenous voices reflect on advice shared across generations

For National Reconciliation Week (27 May to 3 June), members of CommBank’s Indigenous community reflect on this year’s theme: “Be a Voice for Gener...

29 May 2023

CBA supports Macka’s Pastoral in achieving its carbon neutrality goals

CBA has a long relationship proudly supporting NSW family beef producer Macka’s Pastoral, as they take landmark strides towards sustainability.

29 May 2023

CommBank Indigenous Careers presents Vivid Sydney’s Tumbalong Nights

A free community festival of arts and music entertainment as part of Vivid Music, featuring a stellar line-up of First Nations artists.

26 May 2023

CBA launches $0 Smart Mini reader promotion at CommBank SmallBiz Week 2023

Bank targets support for small businesses, in addition to $0 monthly account fee CommBank Business Transaction Accounts

25 May 2023

CBA announces new reimagined banking services

Commonwealth Bank has today announced a series of innovations and technological advances designed to strengthen and deepen the customer experience ...

24 May 2023

CommBank is partnering with global travel agency Hopper

CommBank is working to integrate Hopper into a new in-app travel experience helping CommBank customers to book, travel and save.

24 May 2023

CBA delivers superior customer experience via Australia’s #1 banking app

Commonwealth Bank today unveils the latest version of Australia’s #1 banking app, CommBank App v5.0.

24 May 2023

CBA launches new 48-hour and seven-day notice deposits to help SMEs maximise cash flow

Businesses will be able to maximise their cash flow thanks to a new Commonwealth Bank innovative short notice deposit account that allow customers ...

23 May 2023

CBA launches small business Sustainability Action Tool

CBA is the first Australian bank to offer a sustainability action tool to help small business customers improve environmental outcomes while enhanc...

22 May 2023

Australians in their early thirties and renters feeling most pressure from rising cost of living

New CommBank iQ Cost of Living Insights Report uses bank transaction data to provide business customers with powerful insights into changes in cons...

17 May 2023

Manufacturers set to expand production and drive profit growth with ‘efficiency, productivity and sustainability’

Australian manufacturers expect to increase production volumes in the next 12 months, supported by higher capital expenditure and investment in tec...

17 May 2023

Girls in Tech fostering the next generation of women in STEM

Hundreds of high school students learned about the vital ideas and perspectives women bring to STEM fields at an annual event presented by CommBank...

12 May 2023

Household spending declines in April

Drop in CommBank HSI Index due to reduced trading days for Easter and ANZAC Day holidays, as annual spending growth continues to moderate.

9 May 2023

Customer focus and balance sheet strength, delivering for all stakeholders

Our focus on customers, underpinned by our balance sheet strength and consistent operational execution has delivered record customer advocacy score...

9 May 2023

Federal Budget reaction: CommBank Chief Economist

“This budget seeks to balance the risks to the economy from high inflation, the need for ‘cost of living’ relief and the requirement to move the me...

9 May 2023

CBA announces interest rate changes - May 2023

The Commonwealth Bank has responded to the Reserve Bank of Australia’s cash rate decision.

5 May 2023

New Bankwest and CBA Perth Tech Hub unveiled

CBA’s latest technology hub will join previously launched hubs in Melbourne, Adelaide and Brisbane to foster the next generation of technology talent.

5 May 2023

AI is already revolutionising banking — in ways you might not always see

Dr Andrew McMullan, Chief Data and Analytics Officer at Commonwealth Bank, explains how customers are already benefiting from this incredible techn...

2 May 2023

A year after catastrophic floods, Lismore’s residents share their stories of courage and community

The worst of times can bring out the best in people, as the tight-knit community in Lismore has discovered.

1 May 2023

Tasmania back on top: CommSec State of the States

Queensland slips back to second place, in a draw with South Australia.

1 May 2023

Eight ways to get on top of tax time

Filing your tax return can be a painful process but it’s worth taking the time to get it right. We can’t replace your accountant – or the ATO – but...

1 May 2023

Thread Together: The not-for-profit with a simple premise, but a powerful impact

SubheThis not-for-profit saves clothes destined for landfill and helps women in need.ad

1 May 2023

Federal Budget 2023 preview: Government has ‘difficult challenge of meeting multiple goals’

A report by CBA’s Chief Economist Stephen Halmarick ahead of next week’s Federal Budget on 9 May forecasts a sharp reduction in the budget deficit.

1 May 2023

Unpacking the grit and resilience of women in business: Women in Focus and Women’s Agenda launch new research report

The research shows that, despite facing significant obstacles, women in business remain determined to succeed.

27 April 2023

CBA expands green financing to enhance energy efficiency and sustainability

Commonwealth Bank is expanding its green financing offering for customers

20 April 2023

Remembering our First Nations service people on Anzac Day

As we commemorate the contribution of those Australians who served in times of conflict, CBA employee Linda Smith pays tribute to her grandfather E...

20 April 2023

Return to work drives increased transport spending

Rise of CommBank HSI Index in March also led by increased entertainment, retail, travel and education spending - as annual spending growth continue...

18 April 2023

CBA launches green vehicle and equipment finance