CBA’s Chief Data & Analytics Officer, Dr Andrew McMullan, said: “We’re using our world-leading data and analytics capabilities, along with artificial intelligence and machine learning to proactively identify and quickly engage with customers potentially impacted by various emergencies and offer support.”

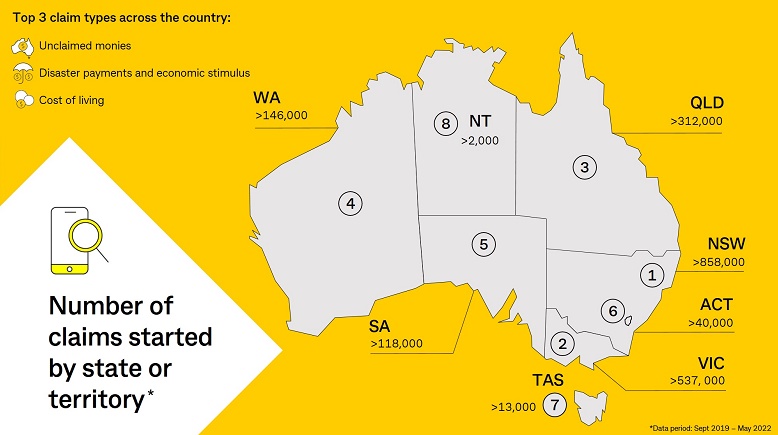

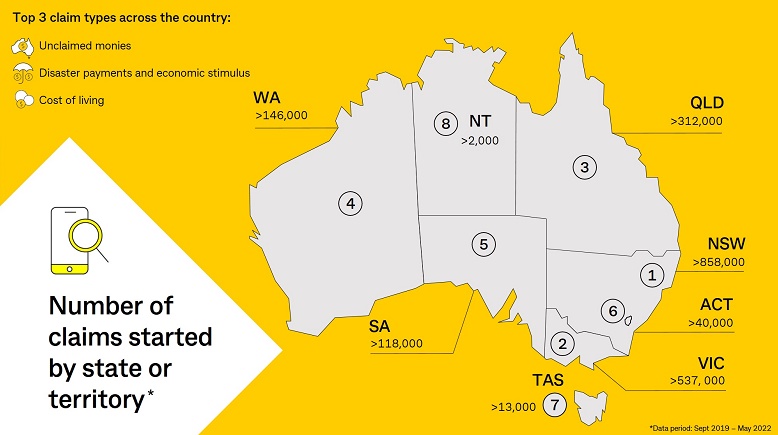

Looking across the country, customers based in New South Wales are responsible for the greatest number of claims commenced (858,000) since the Benefits finder feature was first launched, followed by customers living in Victoria (537, 000) and Queensland (312,000).

Since the feature was expanded to businesses in June 2021, 25,000 claims have been initiated by more than 18,000 Australian businesses.

The Benefits finder feature in the CommBank app helps to connect the bank’s customers with government authorities and service providers to create seamless data integrations and make Benefits finder available to all Australians.

Dr McMullan said millions of Australians have been re-connected with their own money or have been able to access benefits they might not have claimed had they not been prompted via digital messages through the Benefits finder feature.

“At Commonwealth Bank, we want to help our customers. We understand they have really appreciated the opportunity to be able to make claims for money that was lost or unclaimed, and apply for benefits that have been made available by the federal and state governments to help them given their specific needs.

“If we see that there is a new or updated benefit, rebate or emergency support being offered, we will proactively contact our customers to let them know – often within 24 hours of the announcement being made. Some recent examples include the NSW Dine & Discover program and Flood Support payments in QLD and NSW from earlier this year,” he said.

The Benefits finder feature uses CBA’s Customer Engagement Engine, data and decision science expertise to organise, personalise and simplify the claim process for customers. This, in turn, is helping to deliver real financial and social support for the bank’s 7.6 million digitally active retail customers. Benefits finder was developed as part of the long-standing behavioural science collaboration with the Harvard Sustainability Transparency and Accountability Research (STAR) Lab.

Professor Michael Hiscox from Harvard University said researchers are seeking to better understand why many eligible individuals are not claiming needed government support. Past research has shown individuals who qualify for benefits often do not receive them because they are unaware they are eligible or because the processes for accessing benefits are complicated and time-consuming. Behavioural economics helps to identify barriers that prevent people from accessing assistance, including limited attention and cognitive capacity, and the high immediate costs imposed by complex application processes.

“In partnership with CBA, we have conducted a number of trials and published research indicating that, when CBA reaches out to customers who very likely qualify for benefits and simplifies the initial steps in the application process, customers engage at very high rates and report high levels of satisfaction. Benefits finder illustrates how private institutions can play an important role in improving public policy outcomes,” Professor Hiscox said.

There are now 400 different benefits, refunds and rebates available for personal and business customers through Benefits finder, either through direct state benefits or more general ones offered by the Federal Government, its agencies and related organisations.

The number of claims started by each state are:

- New South Wales – more than 858,000

- Victoria – more than 537, 000

- Queensland – more than 312,000

- Western Australia – more than 146,000

- South Australia – more than 118,000

- Australian Capital Territory – more than 40,000

- Tasmania – more than 13,000

- NT – more than 2,000

The top 10 claim types across the country are:

- ASIC Unclaimed Money

- Revenue NSW unclaimed money

- COVID-19 Disaster Payment

- NSW Dine and Discover

- VIC Unclaimed Money

- QLD Unclaimed Money

- Unclaimed Super

- WA Unclaimed Money

- Power Saver Bonus

- Rent Assistance

The top 3 claim types by state (since 2019) are:

NSW

- NSW Unclaimed Money

- Dine and Discover

- ASIC Unclaimed Money

VIC

- VIC Unclaimed Money

- ASIC Unclaimed Money

- COVID-19 Disaster Payment

QLD

- QLD Unclaimed Money

- ASIC Unclaimed Money

- COVID-19 Disaster Payment

WA

- WA unclaimed money

- ASIC unclaimed money

- Unclaimed super

SA

- SA Unclaimed Money

- ASIC Unclaimed Money

- SA Cost of living

ACT

- ACT Unclaimed Money

- ASIC Unclaimed Money

- COVID-19 Disaster Payment

TAS

- ASIC Unclaimed Money

- Unclaimed Super

- Rent Assistance

NT

- NT Unclaimed Money

- ASIC Unclaimed Money

- Unclaimed Super

About Benefits finder

The Benefits finder feature was launched for retail customers in September 2019 and expanded for Australian businesses in June 2021. It can be accessed via the CommBank app and NetBank.

Customers are asked to answer five simple questions, with answers determining what benefits or rebates they may be eligible to claim. Customers are provided with details on each benefit or rebate, including how much they may be able to claim and instructions on how to claim, and are then directed to the relevant website to start the claim.

The Benefits finder feature was developed as part of the ongoing collaboration between CBA and Harvard University’s STAR (Sustainability, Transparency and Accountability Research) Lab.

Find out more at www.commbank.com.au/digital-banking/benefits-finder.

1 More than $481 million was saved by CBA customers in utility bills and additional government payments between July 2019 and August 2020. Customers saved more than $127 million in utility bills and generated $354 million in additional income on a recurring annual basis. CBA designed the evaluation in partnership with Harvard University’s STAR Lab.

2 https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4058715