CommSec Chief Economist Craig James said: “One of the trends we have seen is some compression in the rankings. For instance NSW and the ACT have lost ground to other economies on some indicators while Queensland and Western Australia have seen relative improvement in their economies.

“While Victoria has slipped to second position in the rankings, this is largely due to Tasmania forging ahead on a number of indicators. Victoria has generally held steady, however there are now greater risks for the Victorian economy given the second wave of coronavirus and a return to more stringent lockdown that has occurred in recent weeks.

The latest State of the States report uses the most up-to-date economic data. However while some data relates to the March quarter, other data – such as unemployment – is timelier, covering the month of June.

“The coronavirus crisis is posing significant challenges across all states and territories. Some have been more successful in suppressing coronavirus cases and that may lead to relative out-performance on economic indicators in future months. Each state and territory has its unique pressures, for example domestic tourism will impact the states differently. However the coronavirus pandemic has demonstrated how we’re all interconnected. We really are all in this together.

“Future reports will prove valuable as we track how each state and territory navigates the crisis, especially the recovery phase. Infrastructure spending will be vital in generating economic momentum. Further, the performance of the Chinese economy will be important in driving resource and engineering sectors,” Mr James said.

State and territory highlights

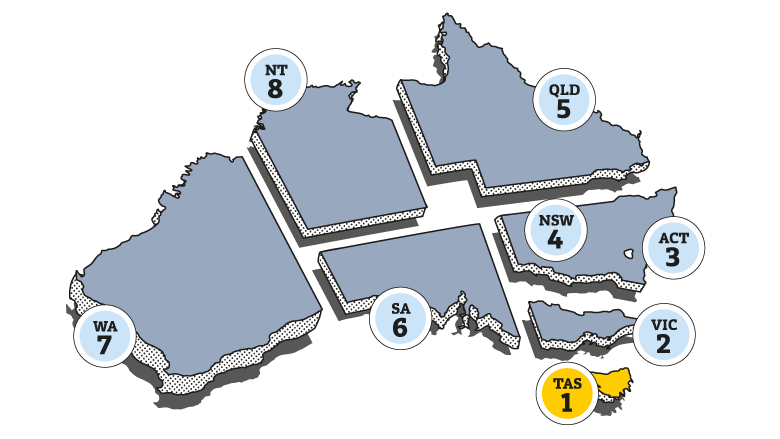

- Tasmania is ranked first on relative population growth, relative unemployment, equipment investment and retail trade. Tasmania ranks second on two other indicators.

- Victoria is in second position. Of the eight indicators, Victoria ranks first on economic growth and construction work completed. Victoria’s lowest ranking is sixth on equipment investment. Victorian population growth has also slowed and is the slowest in eight years while the jobless rate is the highest since November 1998.

- The ACT remains in third position. The ACT is ranked first on housing finance and dwelling starts.

- NSW ranks fourth on the economic performance rankings. NSW is third on housing finance, construction work and equipment investment. NSW dwelling starts are the lowest in six years while population growth is the slowest in 7½ years and the jobless rate is the highest since November 1998.

- Queensland is now in fifth position on the performance rankings. Queensland is ranked second on relative unemployment and third on both relative population growth and retail trade.

- South Australia is now in sixth position on the economic performance rankings. South Australia is second ranked on relative population growth. Also encouragingly dwelling starts are at 21-month high. South Australia is ranked eighth on relative population growth.

- Western Australia retains its seventh position on the economic performance rankings. Western Australia is ranked second on both relative economic growth and equipment investment but eighth on relative unemployment. Equipment investment is the highest in more than six years. Data also shows dwelling starts are at 19-year lows while the jobless rate is the highest since January 1994.

- The Northern Territory is fifth-ranked on relative economic growth and sixth on relative unemployment but lags all of the other states and territories on the other six indicators.

Annual growth rates

- Annual changes in economic indicators are useful for measuring economic momentum. Of the eight indicators assessed, Victoria, the ACT and Western Australia top the annual changes on two measures. Tasmania and the Northern Territory lead the way on one measure each.

To access the full State of the States Report for July 2020, including the detailed breakdown of each economic indicator and additional commentary from CommSec’s Chief Economist, Craig James, visit www.commsec.com.au/stateofstates

Interviews with Craig can be requested via the CBA Media team on (02) 9118 6919 or media@cba.com.au.