Speaking at the CommBank SmallBiz Week event at Marvel Stadium in Melbourne, CBA Executive General Manager Business Lending and Small Business Banking, Grant Cairns, said:

“We’re delighted to launch this $0 Smart Mini reader promotion to coincide with our sponsorship of CommBank Small Biz Week. We know it is a tough environment for many small businesses and that every saving helps with the bottom line.

“Together with our existing $0 monthly account fee option for new CommBank BTAs, we’re pleased to be providing tangible support to the small business sector by removing a number of banking services costs.”

CBA General Manager of Merchant Solutions, Karen Last, said portable payment solutions were are an important payment option for many small businesses and that Smart Mini offered a range of attractive benefits.

“Recent CBA research highlighted the growing usage of payments on the go and the big increase in business start-ups post-Covid - many of which rely on portable payments.

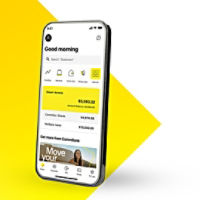

“Our $0 Smart Mini reader promotion gives small businesses the opportunity to trial its many benefits, including a highly competitive flat rate transaction fee, anti-fraud technology, almost real-time transaction insights and same day settlement on all transactions where the device is linked to a CommBank BTA.

“Portable payments is a very competitive space between different providers and we’re pleased with the advantages that Smart Mini delivers to our customers and its traction in the market since launching in March,” Ms Last commented.

Access the $0 Smart Mini reader promotion by visiting commbank.com.au/smart-mini and for more information on the $0 monthly account fee option for new CommBank Business Transaction Accounts, visit commbank.com.au/bta

Things you should know: This media release is intended to provide general information of an educational nature only. It does not have regard to the financial situation or needs of any reader and must not be relied upon as financial product advice. You should consider seeking independent financial advice before making any decision based on this information. The information in this article and any opinions, conclusions or recommendations are reasonably held or made, based on the information available at the time of its publication but no representation or warranty, either expressed or implied, is made or provided as to the accuracy, reliability or completeness of any statement made in this article. Eligibility criteria, terms and conditions and fees apply to CBA’s merchant services. Find out more at commbank.com.au/smart-mini.

1 1.1% covers Mastercard, Visa, AMEX, JCB, eftpos, and UnionPay transactions (JCB coming soon for Smart Mini, additional costs may apply for all other cards). AMEX is subject to approval, available to eligible customers only. Eligibility criteria, terms and conditions apply. Please contact AMEX for more information on 1300 363 614, available weekdays 8am to 6pm Sydney time.

2 Merchant customers with a CommBank Smart Mini reader (or readers) and process at least $2,000 of transactions using that reader (or readers) by 31 July 2023 (was previously 30 April 2023), will receive a one-off payment of $100 to their linked settlement account which must be a CommBank Business Transaction Account. Linked settlement accounts held at other financial institutions will not be eligible for this offer. A maximum of $100 will be paid for each valid, new merchant number you have with us. Payment will be made into your CommBank Business Transaction Account within 45 days of the conclusion of the offer. Offer subject to change. If you have purchased a CommBank Smart Mini reader (or readers) and met the eligibility criteria by 30 April 2023, you will receive your payment within 45 days of that date. If you are yet to process at least $2000, you will have until 31 July 2023 to meet the eligibility criteria. For more information on our range of EFTPOS products and pricing plans, visit commbank.com.au/merchants.