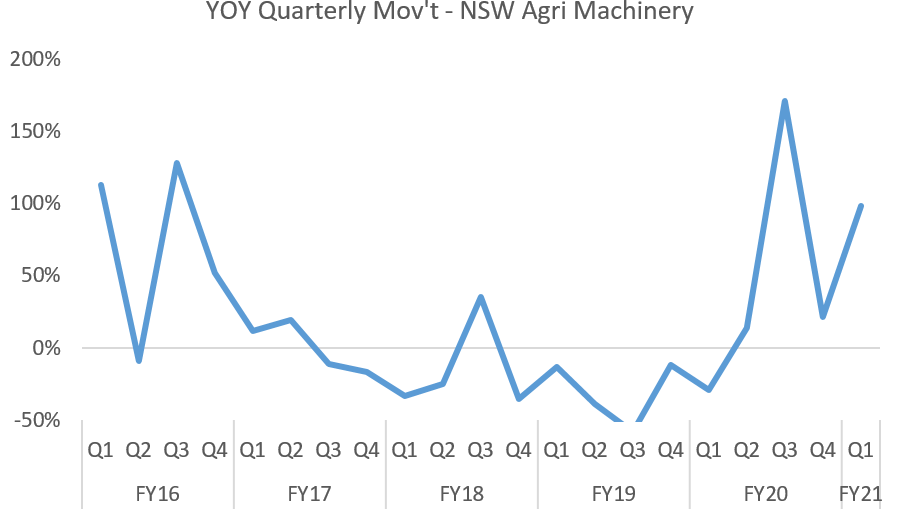

Commonwealth Bank's Executive General Manager Regional and Agribusiness, Grant Cairns, said New South Wales had led the growth, with lending up more than 100 per cent in the state, compared to the same time last year.

“For many of Australia’s farmers, this year has been a rebound from drought with favourable growing conditions, a successful winter crop in many regions and strong optimism about yields and quality of harvest,” Mr Cairns said.

“Over the past few months we’ve seen financing in the sector increase dramatically – largely driven by farmers purchasing agricultural machinery for this year’s crop season.

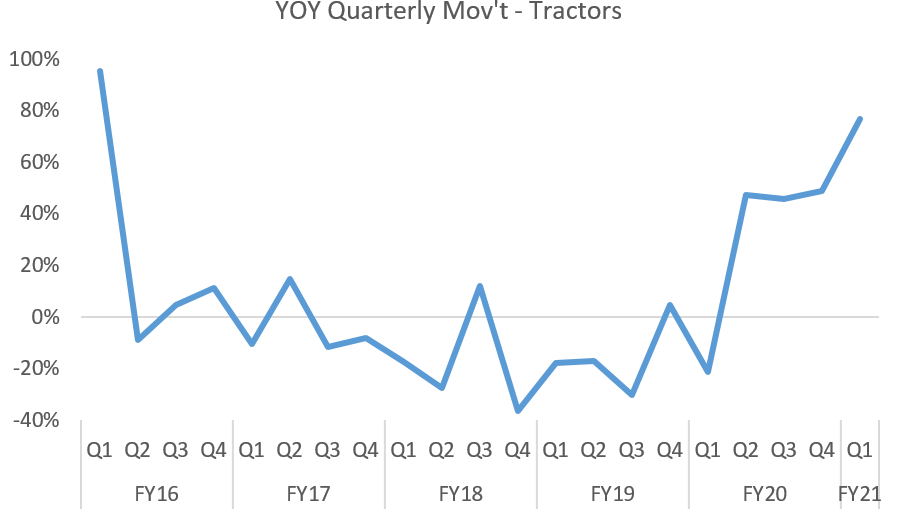

“We’ve seen asset finance for ag machinery, particularly tractors and harvesters, increase significantly. Across the country, new asset financing for tractors is up 119 per cent – the highest volumes with seen in the past three years, and financing for harvesters is up 108 per cent.”

Mr Cairns says the Government’s expansion of the instant asset finance write off scheme is providing further incentive for farming businesses looking to take advantage of the positive outlook and expand for the future.

“Agriculture confidence is at an all-time high for a number of reasons – nationally, farm values are up, commodity prices are holding firm, interest rates are at record lows, seasonal conditions have been good, there is strong consumer and retail demand for fresh produce, and there’s Government incentives like the instant asset write off scheme.

“The trends we’ve been seeing signals a higher confidence across the farming sector, and that’s good for everyone – for the regional towns where the farms are located, for the whole supply chains that support our food and fibre, for the markets they sell to, and for all of us who enjoy fresh Australian produce.

One business that has seen a noticeable difference is Simon Codemo from Griffith-based agri equipment supplier, Codemo Machinery Services.