CBA’s Chief Digital & Analytics Officer, Dr Andrew McMullan said: “It’s a known fact that people regularly leave ‘free money’ on the table and don’t always claim what they are entitled to. Benefits finder helps tackle this and it’s been encouraging to see people across NSW supporting various dining, arts and recreation businesses across the state and providing much welcomed revenue.”

Minister for Digital and Customer Service Victor Dominello said the NSW Government welcomes CBA’s Benefits finder and the promotion of the Dine & Discover program to its customers.

“Similar to the NSW Government’s cost of living program, the CBA’s Benefits finder is all about raising awareness and making it easy for customers to access information,” Mr Dominello said.

“When it comes to the Dine and Discover, the great news for customers and businesses is that 16 million of the 28 million vouchers issued remain unspent, with seven months to run before the end of the program.

“We are making some enhancements to the app experience over the next month to make it easier for customers to find and transact with participating businesses, especially in the discover component of the program.

“I commend CBA and other institutions for promoting Dine and Discover and other NSW Government stimulus initiatives.”

The bank recently launched a digital campaign in collaboration with Service NSW to leverage the bank’s Benefits finder feature and Customer Engagement Engine1. The objective was to raise awareness of the stimulus program, provide periodic digital reminders, and also offer support to help make the claim process simple and easy.

The research shows the campaign helped accelerate the NSW Government stimulus take-up, with customers also spending additional money to bolster the value of the vouchers:

- More than half a million customers engaged with the initial Dine & Discover NSW nudge between April and August 20212 and more than 150,000 customers used Benefits finder to start a claim for their vouchers3.

- More than120,000 new dining and entertainment transactions were generated in June by customers who were sent the nudge in the CommBank app.4

Dr McMullan said his team are passionate about leveraging digital and their data and analytics capabilities to support customers and the community.

“Through Benefits finder we’re supporting Aussies to claim their Dine & Discover NSW vouchers and spend on what they enjoy, while helping to get Australian businesses back on their feet.

“Our recent partnership with AI leader H2O.ai will only extend our artificial intelligence capability to enable us to better anticipate customer needs and accelerate what we are doing to reimagine products and digital experiences to meet those customer needs and add value.”

The two additional Dine & Discover NSW vouchers valued at $25 each recently started appearing in the Services NSW app and will be delivered by 3 December 2021. All vouchers can be used seven days a week, including public holidays, and are valid to 30 June 2022.

Notes for Editors

1 The Customer Engagement Engine uses Artificial Intelligence (AI), machine learning and insights from customer activity to drive highly relevant and personalised interactions to help customers better manage their finances and improve financial wellbeing. In 2020, the Customer Engagement Engine analysed 157 billion data points in real-time and sent 731 million in-app messages relating to COVID-19 support and information.

2 The digital campaign ran from April to August 2021, and more than half a million customers clicked on the initial Dine & Discover NSW message in the CommBank app.

3 More than 150,000 customers used Benefits finder to start a claim via Service NSW between April and August 2021.

4 More than 120,000 individual dining and entertainment transactions were generated in June 2021 by those who were sent the Dine & Discover nudge.

About Benefits finder

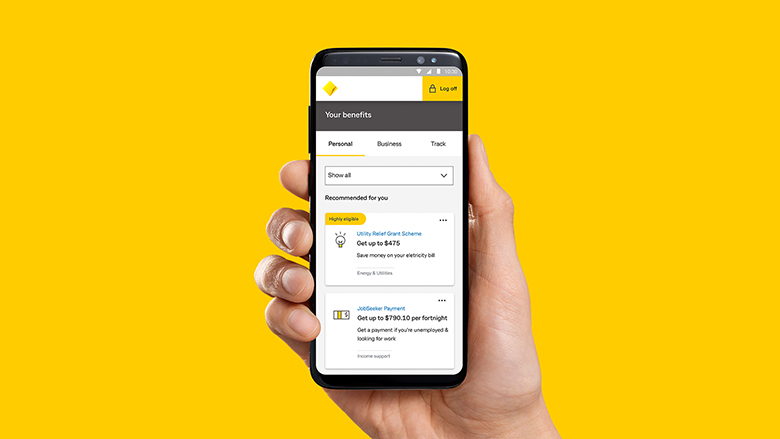

Benefits finder can be accessed via the CommBank app and NetBank. Customers are asked to answer four simple questions, with answers determining what benefits or rebates they may be eligible to claim. Customers are provided with details on each benefit or rebate, including how much they may be able to claim and instructions on how to claim, and are then directed to the relevant website to start the claim.

Benefits finder has connected customers to half a billion dollars in unclaimed benefits and more than 1.5 million claims have been commenced. The feature has more than 270 benefits and rebates available for personal banking customers and was recently extended to include more than 58 benefits for businesses.