CommSec Chief Economist, Craig James, said: “Australia’s state and territory economies are in solid shape, well supported by strong fiscal and monetary stimulus. Unemployment rates are historically-low across much of the nation. Labour is in short supply across many industries – a reflection of current COVID-related self-isolation requirements and border restrictions. Ahead, the country will continue to face challenges managing the latest Omicron wave with infrastructure spending continuing to be a key driver of growth in 2022.

“Tasmania has held top position in the performance rankings – solely or jointly – for eight consecutive quarterly surveys. While it is likely to remain on top in the short-term, much can change over 2022.

“In fact, the Western Australian and South Australian economies have moved up the rankings, performing strongly during the pandemic, with the former benefiting from a surge in iron ore exports and prices, while the latter has benefited from strong government and business investment.

“In differing ways, each state or territory will attempt to ‘live with COVID’ throughout 2022, potentially leading to major changes in the performance rankings,” Mr James said.

“While Tasmania continues to lead, there is currently little separating the other economies. Lockdowns have weighed on the economic performances of NSW and the ACT in the last survey.

“While both of these economies could scale the rankings again, new challenges are presented by COVID-19 restrictions and the resulting labour shortages – not just for NSW and the ACT, but for all economies. Meanwhile, the opening of domestic and international borders is also likely to further support the Queensland economy.”

The State of the States report uses the most recent economic data available, however while some data relates to the September quarter, other data – such as unemployment – is timelier, covering the month of December.

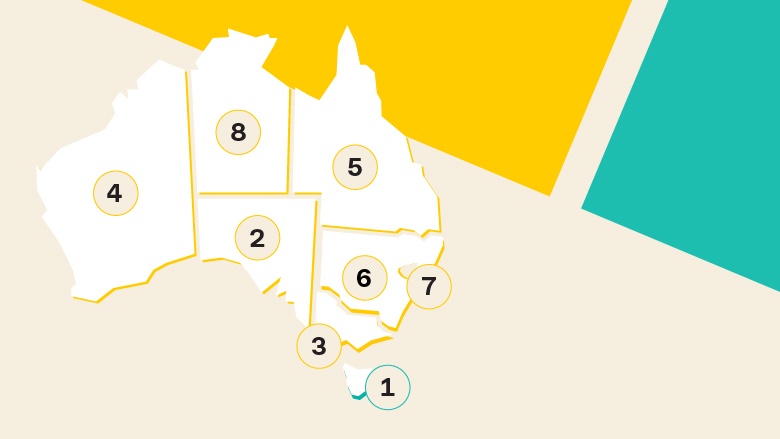

State and territory highlights

- NSW is ranked first on housing finance.

- Victoria ranked first on construction work done and ranked second on both housing finance and dwelling starts.

- Queensland is ranked first on relative population growth, and ranked second on retail trade.

- South Australia ranked second on equipment investment and relative unemployment.

- Western Australia ranked first on relative economic growth and is second-ranked on relative population growth.

- Tasmania is ranked first on retail spending, relative unemployment, equipment investment and dwelling starts. Tasmania ranked second on construction work done and relative economic growth.

- The ACT is ranked third on both relative economic growth and equipment investment.

- The Northern Territory is sixth-ranked on three of the indicators.

Annual growth rates

- Annual changes in economic indicators are useful for measuring economic momentum.

- Of the eight indicators assessed, Western Australia top the annual changes on three measures; Victoria leads on two; while Tasmania, Queensland and the Northern Territory lead on one each.

- When looking across growth rates for the states and territories Victoria, Western Australia and Queensland have annual growth rates equal to or exceeding the national average on five of the eight indicators.

- Tasmania and South Australia lead the national average on four measures. The Northern Territory and the ACT lead the national average on three indicators. NSW leads the national average on two indicators.

To access the full CommSec State of the States Report for January 2022, including a breakdown of each economic indicator and additional commentary from CommSec Chief Economist, Craig James, visit www.commsec.com.au/stateofstates

About the CommSec State of the States Report

CommSec, the digital broking arm of Australia’s largest bank, assesses the performance of each state and territory on a quarterly basis using eight key indicators. Those indicators include: economic growth, retail spending, equipment investment, unemployment, construction work done, population growth, housing finance, and dwelling commencements.

Just as the Reserve Bank uses long-term averages to determine the level of "normal" interest rates, CommSec compares the key indicators to decade averages; that is, against "normal" performance. CommSec also compares annual growth rates for eight key indicators for all states and territories, in addition to Australia as a whole, enabling a comparison of economic momentum.