Unloan, Australia’s first digital home loan with a discount that increases every year for up to 30 years, is launched today. Unloan is built by the Commonwealth Bank, leveraging the best of modern technology and the backing of Australia’s leading bank. Unloan has also been developed through the support and infrastructure of CBA’s venture scaler, x15ventures, offering Unloan greater speed and access to best-in-class tools and experience.

Unloan offers owner occupiers one low variable rate, priced at 2.14% p.a. (2.06% pa comparison rate*), including a loyalty discount that grows by 0.01% p.a. every year, up to 30 years. For investors, Unloan also offers one low variable rate of 2.44% p.a. (2.34% p.a. comparison rate*) and the same loyalty discount that grows by 0.01% p.a. every year, up to 30 years.

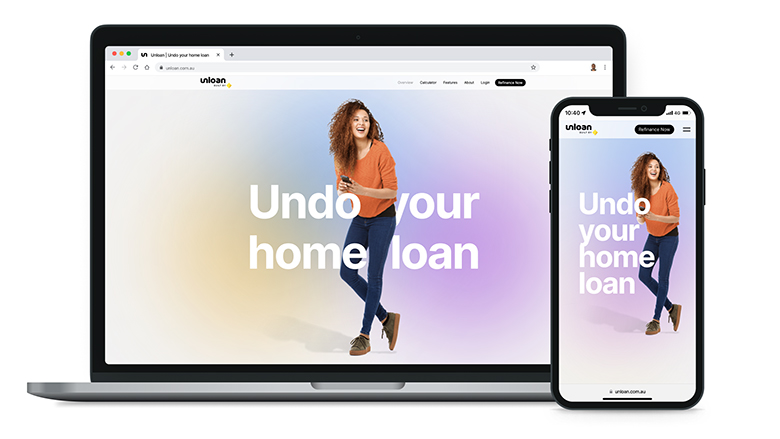

Built on modern technology foundations, Unloan strips away many of the complexities seen in more traditional lending options, with a digital customer experience that allows applications to be completed in as little as 10 minutes.

From today, Unloan is accepting applications to refinance home loans up to three million dollars and up to 80 per cent of the property’s value.

In the coming months, Unloan plans to expand into new home loans, and also enable Open Banking-powered assessments for an even faster application experience.

Daniel Oertli, CEO, Unloan said:

“We believe home loans should be simple to understand, easy to get, and easier to live with.”

“That’s why we built Unloan – a new kind of home loan designed to pass more value back to customers. We have a low variable rate, an ever-increasing discount, and an easy online application.”

Built within the flexible technology and operating environment that x15 enables, Unloan is able to move at pace of a fintech while also benefiting from the back-end banking, payments and compliance services of Australia’s leading bank. In this case, CBA has developed new cloud based capabilities to provide lending and payments services to Unloan, and will also provide downstream compliance and operations services. CBA expects to utilise these capabilities in other parts of its business over time.

Matt Comyn, CEO, CommBank said:

“Driving digital innovation for our customers – including the delivery of distinct and differentiated customer experiences – is core to CBA’s ongoing strategy. Unloan is a powerful example of what can be achieved by successfully bringing together the pace and innovation of the startup world with the scale and assets of Australia’s leading bank, which has always been central to our approach with x15. We are excited to see how Unloan makes a difference for new customers.”

About Unloan

Unloan is a new kind of home loan built for a digital world. We believe home loans should be easy to get and easier to live with. That’s why we built a home loan with a low variable rate, an ever-increasing discount, and an easy online application. For more information visit www.unloan.com.au

About Commonwealth Bank of Australia

The Commonwealth Bank (ASX:CBA) is one of Australia’s leading providers of personal banking, business and institutional banking and share broking services. With more than 15 million customers and a history spanning more than a century, the Group’s purpose is to build a brighter future for all. The Commonwealth Bank is Australia’s leader in digital banking and maintains the largest branch network across the country. Headquartered in Sydney, Australia, the Bank operates brands including Bankwest in Australia and ASB in New Zealand. For more information on Commonwealth Bank, visit www.commbank.com.au.

About x15ventures

x15ventures is Commonwealth Bank’s venture scaler, founded in 2020 to build the next generation of solutions for the bank’s 15 million customers and beyond, and unlock new value from CommBank’s assets through partnership with the tech and innovation community.

x15ventures partners with seasoned entrepreneurs, providing them support and guidance, funding from CBA’s $1 billion annual technology investment envelope, and a technology stack and support model that combines leading-edge cloud technology with bank grade security and integrations to CBA distribution networks – ensuring ventures can scale quickly and sustainably. For more, please visit www.x15ventures.com.au

Disclaimers

Unloan is a division of the Commonwealth Bank of Australia ABN 48 123 123 124 Australian credit licence 234945.

The information has been prepared without taking account of the objectives, financial situation or needs of any particular individual. For this reason, any individual should, before acting on this information, consider the appropriateness of the information, having regards to the individual's objectives, financial situation or needs, and, if necessary, seek appropriate professional advice.

Rates are current at the date of this release and are subject to change. Applications are subject to credit approval, satisfactory security and minimum deposit requirements. Full terms and conditions will be set out in our loan offer, if an offer is made.

Comparison rate calculated on a $150,000 secured loan over a 25 year term. WARNING: Comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.