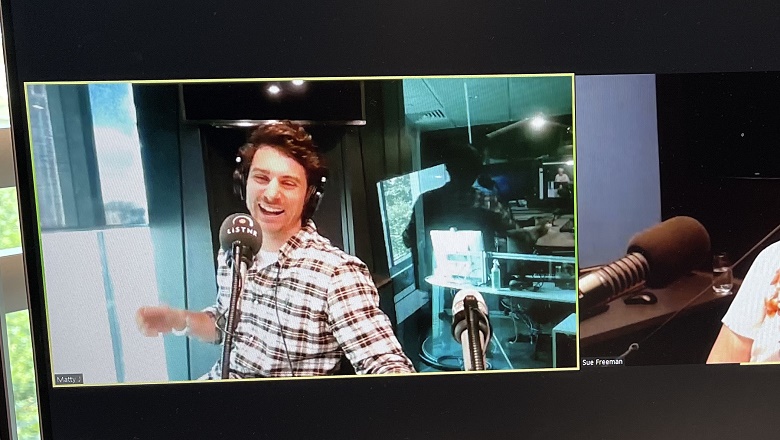

In introducing this week’s podcast, Matty J confessed he is a novice when it comes to investing and believes people who invest are ‘successful adults’.

“When I think of someone who actually knows how to adult properly, that is someone who’s got their foot in the stock market. For example, if I’m at a barbecue with mates and someone asks me about my investment portfolio, that is the perfect time for me to pretend like I need to get a new drink. Because to put it simply, I just don’t get it,” he said in the podcast.

To help demystify the world of ‘investing’, CommSec’s Tom Piotrowski explains what the share market is and how people can invest in it.

He also tackles some of the other questions beginner investors may have, like: ‘where should I start?’, ‘how do I invest?’, and ‘what should my expectations be?’.

After learning a bit about how investing works, Matty J spoke to his mate Clancy Ryan to learn more about his investment journey.

Mr Ryan admits he has always been interested in finance and has long been frugal with his money. So, after buying his first home, he decided to start investing in a bid to make his money work harder for him and his future needs.

By his own admission, Mr Ryan said he didn’t know too much about investing when he first started, so made sure to keep things as simple as possible.

In recapping his chats with both Clancy and Tom, Matty J says he finally understands a little bit more about investing in the share market, but knows the information he gathered in his conversations represents just the ‘tip of the iceberg’.

“My plan on dropping all my savings in one investment then selling it the next week and retiring early requires just a little bit more strategy,” he jokes in the podcast.

“Before I make my first investment, I need to set a budget. These are always so important, it turns out. I need to identify my goals and set realistic timeframes to achieve these, and I need to understand my risk tolerance. Knowledge is key. I need to do thorough research on the industries and companies I want to invest in. And lastly, I’ll start my investing journey now.”