In recent years most Australians have received a tax refund averaging between $2,000 and $3,000 per person. This is often one of the largest cash deposits a household receives in a year, and it comes at a time when the observed financial wellbeing score for Australians is declining.

At present, one third of Australians are living pay-check to pay-check, while approximately 40 per cent don’t have a sufficient emergency savings buffer. As such, an end of financial year tax refund is a golden opportunity to progress on a goal, recover from a setback, or build up a buffer for the future.

Unfortunately, if the choice architecture is not helpful when the tax refund arrives, we can spend more quickly or less mindfully. The science tells us that heat of the moment financial decisions are more myopic, less focused on future trade-offs, and highly influenced by unhelpful cues. We forget about our goals, ignore the maths and go with the flow.

A good choice architecture would recognise the opportunity of the tax refund moment and design it in a way that would help us to more easily determine what it is we really want to do at that moment. Good choice architecture would make it easier to see and act on our goals.

Over the past couple of years our team has been trialling different tax time choice architectures for our customers – in a bid to help make errors less likely and financial wellbeing outcomes more likely.

In a recent trial we messaged customers a month in advance of their tax return arriving, offering them the opportunity to pre-commit their future return to savings or to pay down credit card balances. Pre-commitment strategies have been successful in a range of behavioural experiments, as they help us to lock in carefully considered plans, and to prevent our ‘future-selves’ making too many impulsive choices when the money does arrive.

In another trial we provided real time alerts to customers when their tax return arrived, and provided helpful information and an easy path to pay down high interest debts. The benefits were made clear and frictions to payment were removed. Those that received this experience were around 7 per cent more likely to make a payment on their credit card, and average repayment amounts were $25 higher.

An important feature of good choice architecture is that all choices ultimately remain with the customer, but the trade-offs of the different options are easier to understand and seemingly higher wellbeing opportunities are made easy to act on.

Other experiments have looked at the psychology of how we interpret the tax time moment. Our research partners at the University of Chicago ran a study were people were offered a $25 payment, either framed as a ‘bonus’ or a ‘rebate’.

The study found 79 per cent of those who were given money labelled as a rebate saved all $25, while only 16 per cent who were given money labelled a bonus saved their total amount. It turns out that we interpret ‘extra’ money as more easily spendable than our own money returned, and we can see the importance for how the tax return is presented to us.

This study also reinforced the notion that simple, low cost, and seemingly unimportant features of the decision moment can have a significant impact on the financial decisions we make.

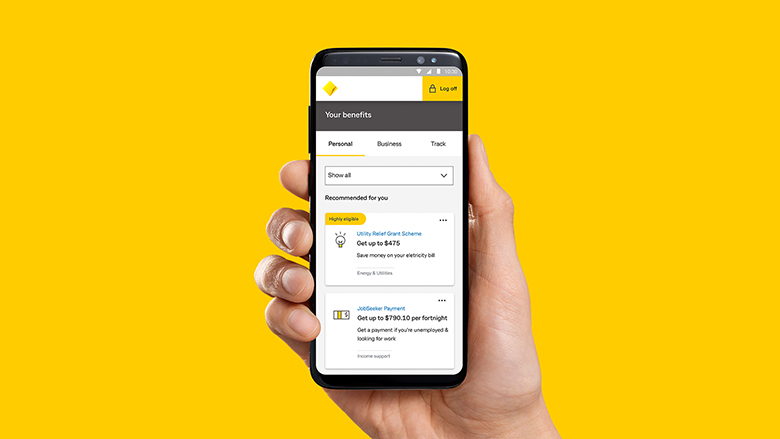

At CBA we are continuing to look at the choice architecture of moments that matter to our customers. While the end choice is always with the customer, our focus is on making it easier for them to identify, lock in, or act on their long term plans, and improve their financial wellbeing.

To hear more from Will Mailer and understand how you can maximise your tax refund, listen to his podcast with CBA Newsroom.