Help & support

Your benefits may be locked if you do not meet the eligibility criteria for CommBank Yello. To unlock CommBank Yello benefits, you must meet the eligibility criteria for one of the below benefit sets:

Everyday (base eligibility criteria)

You’re eligible if you:

Everyday Plus

You’re eligible if you:

Homeowner

You’re eligible if you:

You can only be eligible for one benefit set at one time.

You’re not eligible for CommBank Yello if:

Note that as eligibility for benefits is typically assessed in the first week of a month, it can take more than a month to start receiving benefits again.

We assess eligibility every month, typically on a day within the first week of each month. Read examples of eligibility journeys.

To access CommBank Yello, you need to have one or more of the below CommBank transaction accounts:

You need to make at least five completed outbound transactions a month from an eligible account or credit card to be eligible for CommBank Yello (and at least 30 completed outbound transactions to be eligible for Everyday Plus or Homeowner benefits). The below outbound transaction types count towards your CommBank Yello eligibility:

We may also from time to time consider other transactions to be outbound transactions.

It’s important to note that outbound transactions don’t include pending transactions, which are payments, cash withdrawals or deposits shown as pending on your account. You can view your pending transactions in the CommBank app or NetBank.

We assess eligibility and access to CommBank Yello on an individual basis. If you and someone else jointly hold an eligible account or eligible home loan and you meet the CommBank Yello eligibility criteria, we determine your eligibility for benefits individually. If one of you doesn’t meet the eligibility criteria, or chooses to opt out of CommBank Yello, the other will still have access to the program as long as they meet the eligibility criteria.

If you don’t have an individual account, benefits such as CommBank Yello product cashbacks (e.g. home insurance, Home Loan Package or personal loan cashbacks) will be paid into your newest joint account – even if the joint account holder isn’t eligible for the benefit. You may be able to select which account your CommBank Yello product cashbacks are paid into via the CommBank Yello hub in the CommBank app.

Please note that if we pay benefits into your joint account, the payment itself may reveal to the other joint account holder your financial status or the products that you hold with us (e.g. whether you’re eligible for Homeowner benefits).

For cashbacks on home insurance where there's more than one policyholder, we pay the cashback to:

For cashbacks on Home Loan Packages where there’s more than one eligible Package holder, we pay the cashback to:

For cashbacks on Digi Home Loans where there’s more than one eligible account-holder, we pay the cashback/s to:

To access all of your CommBank Yello benefits, make sure you’re using the latest version of the CommBank app.

Benefits such as CommBank Yello product cashbacks (e.g. home insurance) will be paid into your newest individual account.

If you don’t have an individual account, the benefits will be paid into your newest joint account – even if the joint account holder isn’t eligible for the benefit.

You may be able to select which account your CommBank Yello product cashbacks are paid into, in CBA Yello Settings on the CommBank app. Changes to your selected CommBank Yello account will be reflected from the start of the month after you submit your selection.

We’ll make every effort to pay your CommBank Yello product cashbacks into the account you select, but in some circumstances this may not be possible (for example, if you’ve closed the account at the time of benefit payment). In such cases, we’ll pay the benefits as if you hadn’t made the selection.

CommBank Yello Cashback Offers will be paid into the account associated with the Mastercard® you paid with.

Eligible CommBank Yello customers can activate a free Kit membership for 12 months.

Kit is an earning-and-learning, mindfully-spending, money-mastering app for kids. Kit comes with a digital and physical prepaid card available in-app, and it’s built by CommBank.

If you are a CommBank Yello eligible customer, head to the CommBank app and tap 'CBA Yello'. Scroll to ‘Get more from CommBank Yello’ and tap on the Kit offer to view your unique promo code. New Kit customers will need to apply the code when setting up an account with Kit through the Kit app. Existing Kit customers will be able to apply their code via settings in the Kit app.

Kit and CommBank are working together on an ongoing free membership offer for Everyday Plus and Homeowner benefit sets.

If you’ve opted in to earn Qantas Points on your Smart Awards credit card, bonus points will be converted to Qantas points at the standard conversion rates.

Only primary cardholders are eligible for the CommBank Yello Smart Awards bonus points. You need to hold an active Smart Awards credit card at the time we assess your CommBank Yello eligibility, which typically happens in the first week of each month.

View CommBank Awards T&Cs

If you’re eligible for Homeowner benefits, you could receive a $10 monthly cashback for each eligible home insurance policy distributed by CommBank and provided by Hollard.

This will appear as ‘CBA Yello Insur Cashbk' in your transactions.

The eligible home insurance cover types are:

that are distributed by CommBank and provided by Hollard (formerly known as CommInsure).

Cashbacks aren’t available for insurance that covers portable contents as a standalone policy.

You must hold the eligible home insurance policy on the last day of the previous month and continue to hold the policy until the cashback is paid in order to qualify for the cashback benefit in a particular month.

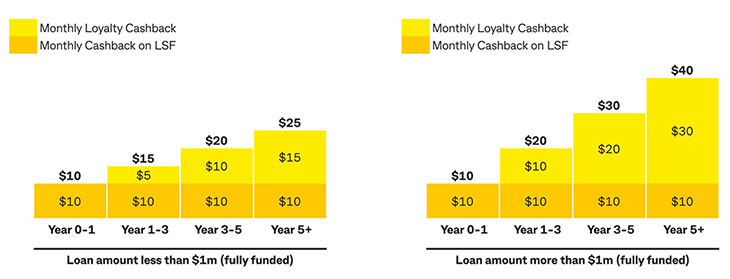

If you’re a Homeowner customer with a Digi Home Loan, you could receive a $10 monthly cashback on your Loan Service fee (up to $120 annually). Plus, you could get a loyalty cashback which increases over time, once your loan has been fully funded for a year.

If you have a Digi Home Loan of less than $1 million for:

If you have a Digi Home Loan of more than $1 million for:

The cashback will be paid per Digi Home Loan, rather than per customer. Your Digi Home Loan must be open on the last day of the previous month to be eligible for the cashback benefits. If there is more than one eligible Digi Home Loan account holder, we pay the cashback to:

This will appear as ‘CBA Yello Digi CbkXXXX', where XXXX is the last four digits of your Digi Home Loan account number.

Eligibility is typically assessed monthly and customers must also meet the CommBank Yello Homeowner eligibility criteria.

There may be tax implications in receiving cashback benefits. You should check with your accountant or tax adviser for further information.

If you’re a Homeowner customer, you could receive a $5 per month loyalty payment for investing Australian Shares with CommSec.

You’ll need to settle one trade over $1,000 with an Individual CommSec Share Trading Account to a Commonwealth Direct Investment Account (CDIA). The trade must be settled by the last day of the previous month.

You must be eligible for the CommBank Yello Homeowner benefit set. We typically check eligibility at the start of the month.

The loyalty payment will be paid per customer and is limited to one payment per month. The loyalty payment will be paid into your most recently opened individual account, unless you have selected a different account in the CommBank app. Accounts that have been stopped (no longer permitted to make transactions) aren’t considered opened accounts.

The loyalty payment is not available to customers with a Joint, Company or Trustee CommSec Australian Share Trading Account, and to customers trading through CommSec Pocket, International Shares, Exchange Traded Options or Margin Loans.

There may be tax implications in receiving the loyalty payment. You should check with your accountant or tax adviser for further information.

If you’re eligible for Homeowner benefits, you could receive a $4 monthly cashback on your Home Loan Package fee (Wealth Package or Mortgage Advantage). The cashback will be paid per Package. Cashback is not available where the Package is pending or closed, or where the Package fee has been fully or partially waived.

This will appear as ‘CBA Yello HLPckg’ in your transactions.

The CommBank Yello Property Report highlights information on your property or the real estate market.

You may qualify for a property report if you meet the below eligibility criteria:

Property reports are prepared by our service partner. If we don’t have a record of your full address, you may receive a suburb report instead, which focuses on your suburb rather than your specific property.

Property reports will be available via the CommBank Yello hub in the CommBank app twice a year.

If you sell your property, refinance to another financial institution, and/or close your CommBank home loan, you’ll no longer receive property reports for that property, but you may continue receiving them for other eligible properties.

Please message us in the CommBank app or visit your local branch to provide us with your full address details. This will help ensure you receive a Property Report when you’re next eligible.

Eligible CommBank Yello customers get access to presale and preferred tickets to selected Live Nation Australian tours. Preferred tickets are a limited number of tickets set aside from the general public.

To access presale tickets, you'll need to be an eligible CommBank Yello customer and pay for the ticket with a CommBank Mastercard. Discover the benefits and how to become eligible, in the Eligiblity & benefits overview.

Yes, eligible CommBank Yello customers can access preferred tickets. These are a limited number of tickets set aside from the general public.

You can find upcoming presales in CBA Yello on the CommBank app.

No, all you need to use is an eligible CommBank Mastercard at checkout.

For all checkout and technical issues, please contact the ticketing providers (Ticketek or Ticketmaster) or see Live Nation's customer support. For all credit card related inquiries or denied transactions, please contact us or Mastercard.

If an event is postponed or rescheduled, the event organiser will contact you with the new event date. Unless stated otherwise, your original tickets will be valid for the rescheduled event date. If you're unable to attend the rescheduled event date, you may request a refund. If an event is cancelled and will not be rescheduled, you'll be issued a refund. Please contact Live Nation for more information.

You can use any eligible CommBank debit Mastercard or credit Mastercard to redeem cashback offers.

Check eligible cards in CommBank Yello Offers by tapping the Settings icon in the top-right corner of your CommBank app screen, then ‘Offer notifications & support’.

Any cashback offers made to the primary cardholder can be redeemed by the additional cardholder. Cashback offers redeemed by the additional cardholder will be paid to the primary cardholder’s account.

Cashback is typically paid within 14 business days of a qualifying transaction. You’ll be notified in the CommBank app when it’s on its way.

It will be displayed in your account as ‘CBCASHBACK’ (or similar)

Check whether you’ve met all the offer eligibility criteria. To be eligible for cashback, you must:

You’re unable to claim cashback if you use a payment platform like Afterpay, Zip or PayPal.

Check you've followed these three steps:

1. Go to Settings and turn on notifications in the CommBank app

2. Go to ‘CommBank Yello Offers’, tap the Settings icon, and tap ‘Offer notifications & support’ to enable notifications for redeemed offers

3. Go to your mobile settings and turn on notifications

We’ll do our best to inform you about your transactions and payments. Occasionally, notifications may not be sent or received because:

In some circumstances, we may not present CommBank Yello Offers to you. Such circumstances may include when you are not eligible for CommBank Yello, haven’t transacted recently on your card, or when you are in default in respect of the terms and conditions applicable to any of your CommBank accounts.

Yes – to opt out of CommBank Yello, please message us in the CommBank app or visit a branch.

Yes – we’d love to have you back! You can message us in the CommBank app or visit us at a branch to opt back in.

Just a reminder that you’ll still need to meet the CommBank Yello eligibility criteria, and it may take over a month before you can access benefits again.

As this information has been prepared without considering your objectives, financial situation or needs, you should consider its appropriateness to your circumstances before relying on this information.