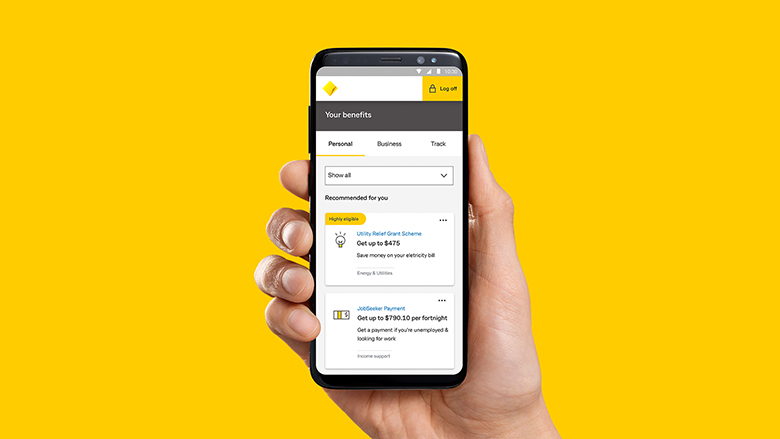

We’re giving customers easy access to things like telecom (NBN) and energy, just to mention a few, with great offers from our partners. While I feel we have already made great progress in broadening our propositions, more will come and just as importantly, more will be done to create a coherent, relevant proposition.

Now, to be able to do all of this, ultimately creating an ecosystem that goes beyond banking to the benefit of our customers requires quite a shift from a technology point of view.

Two key shifts in digital technology

Banks have a great history of leveraging technology and even being at the forefront in many areas. For some banks, this has turned into a disadvantage in their digital transformation, as they have not been able to modernise over time and consolidate onto more modern technology. But today I want to focus on two key shifts in the requirements that the digital transformation brings.

The first is back to the customer experience and the use of data.

Banks used to be in a situation where we only used as much information as required to be able to update the ledger. If you spent $50 dollars, the most important thing was that your balance was updated with that amount. We did not care about what kind of purchase it was, where it was, what similar things you may have done previously, et cetera.

To be able to provide an outstanding customer experience today, this kind of data is crucial, but older generations of banking technology stacks were never designed to capture any of this. Today, and especially outside of our traditional banking competitors, this is the differentiator and the reason why many care about banking at all. So the point is:

Our technology stacks have to be geared to use data to deliver the value and experience that customers today expect.

At the Commonwealth Bank we have invested heavily over the last many years to get to what is widely considered a global tier one capability in banking. We still have a tremendous amount of work ahead of us, so this is continuing at pace.

The second is then about combining our own products with those of our partners. Again, historically banks have just been about surfacing their own products in their own channels, and the technology stack often reflects that closed system.

To now connect quickly, safely and easily with others, constitutes a whole new set of requirements on our technology and how we build software. To address this, we are relying on APIs and microservices, and obviously Cloud.

Here, I need to issue a word of caution though, because all of these terms are easy to throw around but hard to get right. If you wanted to, you can call any integration an API, any service a microservice and then forklift it off to the Cloud, and quite possibly be worse off than where you came from.

We are trying to drive towards a clear 3-tiered architecture with reusable, discoverable, layered and productised APIs and microservices with consistent patterns and capabilities, including things like recoverability. This is a huge transformation in itself, and clearly not something you can complete overnight.

The foundation of customer experience at CommBank: Our People

So now I have talked a bit about how we obsess about Customer Experience, how we leverage partnerships to broaden our offerings and enhance that experience, and how that drives a shift in our technology. Of course, the foundation to all of this is our people and how we set ourselves up to deliver on all of it.

I have already mentioned the focus on data and insights, and we are investing a lot in both attracting some of the best and developing our people in this field. We have fantastic cases of people evolving from customer facing roles in branch to leading the charge in our Data & Analytics Office.

We are also going hard on elevating our engineers and developing our engineering practices. We have added huge numbers of engineers to our workforce in both Australia and India over the last couple of years, and we are continuously putting a lot of focus on training and development of all things engineering.

As I alluded to before on Cloud, API and microservices, good engineering is hard, and bad engineering is disastrous, so we are completely dependent on continuing to develop a tier one engineering workforce.

Last but not least, we have been shifting towards enterprise agile ways of working, in particular trying to go towards persistent, cross-functional teams that have a clear connection to the customer outcomes they try to create. We seek to create an environment where teams are empowered to work on solving complex customer problems, as opposed to being order takers and implement defined solutions.

We have already seen that this generates a higher sense of purpose for the teams. It also helps exposing a number of areas where we have a lot of work ahead of us to unleash the full potential of our people and our technology, that we may previously not have understood the full magnitude of.