Help & support

A money mule is a third party (person or entity) who is typically enticed and/or instructed to transfer or move illicit proceeds of crime on behalf of criminal organisations (often for a fee/commission). A money mule can be witting, unwitting, or complicit in the illicit activity.

As part of Australian anti-money laundering and counter terrorism financing laws, money muling is considered criminal activity. Even if you’re unaware, you could still be held legally responsible.

Money mule scams may be presented as job opportunities, business opportunities or online relationships. Here are some examples:

Sam received a message on WhatsApp from an unknown number offering an easy full time/part time job.

The benefits listed were:

Requirements for the role were:

Ming was contacted by scammers, pretending to be the ‘Chinese police’. The ‘Chinese police’ told Ming his visa and passport had been used in criminal activity overseas and that he needed to pay bail pending a trial in China.

The ‘Chinese police’ harassed Ming every hour so that they could monitor Ming’s whereabouts and told him if he did not listen, he would be facing criminal charges and arrest.

The ‘Chinese police’ demanded Ming to transfer his own funds and some received funds to another account in order to release him of criminal charges.

Luka received a friend request from an attractive woman from overseas who he’d never met. After messaging back and forth for a few days the woman asked Luka to move to a different app so that they could share photos and messages easily and more privately.

Luka then received illicit sexual images from the woman and was pressured into sending some back with the promise that she’d delete any images Luka shared with her.

The woman then used the photos Luka had shared as blackmail to get him to comply with her demands. She asked him to receive money from her associates and then transfer the payments on to other bank accounts she provided.

Sarah owns a small business and received an email from a company claiming to be a venture capital firm interested in investing in her business. The email seemed legitimate and included a proposal that matched her business.

The ‘venture capital firm’ first wanted Sarah to complete a series of transactions to demonstrate her financial management capabilities. Sarah was asked to receive funds into her business account and then transfer them on to different international accounts. The ‘venture capital firm’ provided her with profressional-looking documents such as non-disclosure agreements (NDAs), investment plans, and a ‘formal contract’, which helped to reassure Sarah that this was a legitimate opportunity.

These types of scams can have financial and reputational impacts on businesses.

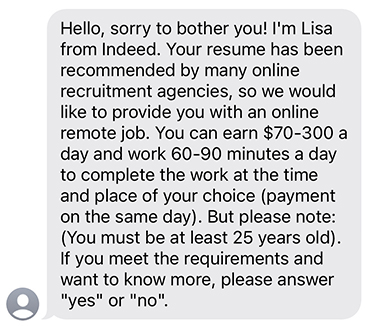

If you unexpectedly receive a job offer for an online remote job with an appealing commission or incentive for minimal hours, this is likely a money mule scam. Often you will be contacted directly via text message or social media from someone claiming to be from a recruitment agency.

A legitimate company will not ask you to use your own bank account to transfer money on behalf of an organisation, open a new account to transfer money, or to register a company in your name. Your bank account is yours.

If you are approached by someone wanting to buy or rent your bank account, always reject the offer and don’t share your bank account details with anyone. Scammers can take over accounts to move money under a different name.

If you receive unexpected deposits in your bank account from someone you don’t recognise, contact us immediately. This could be a sign of money muling and the scammer might claim this to be an accident and offer you a portion of the money for the inconvenience if you send the rest of the money on to a different account.

Scammers often create a sense of urgency to prevent you from thinking things through. If someone is pressuring you to transfer money quickly, this could be a scam.

Example of a money mule scam text message

Ceba can help you lock your card or securely connect you to a specialist in the CommBank app.

Fast-track your call, see expected wait times and connect with a specialist in the CommBank app.

Send us a copy or screenshot if you receive a hoax email or SMS.