CBA Group Executive Business Banking Mike Vacy Lyle said: “Businesses know that support and benefits are available, but understanding eligibility and accessing them can be overwhelming. We’ve moved quickly to update our Benefits finder digital feature to make that process easier and help business owners understand what is out there, what they are eligible for, and access what they need sooner and more efficiently.”

Business specific benefits available in Benefits finder include:

- NSW COVID-19 business grants: offering up to $15,000 to those businesses impacted by the current Greater Sydney COVID-19 restrictions;

- VIC COVIDSafe Deep Cleaning rebate: offering up to 80 per cent of the cleaning costs to a maximum of $10,000;

- NSW JobSaver Payments: to help small businesses maintain employee headcount;

- South Australia COVID-19 Business Support Grant; and

- Wellbeing and Mental Health Support for VIC Small Businesses.

CBA has a range of additional support measures available for its small business customers including:

- Repayment deferrals on eligible business loans;

- A refund of merchant terminal fees for up to 90 days for eligible customers;

- A waiving of fees and notice periods on Cash Deposit and Farm Management Deposit accounts for eligible customers;

- Loans for eligible customers of up to $5 million through the Federal Government-backed SME Loan Recovery Scheme, with variable interest rates from as low as 2.6% p.a. for secured loans;

- Access to a range of tailored grants and benefits specific for businesses;

- An easy-to-use Financial Support Guide to help businesses, community groups and individuals understand the options available and range of initiatives already announced by the government and Commonwealth Bank;

- Free counselling services; and

- Free mental health webinars facilitated by Smiling Mind.

The Smiling Mind Webinars will be held from 9-25 August. For more information and to register click here.

Any businesses that needs financial support, are encouraged to visit www.commbank.com.au/support/emergency-assistance.html or reach out to their dedicated CommBank Relationship Manager.

Notes to editor

1 Between launch in September 2019 and February 2021, more than 1 million claims have been started, with 695,000 claims started since the start of the coronavirus pandemic in March 2020.

2 More than $481 million was saved by CBA customers in utility bills and additional government payments between July 2019 and August 2020. Customers saved more than $127 million in utility bills and generated $354 million in additional income on a recurring annual basis. CBA designed the evaluation in partnership with Harvard University’s STAR Lab.

3 Research conducted by Fiftyfive5.

About the Benefits finder feature

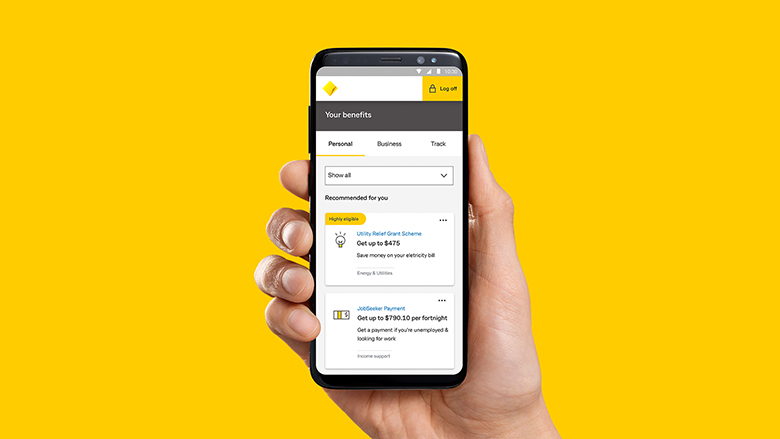

- Benefits finder currently has more than 320 benefits and rebates available for both personal and business customers to claim. Additional benefits and rebates are continually being added into the digital feature.

- Benefits finder can be accessed via the CommBank app and NetBank. Customers are asked to answer five simple questions, with answers determining what benefits or rebates they may be eligible to claim. The feature provides a simple overview of each eligible benefit or rebate, including how much they may be able to claim and the steps to apply before being directed to the relevant website to start the application.

- Benefits finder was developed as part of the ongoing collaboration between CBA and Harvard University’s STAR (Sustainability, Transparency and Accountability Research) Lab. For more information visit www.commbank.com.au/digital-banking/benefits-finder