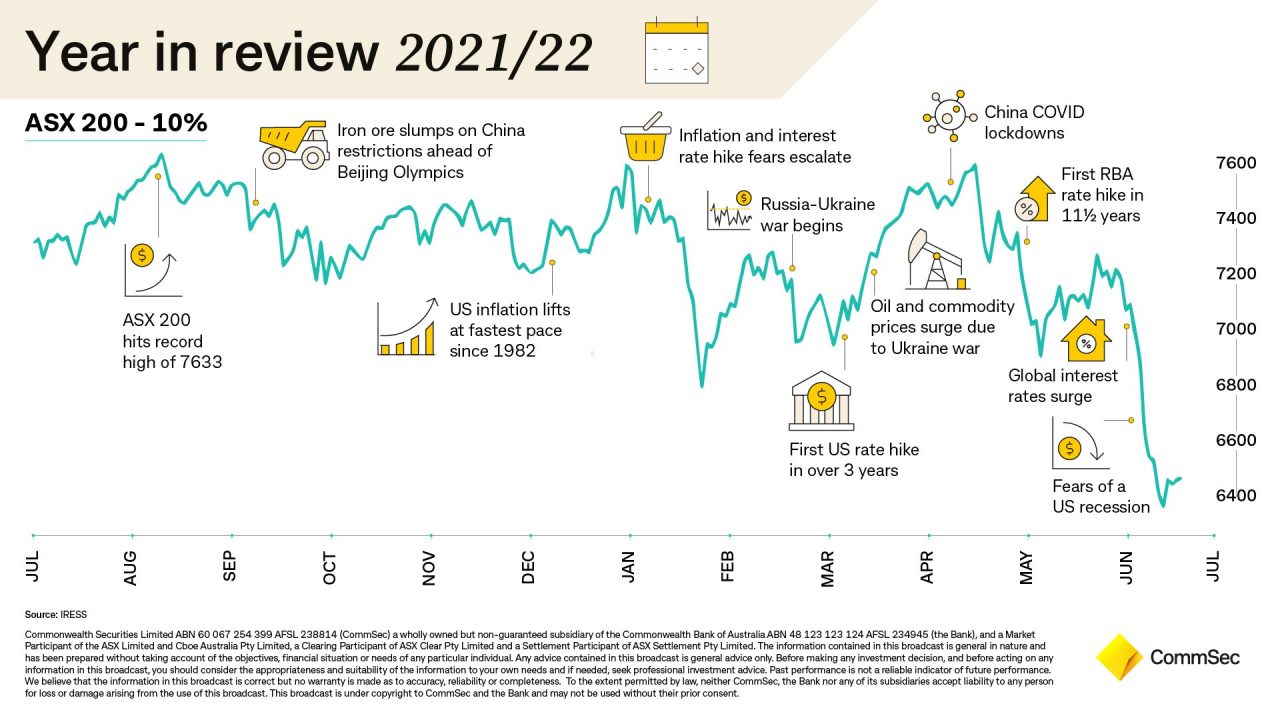

CommSec is tipping the Australian sharemarket to rebound in 2022/23 after a year of national and global challenges. In financial year 2022, Aussie investors contended with heightened sharemarket volatility due to the Covid-19 pandemic, war in Ukraine, supply chain disruptions, high inflation, rising interest rates and fears over a possible global recession.

In the financial year to 30 June, both the Australian All Ordinaries index and S&P/ASX 200 fell by around 10 per cent after rising by around 25 per cent in the 2020/2021 financial year. Total returns on Australian shares (share prices and dividends) fell by 7.4 per cent after rising 30.2 per cent in the prior year.

Speaking at the release of CommSec’s ‘Year in Review. Year in Preview’ report, CommSec Chief Equities Economist Craig James said soaring inflation and aggressive policies from global central banks to wind back the stimulus seen through the COVID period, contributed to the weakness in the Australian sharemarket over the past year.

“Although the Australian sharemarket fell over the past year, this followed bumper gains in the year prior with the benchmark ASX 200 index up 24 per cent. Supported by a strong domestic economy, and an easing in inflationary pressures, the Australian sharemarket is tipped to claw back losses over the next 12-18 months. But with rapid changes taking place as the economy adapts, investors need to remain alert, pivoting their portfolios as needed,” Mr James said.

“In volatile times, it’s always important investors to assess over longer time frames. While down over the past year, total returns on shares have risen by around 8.5 per cent per annum over the past five years."

Despite falling over the past year, Australia performed in line with global sharemarkets. While losses for Australian shares exceeded those in Japan (down 8.3 per cent compared to the 10.2 per cent fall of S&P/ASX 200 index), they were consistent with mainland European markets (STOXX 600, down 10.1 per cent).

The United States saw bigger losses with the Dow Jones falling 10.8 per cent over 2021/2022, the S&P 500 index down 11.9 per cent, and the Nasdaq down by 24 per cent.

Australia’s Utilities sector out-performed in 2021/22. The Utilities sector lifted by 29.3 per cent over 2021/2022, ahead of Energy (+24.5 per cent) and Industrials (+0.8 per cent). They were the only sectors that rose over the year.

At the other end of the scale, Information Technology fell by 38.7 per cent while Consumer Discretionary lost 22.8 per cent.

CommSec’s ‘Year in Review. Year in Preview’

Disclaimer: The information has been prepared without taking into account the objectives, financial situation or needs of any particular individual. For this reason, any individual should, before acting on this information, consider the appropriateness of the information, having regards to the individual's objectives, financial situation or needs, and, if necessary, seek appropriate professional advice.

Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 (CommSec) is a wholly owned but non-guaranteed subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945. CommSec is a Market Participant of ASX Limited and Cboe Australia Pty Limited, a Clearing Participant of ASX Clear Pty Limited and a Settlement Participant of ASX Settlement Pty Limited.