Help & support

Keeping your accounts safe is our priority. Find out more about how to recognise hoaxes and what to do if you see one.

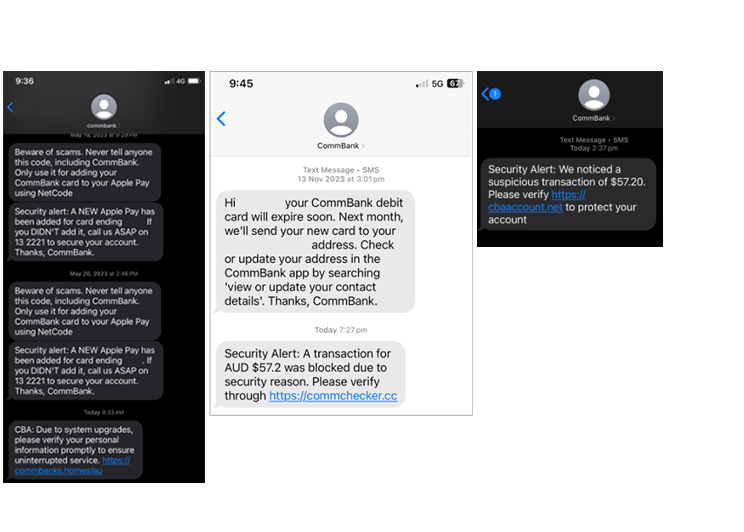

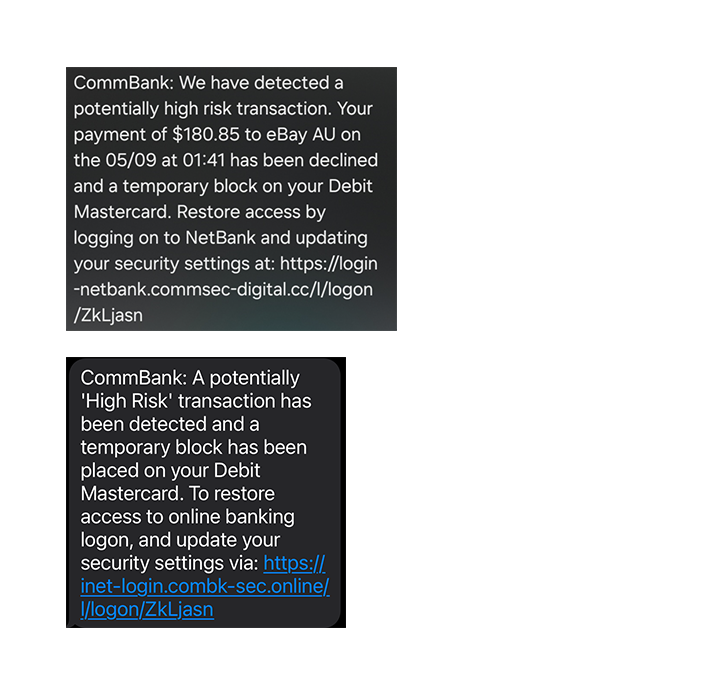

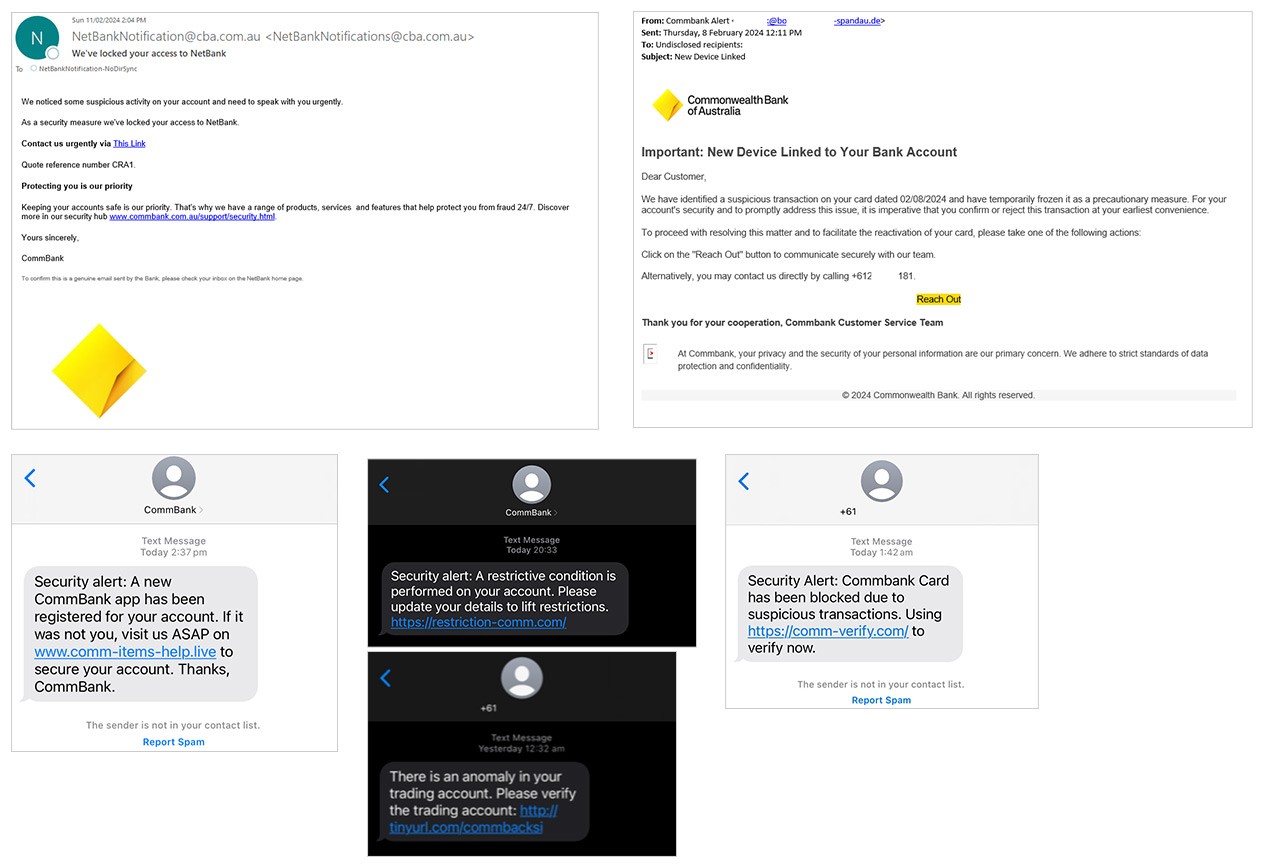

The below emails and SMS messages, which have been reported, are not from CommBank and are not authorised by us.

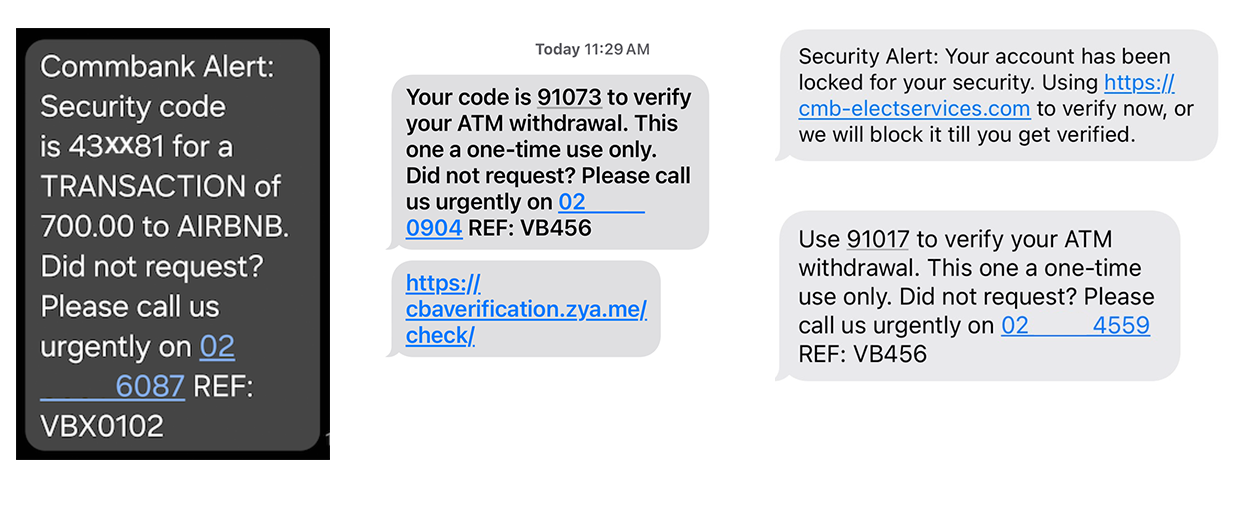

A range of fraudulent SMS messages are currently in circulation designed to trick customers into clicking links or calling phone numbers and prompting them to disclose sensitive information including:

credentials, such as Netbank IDs, CommBiz IDs, passwords and token codes; or,

personal identifiers, such as ID details, addresses, phone numbers, date of birth, etc; or,

account details, such as account and/or card numbers

These messages might seem legitimate, and may even show up in the same thread as real messages from us, however, they are not from CommBank. We will not ask you to verify transactions via a link in an email or SMS message.

Always check the best method to contact us by visiting commbank.com.au/support/contact-us.html and only access your banking from the CommBank app; or, CommSec, CommBiz and NetBank from a trusted location, never via a link in a message.

Be suspicious of any message that asks you for sensitive information, or to complete tasks like updating software, or giving remote access via email or text.

We’re aware of scam text messages impersonating CommSec and CommSec stockbrokers, offering investment opportunities and directing recipients to contact them via WhatsApp.

What to look out for:

Unsolicited investment offers via text message, email, or social media.

Requests to communicate via WhatsApp or other messaging apps instead of official CommSec channels.

Promises of guaranteed high returns with little to no risk.

Pressure to act quickly to secure an exclusive deal.

Requests for personal details or payments to set up an investment account

How to protect yourself:

Do not respond to or click on links in unexpected messages claiming to be from CommSec.

Verify directly by logging into your official CommSec account or contacting CommSec through official contact details on the CommBank or CommSec website.

Be cautious of anyone requesting to communicate via messaging apps instead of official channels.

Report scams to Scamwatch and forward suspicious messages to CommBank via hoax@cba.com.au.

We are aware that scammers may be impersonating CommBank by spoofing legitimate phone numbers, including our international contact number (02 9999 3283). This means that when they call, it may appear as if the call is coming from CommBank, but it is actually a scam.

How the Scam Works:

You receive a call from what appears to be CommBank’s international contact number.

The scammer claims to be from CommBank’s fraud team, warning of an urgent fraudulent transaction on your account.

They may instruct you to provide a Netcode or one-time passcode to “cancel” or “reverse” the transaction.

In reality, they are using this information to authorise transactions in your name.

How to Protect Yourself:

CommBank will never call and ask you for a Netcode or one-time passcode. Always read the Netcode to confirm what you are authorising.

If you receive a call about fraud from CommBank and cannot be identified via CallerCheck, hang up and call us directly on 13 22 21 (do not redial the number you received the call from).

Be cautious of any urgent requests to provide codes or transfer money.

Scammers are becoming increasingly sophisticated in their tactics. Always verify who you are speaking with before providing any personal or banking details. For more scam awareness and protection tips, visit CommBank Safe

We have seen an uptick in scammers contacting customers claiming to be from CommBank, advising that their accounts have been compromised. Scammers may claim they are calling to confirm 'unauthorised' transactions before transferring to a fake “CommBank Security Department.” Throughout the call they will prompt you to download remote access software. This gives the scammer full access to your computer – and personal information – from a remote location.

Important points to note, we will never:

Request remote access to a customer’s computer

Ask customers to provide us with a Netcode or code from a CommBiz token. Always read the NetCode to ensure you are aware of what is being authorised.

These criminals will then go on to advise that police are involved and arrange for a courier to visit your home to collect cards, PINs and/or passwords for “investigation" purposes. Please be aware that no legitimate organisation will ever request your card, cash or passwords in this manner. Always verify the identity of anyone who contacts you by reaching out to the organisation directly using a trusted number.

If you get an unexpected call from CommBank you can ask us to use CallerCheck to verify it’s us.

There has been an increase in scammers calling customers out of the blue, claiming that their sensitive information has been compromised. They'll ask for a Netcode to 'secure your account', but it's actually a trick to authorise large transactions.

Whilst our fraud team may contact you to verify a transaction, we will never ask you for sensitive banking details such as NetBank or CommBiz token/passwords, PINs or NetCodes. When you receive a Netcode, always read it carefully to understand what you are authorising. Never share your Netcode with anyone, including The Bank.

If you get an unexpected call from CommBank you can ask us to use CallerCheck to verify it’s us.

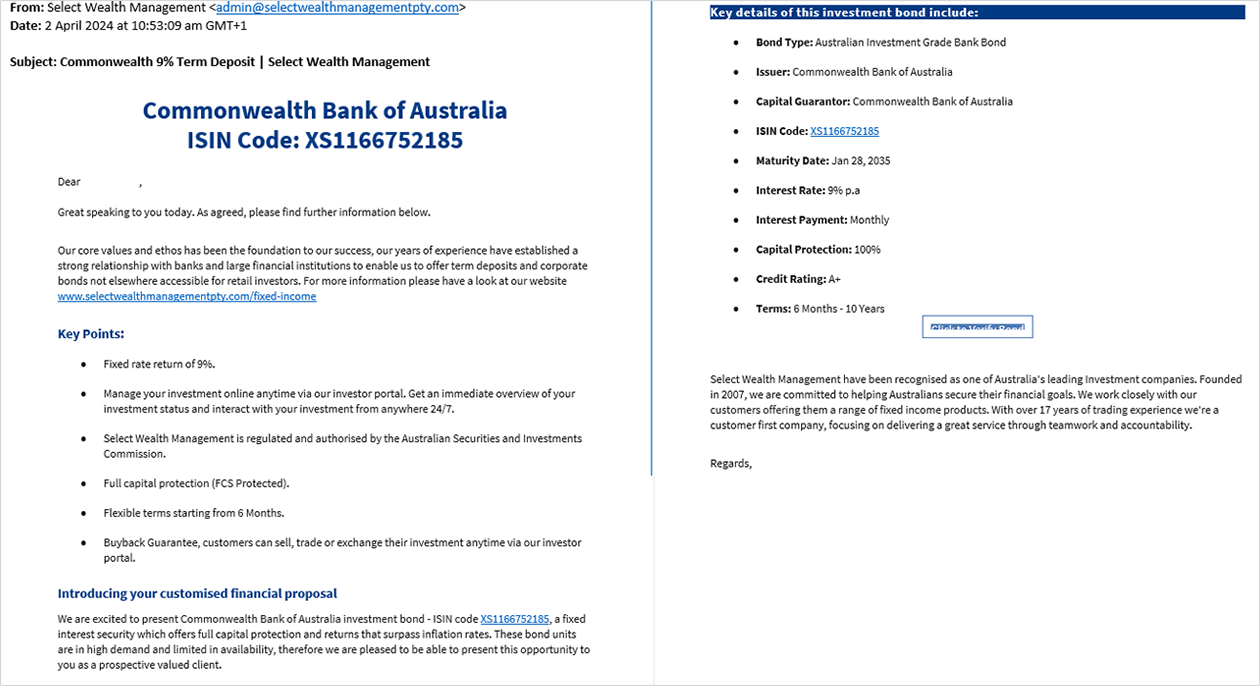

Be cautious of fraudulent investment offers impersonating Commonwealth Bank (CommBank). Scammers are promoting an exclusive rate with claims of full financial protection under the Australian Government’s Financial Claims Scheme (FCS) and exceptional returns. These communications may feature professional branding and language designed to mimic official CommBank messages, encouraging you to provide personal details or request more information.

CommBank will never offer exclusive investment opportunities via unsolicited emails, messages, or calls. Always verify offers by visiting official CommBank channels or contacting us directly. Remember to Stop, Check, and Reject if you come across an investment opportunity that appears too good to be true.

If you’re ever unsure, please contact us.

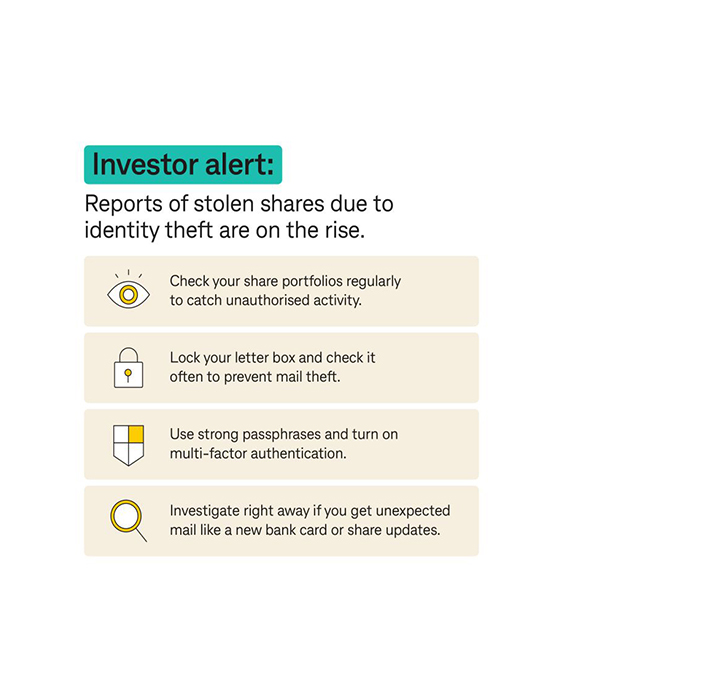

Since August 2024, there has been a significant increase in reports of stolen shares.

Criminals are impersonating individuals and stealing their shares, with many victims unaware their shares have been transferred or sold until they receive a confirmation letter in the mail from a share registry or the Clearing House Electronic Subregister System (CHESS).

Fraudulent activity using stolen identities is increasingly sophisticated, so it’s important to be vigilant. Remember to Stop, Check and Reject calls, emails and messages that appear suspicious.

Here are 4 ways you can increase the security of your CommSec account.

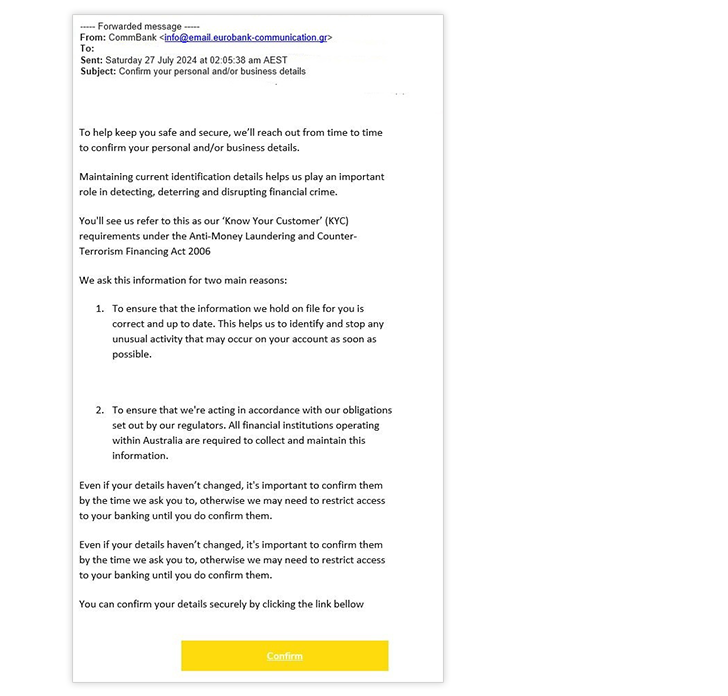

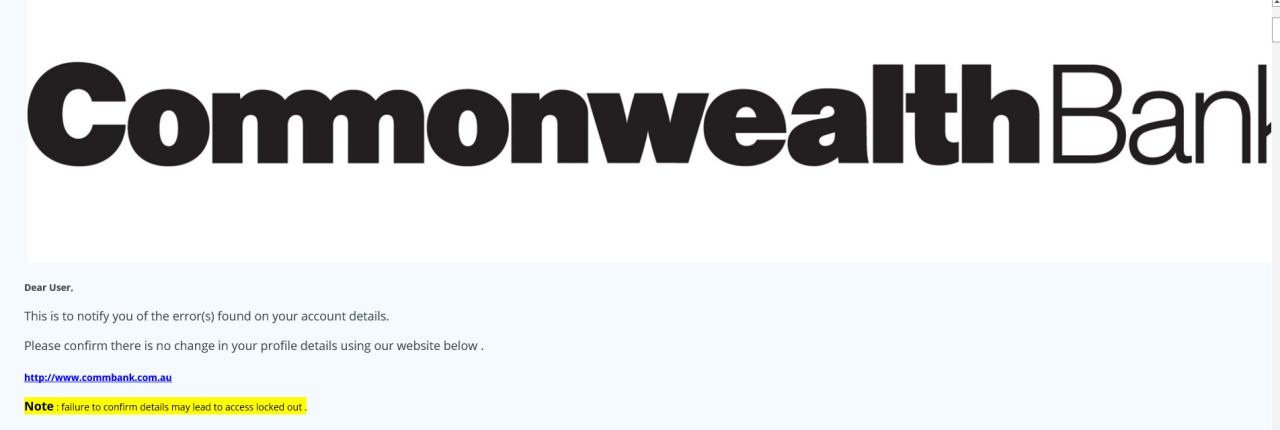

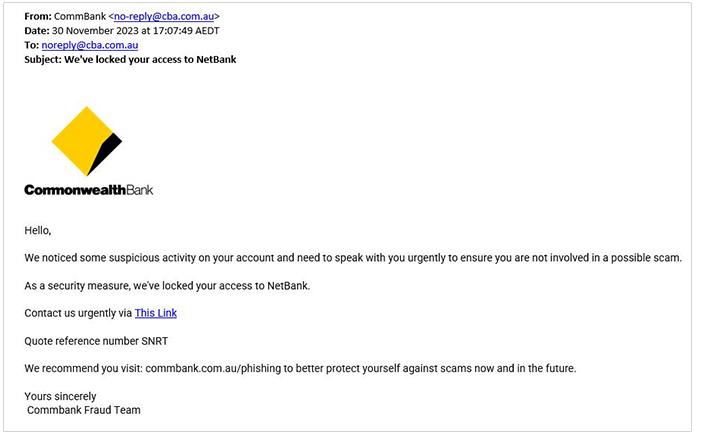

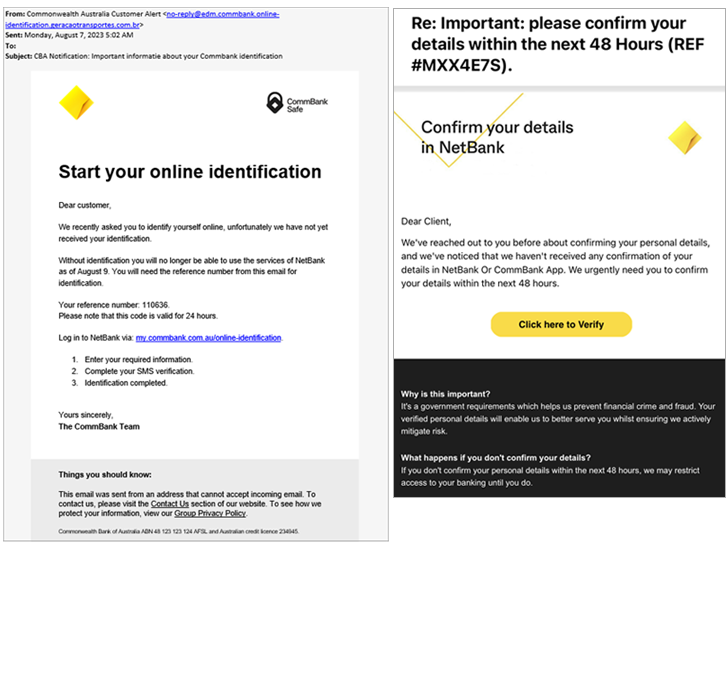

We have observed CommBank themed phishing emails targeting customers and asking them to activate their card or account, or to verify their identity.

Customers are directed to a webpage that asks them to provide their NetBank login, password, card and personal details such as phone number and address.

These are not legitimate CommBank notifications. Please do not engage with these emails. If you have accidentally input your details into a phishing site, please message us in the CommBank app or call 13 2221 or +61 2 9999 3283 from overseas.

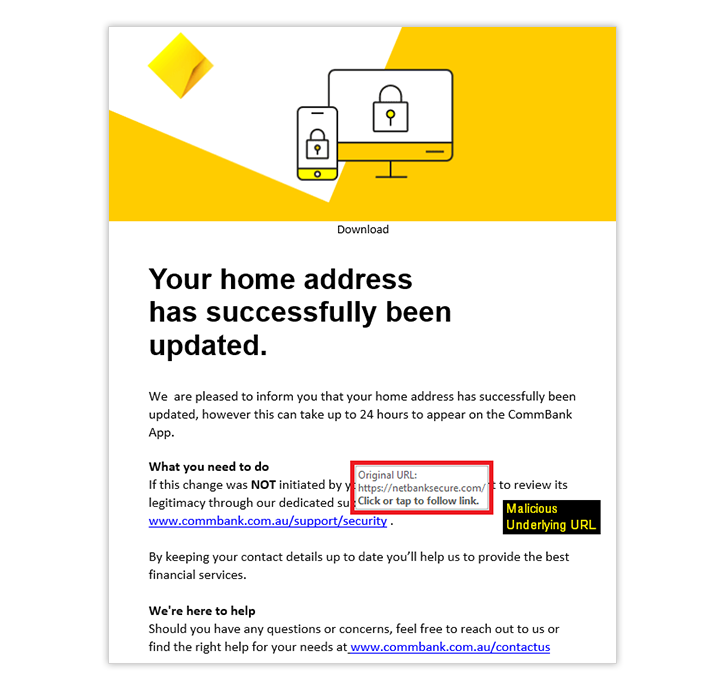

Example phishing emails

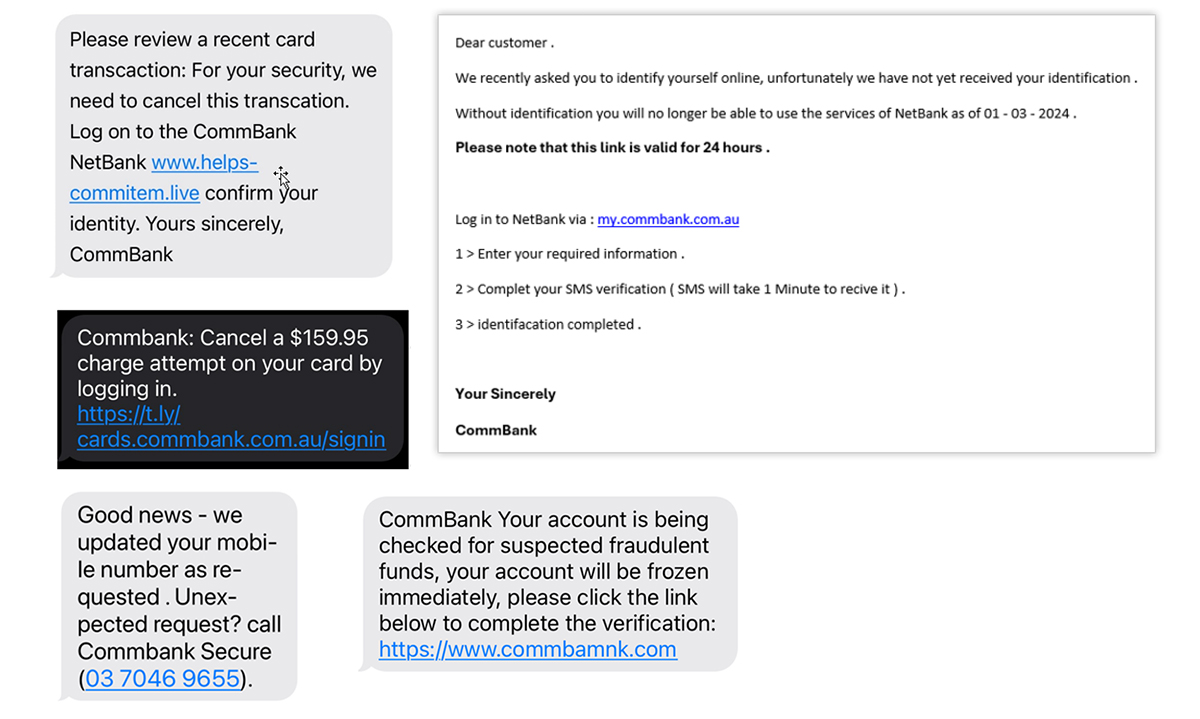

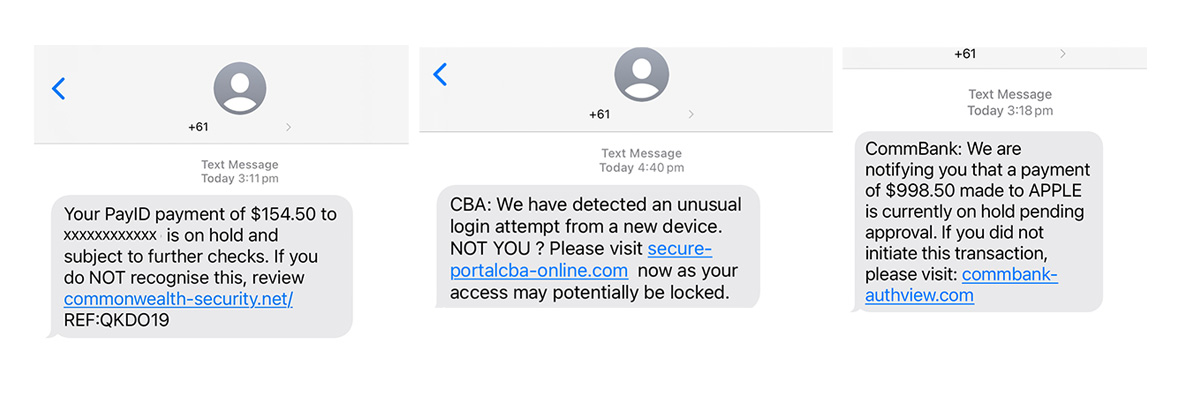

We’re aware of a surge in fraudulent SMS messages designed to trick customers into clicking links or calling phone numbers prompting them to disclose sensitive information like:

credentials, such as Netbank IDs, CommBiz IDs, passwords and token codes; or,

personal identifiers, such as ID details, addresses, phone numbers, date of birth, etc; or,

account details, such as account and/or card numbers

These messages may seem legitimate, and might even show up in the same thread as real messages from us. However, they are not from CommBank. We will never ask you for your details through a link in an email or SMS message.

Always check the best method to contact us by visiting commbank.com.au/support/contact-us.html and only access your banking from the CommBank app; or, CommSec, CommBiz and NetBank from a trusted location, never via a link in a message.

Be suspicious of any message that asks you for sensitive information, or to complete tasks like updating software, or giving remote access via email or text.

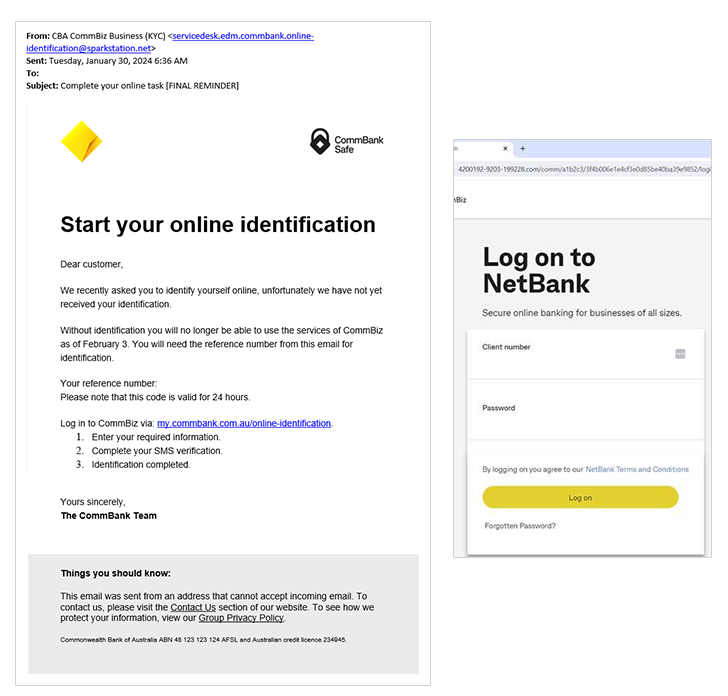

There are emails currently circulating that attempt to solicit personal information under the guise of updating your details.

These fraudulent emails prompt recipients to click on malicious links in the message and enter details into a webpage.

We will never ask you to click through a link on an email and enter personal details.

These are not legitimate CommBank communications. Do not click on the link or reply to the sender.

To be safe, always navigate directly to NetBank yourself and log on from the site you know to be genuine, rather than using any links in communications. For more details about our KYC processes, visit https://www.commbank.com.au/latest/know-your-customer.html

We're aware of fake CommSec advertisements appearing on social media, particularly on Instagram, that attempt to deceive people into engaging with investment scams.

Fake social media accounts are posting about a “stock investing course” that will supposedly help people become successful investors. The scammers misuse the CommBank brand and logo to legitimise their scam.

CommBank urges you to be sceptical of any opportunity that seems too good to be true, even if the information appears on a paid advertisement on social media.

Always Stop, Check and Reject if you have any doubt. You can also review our investment scams information to learn more about recognising these scams.

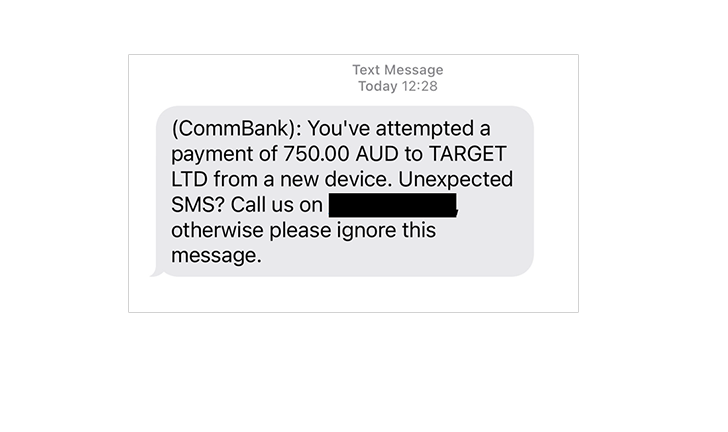

We are aware there are messages in circulation impersonating CommBank that attempt to mislead customers into calling a phone number to dispute a transaction. This phone number is not genuine.

If the number is called, the scammer attempts to convince the customer of their legitimacy by sending a follow up message pretending to be CallerCheck, that appears in the same message thread. The customer is then sent a link to a fraudulent login page which will steal their credentials and other personal information.

CallerCheck is not an SMS based platform and notifications will only be sent via the CommBank app.

These messages are not legitimate CommBank communications. We will never send you a hyperlink from which to login via SMS.

If you are ever unsure as to a communication’s authenticity, please use one of the methods shown on Contact us - CommBank to verify.

We are aware of an increase in investment scams posing as legitimate Term Deposit offerings. These are promoted through fake Term Deposit comparison sites. Scammers are attempting to lure customers to transfer large sums of money into fraudulent accounts.

A customer will be asked to complete an application form for a fake bond or Term Deposit, provide their contact details and to transfer funds into a bank account. Scammers will use this information to steal the person's identity and any money they may be able to obtain access to.

Scammers will do anything to prevent a customer from contacting the legitimate financial institution or receiving a login to access their Term Deposit online. CommBank urges potential investors to check the legitimacy of the investment product directly with the financial institution.

Things to look out for:

Remember to Stop, Check, and Reject if you come across an investment opportunity, even if it appears genuine. If you’re ever unsure, please contact us.

If you’ve been impacted by this scam, please contact us immediately.

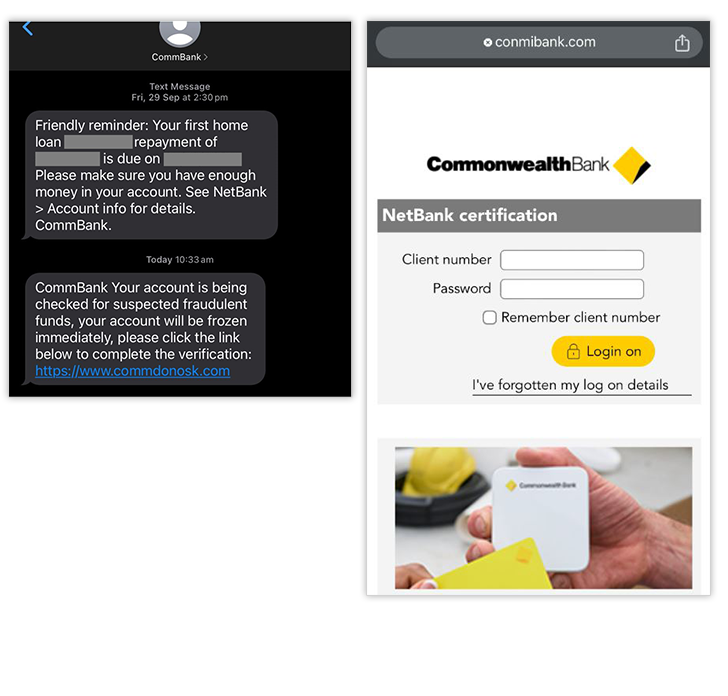

There are a range of fraudulent messages currently in circulation that attempt to mislead customers into clicking on a link. The link leads to a series of webpages that will request details including NetBank IDs, passwords, PINs and token codes.

The premise of the messages is that the account has been locked pending verification of the requested details. These messages may appear alongside legitimate messages in the same thread.

These messages are not legitimate CommBank communications. We will never send you a hyperlink from which to login via SMS.

If you are ever unsure as to a communication’s authenticity, please use one of the methods shown on Contact us - CommBank to verify.

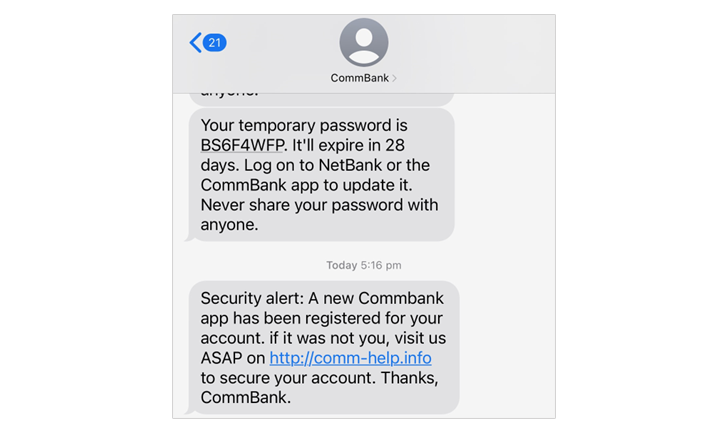

We are aware of a number of SMS messages currently circulating that attempt to deceive customers into clicking on a link and providing credentials, such as NetBank IDs, passwords, PINs and token codes. These may appear in message threads alongside legitimate CommBank communications.

The messages direct recipients to click a link regarding suspicious activities that have been detected on their account. Upon entering their username and password, the recipient may also be asked for a NetCode, as verification.

These messages are not legitimate CommBank communications. We will never send you a hyperlink from which to login via SMS.

If you are ever unsure as to a communication’s authenticity, utilise one of the methods shown on Contact us - CommBank to discuss.

We are aware of SMS messages currently in circulation that attempt to convince customers to click on a link to review “unusual activity”. The destination site then requests the customer provide credentials, such as NetBank IDs, passwords, PINs and token codes. These messages may appear in threads alongside legitimate CommBank communications.

The scammers then use these details to register digital wallets or register new devices to the scam recipient’s account.

These messages are not legitimate CommBank communications. We will never send you a hyperlink from which to login via SMS.

Remember to Stop, Check and Reject and if you are ever unsure as to a communication’s authenticity, you can use one of the methods shown on Contact us - CommBank to verify.

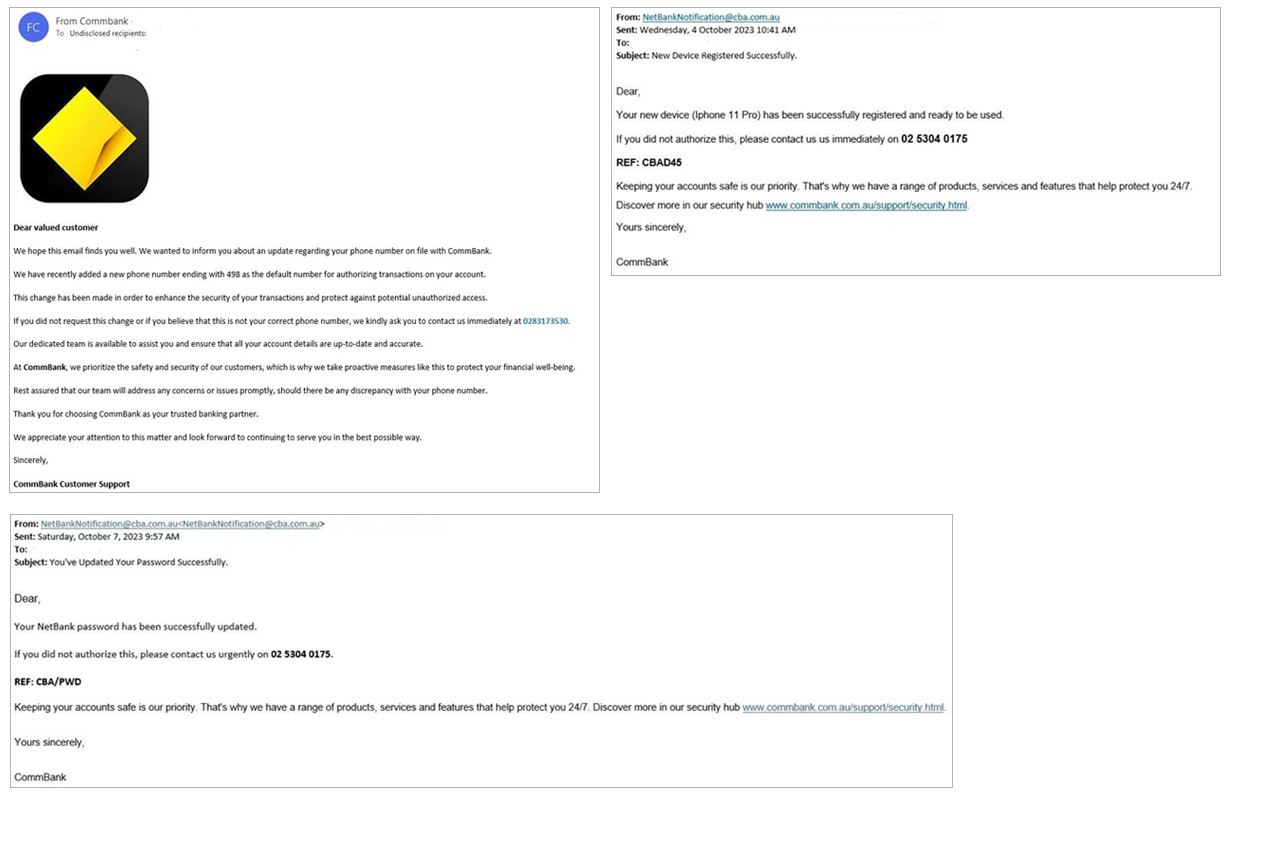

We're aware of a campaign where scammers are impersonating CommBank advising that customers’ personal details have been updated in an attempt to deceive them into clicking on a link, or calling a number, and providing:

credentials, such as Netbank IDs, CommBiz IDs, passwords and token codes; or,

personal identifiers, such as ID details, addresses, phone numbers, date of birth, etc; or,

account details, such as account and/or card numbers

While the messages may look legitimate, these are not from CommBank. We will not ask you for these details from a link in an email. Always check the best method to contact us by visiting commbank.com.au/support/contact-us.html and only access your banking from the CommBank app; or, CommBiz and NetBank from a trusted location, never via a link in a message.

Remember to Stop, Check, and Reject if you come across an email requesting you to click on a link and provide your personal information or banking credentials.

If you’re ever unsure, please contact us.

We're aware of a number and variety of email messages currently circulating that attempt to deceive customers into either clicking on a link, or calling a number, and providing:

credentials, such as Netbank IDs, CommBiz IDs, passwords and token codes; or,

personal identifiers, such as ID details, addresses, phone numbers, dates of birth; or,

account details, such as account and/or card numbers.

While the messages may look legitimate, including links that appear accurate but lead to a fraudulent location, these are not from CommBank. We will not ask you for these details from a link in an email or SMS.

Always check the best method to contact us by visiting commbank.com.au/support/contact-us.html and only access your banking from the CommBank app or, CommBiz and NetBank by navigating yourself to a trusted location, rather than via a link in a message.

Be suspicious of any message that asks you for sensitive information, or to complete tasks like updating software, or giving remote access via email or text.

We're aware of a large number and variety of SMS messages currently circulating that attempt to deceive customers into either clicking on a link, or calling a number, and providing:

While the messages may look legitimate, or even appear to be arriving in the same conversation thread as legitimate messages, these are not from CommBank. We will not ask you for these details from a link in an email or SMS.

Always check the best method to contact us by visiting commbank.com.au/support/contact-us.html and only access your banking from the CommBank app; or, CommBiz and NetBank from a trusted location, never via a link in a message.

Be suspicious of any message that asks you for sensitive information, or to complete tasks like updating software, or giving remote access via email or text.

We're aware of a number of emails and SMS messages currently circulating that attempt to deceive customers into clicking on a link and providing credentials, such as Netbank IDs, passwords and token codes.

The messages direct recipients to click a link regarding a recent transaction, and upon entering your username and password, will also request a Netcode, for identification.

This is not a legitimate CommBank communication. Do not click any links or reply to the sender.

If you are ever unsure as to a communication’s authenticity, utilise one of the methods shown on Contact us - CommBank to discuss .

We're aware of a large number and variety of SMS messages currently circulating that attempt to deceive customers into either clicking on a link, or calling a number, and providing:

While the messages may look legitimate, or even appear to be arriving in the same conversation thread as legitimate messages, these are not from CommBank. We will not ask you for these details from a link in an email or SMS.

Always check the best method to contact us by visiting commbank.com.au/support/contact-us.html and only access your banking from the CommBank app; or, CommBiz and NetBank from a trusted location, never via a link in a message.

Be suspicious of any message that asks you for sensitive information, or to complete tasks like updating software, or giving remote access via email or text.

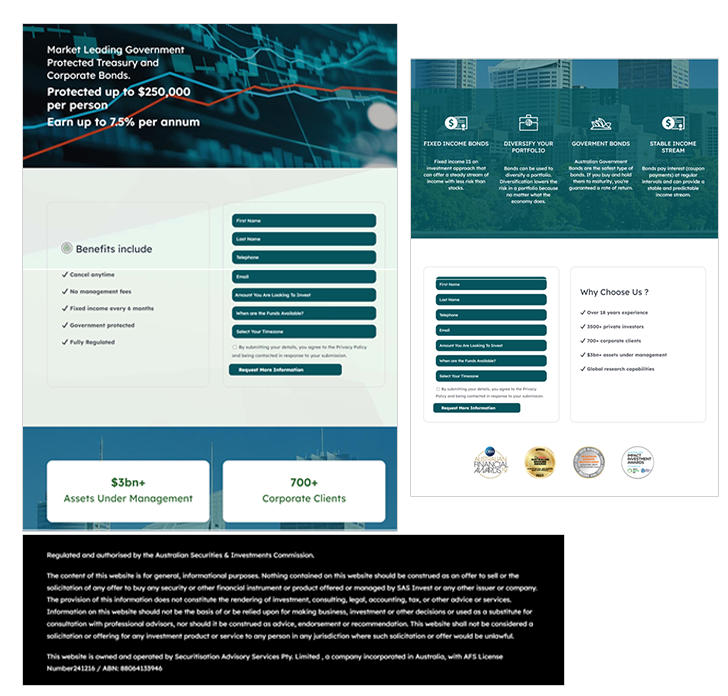

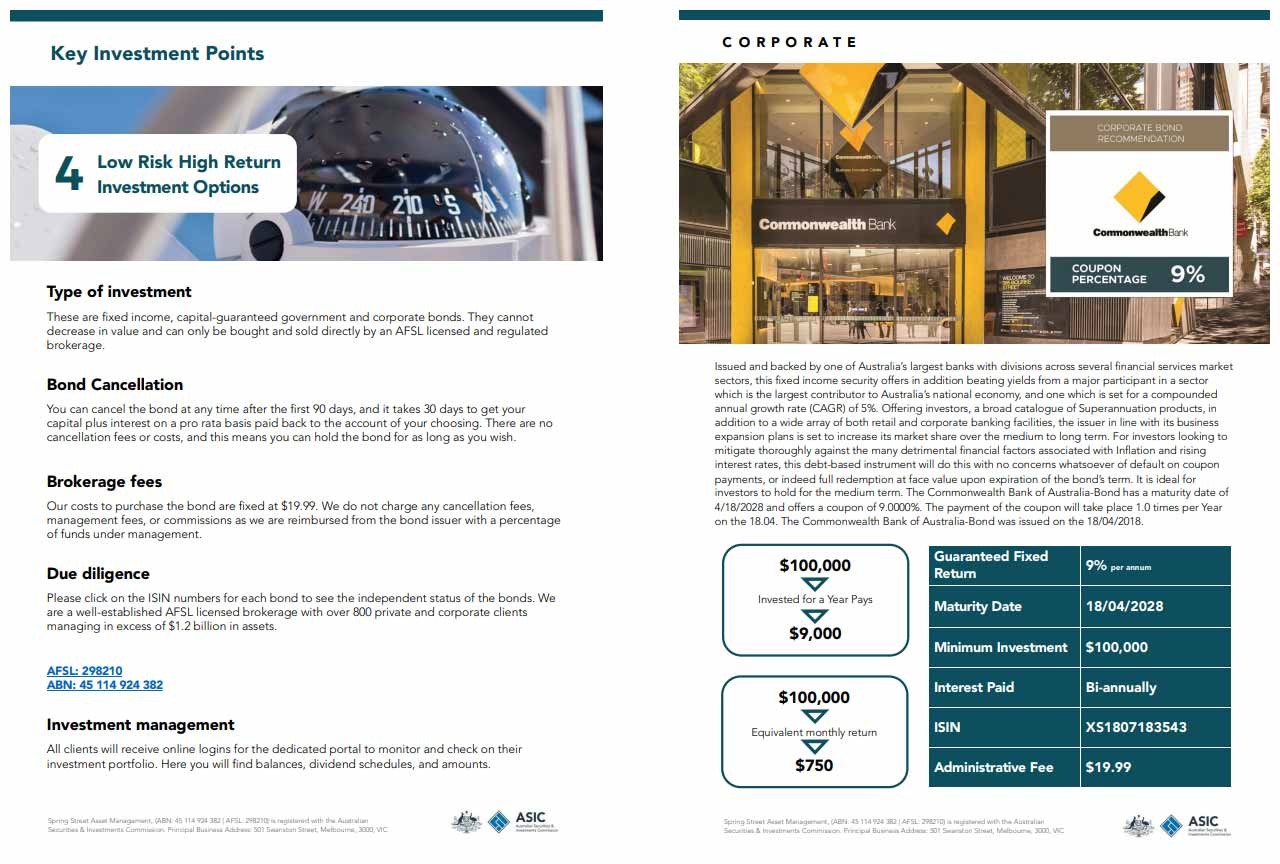

We’re aware of a new type of investment bond scam purporting to be supported by the Commonwealth Bank (CommBank).

This scam claims the bond will provide unrealistic returns and guaranteed protection.

In addition to naming a number of other entities, it names CommBank.

ASIC has also published an Imposter bond investment scams page to warn people of scams such as this.

Remember to Stop, Check, and Reject if you come across an investment opportunity that appears too good to be true.

If you’re ever unsure, please contact us.

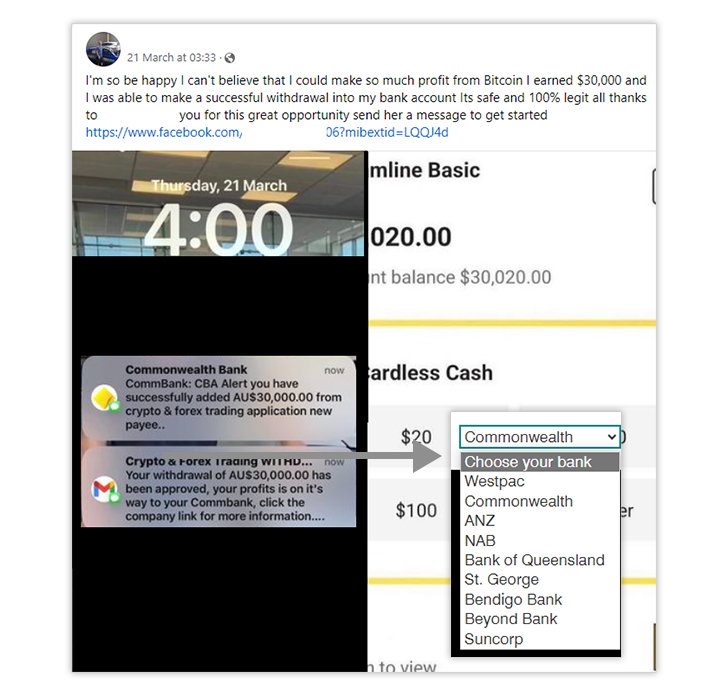

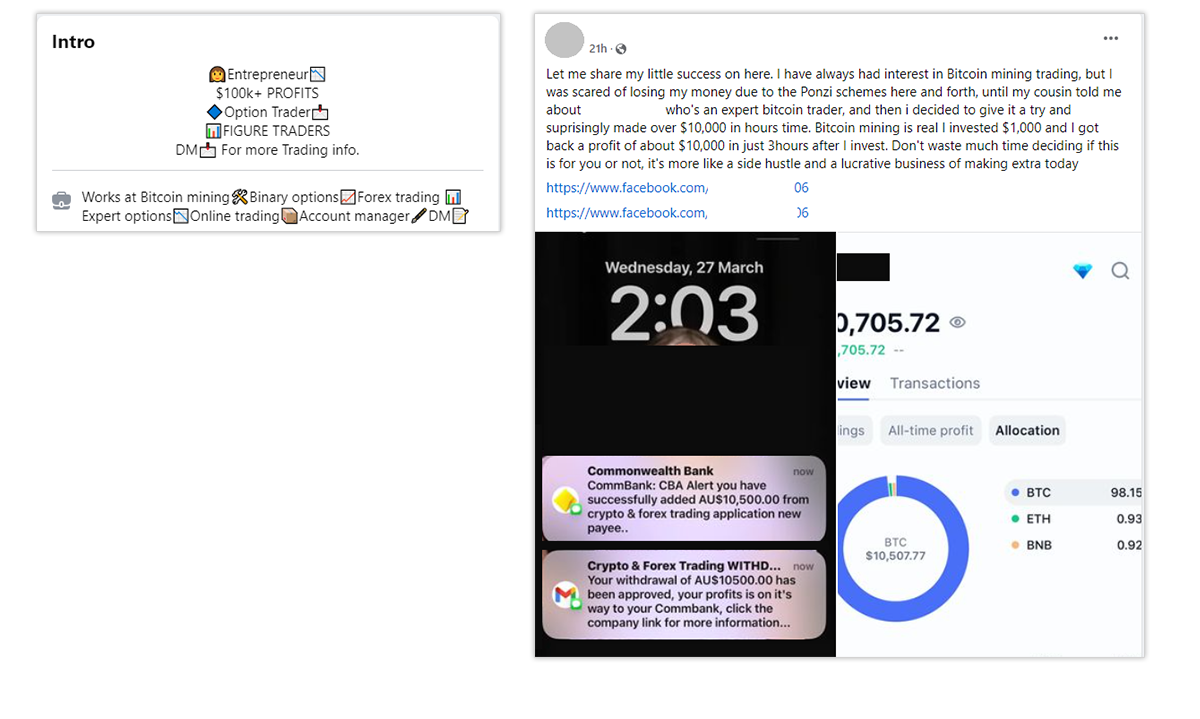

Scammers are posting advertisements on social media, particularly on Facebook, Instagram, WhatsApp and YouTube.

Both fictitious and compromised social media accounts are posting that a “Crypto Broker” (with an introduction similar to the image) helped them make significant sums. A mix of screenshots is used displaying fake notifications, accounts and balances. The scammers misuse the CommBank brand, app and website to try and legitimise their scam.

CommBank urges you to be sceptical of any opportunity that seems too good to be true, even if the information allegedly comes from someone you know.

Always Stop, Check and Reject if you have any doubt. You can also review our investment scams information to learn more about recognising these scams.

We're aware of a large number and variety of email and SMS messages currently circulating that attempt to deceive customers into providing:

While the messages may look legitimate, or even appear to be arriving in the same conversation thread as legitimate messages, these are not from CommBank. We will not ask you for these details from a link in an email or SMS.

Always check the best method to contact us by visiting commbank.com.au/support/contact-us.html and only access your banking from the CommBank app; or, CommBiz and NetBank from a trusted location, never via a link in a message.

Be suspicious of any message that asks you for sensitive information, or to complete tasks like updating software, or giving remote access via email or text.

We're aware of a number of email and SMS messages currently circulating that urge customers to call a number included in the email or SMS. If you call and are not immediately connected, a scammer will call you back, and convince you to provide details to them which they can then use to compromise your accounts or identity.

These are not legitimate CommBank communications. Do not click the links, call any number in a message or reply to the sender. If anyone from CommBank does call you, ask them to identify themselves via the CommBank app using CallerCheck.

Always check the best method to contact us by visiting commbank.com.au/support/contact-us.html and only access NetBank from a trusted location, never via a link in a message.

Be suspicious of any message that asks you for sensitive information, or to complete tasks like updating software, via email or text.

We're aware of a large number of email and SMS messages currently circulating that urge customers to provide their details by logging on to a site impersonating NetBank directly from a link in the email or SMS. While in some instances the link may appear legitimate, we will not send you links to login to our services.

These are not legitimate CommBank communications. Do not click the links or reply to the sender.

Always check the best method to contact us by visiting commbank.com.au/support/contact-us.html and only access NetBank from a trusted location, never via a link in a message.

Be suspicious of any message that asks you for sensitive information, or to complete tasks like updating software, via email or text.

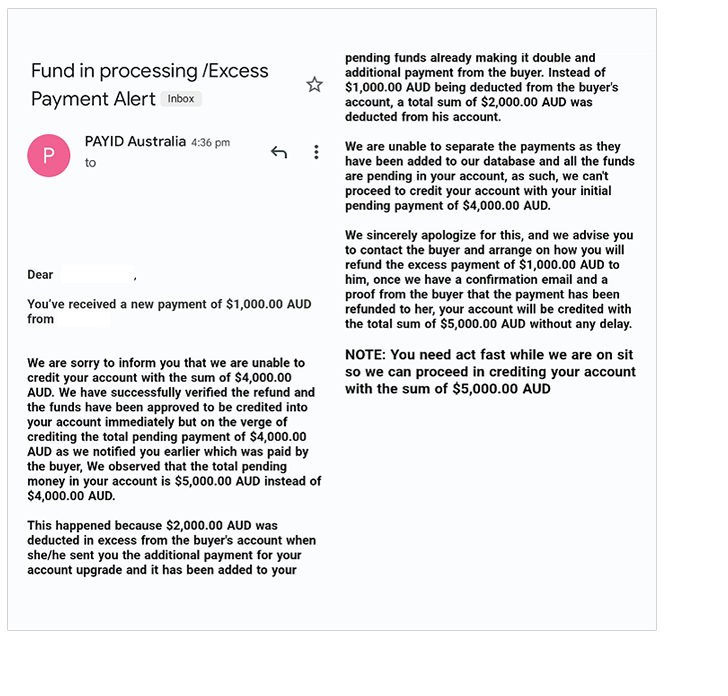

We are aware of emails in circulation claiming that user's ability to receive funds is limited.

The scammers request that you instruct your last payer to send you more money to release the funds.

PayID will never contact you directly. If you encounter any issues with PayID please contact your bank.

Signs it’s a scam:

You receive an email claiming to be from PayID.

You are asked to pay money in order to settle an overpayment or to “unlock” or “upgrade” your account.

You are asked to receive payment via PayID, but also asked for your email address or other irrelevant contact information.

Never respond to emails such as this, as criminals will use them to harvest information about you they may then seek to exploit.

We're aware of a large number of email and SMS messages currently circulating that urge customers to provide their details by either logging on to a site impersonating NetBank directly from a link in the email, or via a call to a number purporting to be CommBank

These are not legitimate CommBank communications. Do not click the links, call any number in an email or reply to the sender.

Always check the best method to contact us by visiting commbank.com.au/support/contact-us.html and only access NetBank from a trusted location, never via a link in a message.

Be suspicious of any message that asks you for sensitive information, or to complete tasks like updating software, via email or text.

We're aware of an email currently circulating that urges customers to login to CommBiz via a link in the email and complete an online identity verification.

This is not a legitimate CommBank communication. Do not click the links in the email or reply to the sender.

Always check the best method to contact us by visiting commbank.com.au/support/contact-us.html and only access NetBank from a trusted URL, like the CommBank website.

Always be suspicious of any message that asks you for sensitive information via email or text.

We are aware of a number of SMS phishing scams reporting to be from ‘CommBank’. The scammers sending these messages are employing a tactic that makes them appear in the same message thread as legitimate CommBank messages, as per the image. The link then takes you to a fake login page where the scammers harvest your credentials.

These are not legitimate CommBank communications. Do not click the links, call or reply to the sender.

We will never ask you to log on or provide sensitive information via a link in an email or SMS.

Beware of SMS phishing scams reporting to be from ‘CommBank’.

These are not legitimate CommBank communications. Do not click the links, call or reply to the sender.

We will never ask you to log on or provide sensitive information via a link in an email or SMS.

We're aware of a number of emails currently circulating that urge customers to provide their details by either logging on to a site impersonating NetBank directly from a link in the email, or via a call to a number purporting to be CommBank.

These are not legitimate CommBank communications. Do not click the links, call any number in an email or reply to the sender.

Always check the best method to contact us by visiting commbank.com.au/support/contact-us.html and only access NetBank from a trusted URL, like the CommBank website CommBank.com.au.

Be suspicious of any message that asks you for sensitive information via email or text.

We are aware of a buying and selling scam involving fraudulent cheques. A scammer contacts a seller who’s selling a high-value good, such as a laptop or phone, and agrees to pay the seller by them or a friend depositing cash into the seller's account. The scammer however deposits a fraudulent or valueless cheque via an IDM (Intelligent Deposit Machine). The seller will see a notification on their phone that funds have been deposited however as the cheque is fraudulent or valueless, the funds will be dishonoured by the issuing bank and the initial deposit will be reversed.

In these circumstances if you’re receiving payment via cash:

We are currently aware of scammers seeking to exploit the recent Optus outage.

Fraudulent messages are asking people to provide Optus and bank login details in order to allegedly claim compensation. The message directs a user to click on a link, at which point they are taken to a fake login page to capture Optus account details. It then requests payment card details and asks the user to select their financial institution, after which the user is directed to a fake NetBank page where banking credentials are captured.

Optus have confirmed, via their outage page https://www.optus.com.au/notices/outage, that they will not be sending any communications via email or SMS concerning this outage with links.

These messages are fraudulent, if in doubt, remember 3 simple steps: Stop. Check. Reject:

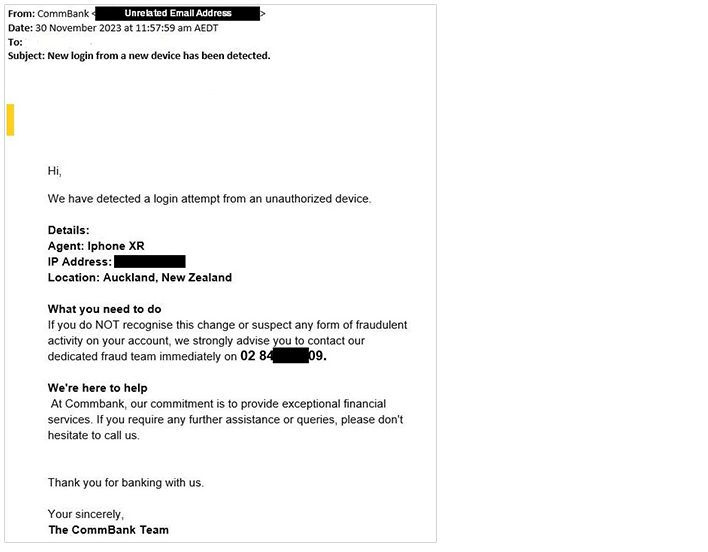

We are aware of new phishing emails pretending to be from CommBank, claiming that a new mobile phone or phone number has been linked to a customer’s account. The goal of these phishing emails is to collect credit card and NetBank login information.

These messages use scare tactics by suggesting that a newly registered phone or phone number can now seamlessly transact to and from linked CommBank accounts, or that a NetBank password has been changed, or that a transaction has been disputed. Anticipating the immediate anxiety that this is likely to cause you, the scammers have included a phone number that can be called for assistance; however, when phoned, the scammer will then claim your accounts need to be secured by providing a credit card number. The scammer then asks for the numbers to be typed on a mobile phone keypad, allowing them to record the sounds made by the phone and steal the credit card information to conduct fraud.

These are not legitimate communications from CommBank. Do not call the phone number in the email, click on any links or respond to the sender. If you are ever unsure of a message you have received claiming to be from us, visit http://www.commbank.com.au/contactus to find legitimate numbers you can call to speak to us directly. If you use the CommBank app, you can request CallerCheck be used as a way to verify you are speaking with the bank.

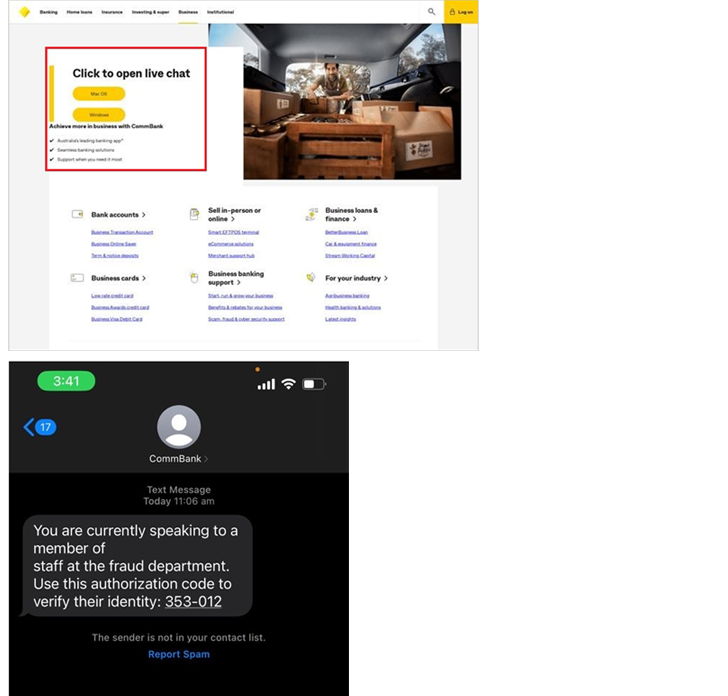

Both business and retail customers are currently receiving calls from scammers claiming to be CommBank staff and the CommBank fraud department.

These scammers are extremely convincing and will send a fraudulent SMS impersonating CommBank with a fake authorisation code to “verify” your identity. They will then ask you read out the fake authorisation code in order to confirm your identity.

CommBank will never send you an SMS to verify your identity and will never ask you to provide your passwords, NetCodes or tokens.

If you get an unexpected call from CommBank you can ask us to use CallerCheck to verify it’s us.

We're aware of an email currently circulating, that urges customers to confirm their identity by logging on to NetBank directly from a link in the email.

This is not a legitimate CommBank communication. Do not click the links or reply to the sender.

Always be suspicious of any message that asks you for sensitive information via email.

A CommBank/CommBiz themed scam is currently operating where scammers are cold calling customers, particularly businesses, pretending to be from CommBank or CommBiz support and advising of a problem with their internet banking.

Customers are then being directed to a Live Chat site, which is a fraudulent duplicate of the CommBank website with hyperlinks that will install remote access software on the customer’s computer, allowing the scammer to take control of it while they talk the customer through providing them necessary details to complete payments.

Important points to note, we will never:

Request remote access to a customer’s computer

Ask customers to provide us with a Netcode or code from a CommBiz token

Ask for any password

Instruct customers to make a transfer

Should you receive a call from someone claiming to be from the bank that is suspicious, hang up and call back on a known number such as your relationship manager, or one of the methods at Contact us - CommBank.

If you get an unexpected call from CommBank you can ask us to use CallerCheck to verify it’s us.

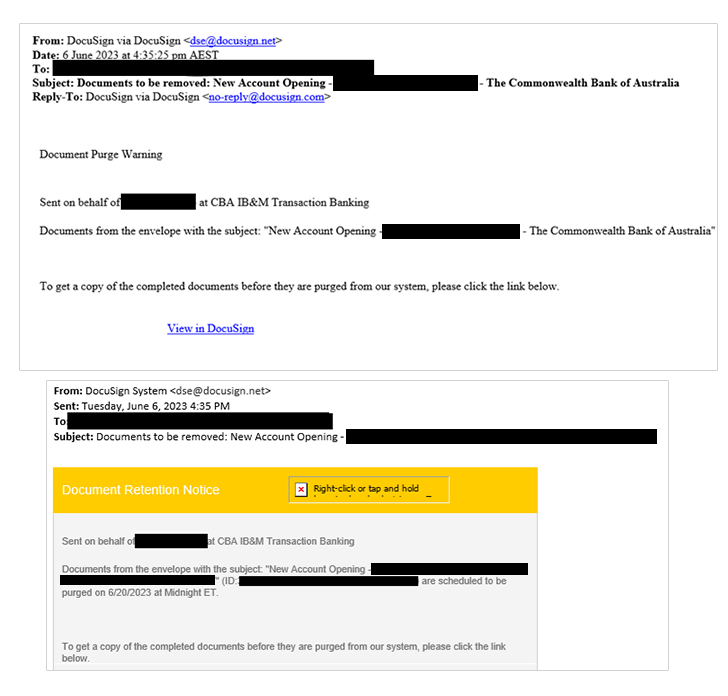

Scammers often impersonate widely used services such as DocuSign to steal credentials and gain unauthorised access to accounts. To increase the credibility of these impersonations, attacks may include names of bank staff. These emails are not from CommBank.

If the email is unexpected, and the layout and branding is inconsistent with DocuSign, it could be a scam.

If you're ever unsure whether an email is legitimate, contact us www.commbank.com.au/contactus or through your Relationship Manager. If you think an email might be a scam, report it to us by forwarding to hoax@cba.com.au, then delete the message.

For more information about how to recognise DocuSign fraud visit https://www.docusign.com.au/blog/how-docusign-users-can-spot-avoid-and-report-fraud

Scammers are posting advertisements on social media, particularly on Facebook, Instagram, WhatsApp and YouTube.

The advert claims to use AI to generate passive income from an initially modest investment and deliver large returns. The scammers often claim you can make between $1000 - $5000 a day from an investment of $350.

The scammers will create a fake trading profile that looks legitimate, and will ask you to begin with a small investment. They'll show you fake returns on your investment, then ask for more money, often through cryptocurrency.

The scammers misuse well-known news brands and the CommBank brand to try and legitimise their scam. Scammers have even used fraudulent, AI generated videos of CommBank CEO Matt Comyn, and others, to try and convince people to invest.

CommBank urges you to be sceptical of any opportunity that seems too good to be true. Always Stop, Check and Reject if in doubt. You can validate the authenticity of any investment product offered by CommBank by contacting us directly through our official phone numbers, which can be found on our Contact us page. You can also review our investment scams information to learn more about recognising these scams.

Be on the lookout for an SMS scam falsely claiming to be from CommBank.

The SMS requests recipients to call regarding a newly completed transaction.

This is not a legitimate CommBank communication. Do not click any links, call the number in the message, or reply to the sender.

If you are ever unsure as to a communication’s authenticity, utilise one of the methods shown on www.commbank.com.au/contactus to call a CommBank number you know to be legitimate in order to speak with us.

Beware of email and SMS scams reporting to be from CommBank.

These are not legitimate CommBank communications. Do not click the links, call or reply to the sender.

We will never ask you to log on or provide sensitive information via a link in an email or SMS.

Both business and retail customers are currently receiving calls from scammers (often with UK/British accents) claiming to be Commonwealth Bank staff.

These scammers are extremely convincing and will often:

Whilst our fraud team may contact you to verify a transaction, we’ll never ask you for sensitive banking details such as NetBank or CommBiz token/passwords, PIN’s or NetCodes. We’ll also never ask you to transfer money, download software or get you to login via a link sent through email or SMS.

If you are speaking to someone claiming to be from Commonwealth Bank, whether they seem to be legitimate or not:

If you receive a call from anyone claiming to be from the Commonwealth Bank, request they use CallerCheck to identify you. If you do not have the CommBank app and are unsure if the caller is legitimate, hang up and contact us via www.commbank.com.au/contactus to verify.

Scammers have recently published a fictitious website impersonating Commonwealth Bank’s subsidiary – Securitisation Advisory Services Pty Ltd (ACN 064 133 946) (AFSL 241216) to promote the sale of scam investment products, including treasury and corporate bonds.

To attract potential victims, the scammers have created this fake price-comparison website, offering to provide investors with information on the best rates for various products. Potential investors who leave their personal details on the site are very likely to receive a call from the scammers. The caller will impersonate as a staff member working for Securitisation Advisory Services. They will supply the potential investor with good quality documents containing details of the proposed investment, which will usually provide a greater return than an equivalent legitimate product in the market. The fictitious website used for this scam is ‘sas-invest.com’.

Commonwealth Bank urges you to review carefully before proceeding when considering any investment opportunity. Always Stop, Check and Reject if in doubt. You can validate the authenticity of any investment product offered by Commonwealth Bank by contacting us directly through our official phone numbers, a full list of which is provided on our Contact us page. You can also review our investment scams information to learn more about recognising these scams.

A large number of CommBank-themed phishing messages and emails are currently in circulation.

These fraudulent communications urge recipients to click on a link by informing them of unusual or unexpected activity on their accounts, such as unexpected logins, registered devices, Netcodes, and payments.

These are not legitimate CommBank communications. Do not click the link or reply to the sender.

Here are some of the current scam trends and tactics that we’re seeing affecting our customers.

We have been alerted to a scam involving fraudulent letters that appear to be from the Australian Securities and Investments Commission (ASIC). These letters use ASIC branding and formatting to appear legitimate and claim that bank staff are under investigation. The letters instruct recipients to transfer funds to a “secure account” to protect their assets. These are not legitimate notifications. Please do not engage with these letters.

Remember:

If you receive a suspicious letter or email with an urgent call to action, remember to always Stop, Check, and Reject. Always report suspected scams to your financial institution immediately.

Scammers often exploit natural disasters, such as Cyclone Alfred, targeting those seeking support. Common scams include fake donation sites exploiting the generosity of people wanting to make a donation, and fraudulent offers of support from individuals impersonating banks, insurance companies, government organisations, and charities.

Be wary of unsolicited contact, avoid clicking on links and always verify the legitimacy of the organisation offering assistance or requesting donations. Always do your research and contact organisations directly using details from their official platform.

If you receive a suspicious message or email with an urgent call to action, remember to Stop, Check, and Reject. Report suspected scams to your financial institution immediately.

For more information on the support we're providing to impacted communities, visit: commbank.com.au/support/emergency-assistance.

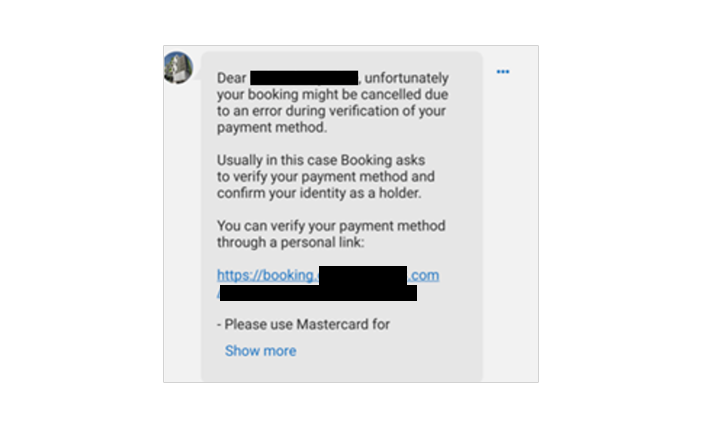

There have been reports of a phishing scam targeting users of accommodation sites, such as Booking.com. Reports claim users receive a message from official website email addresses such as ‘noreply@booking.com’ or from the messaging function within the booking app.

The message claims that a booking will be cancelled if customers do not input credit card details through a provided link. The message or email is typically received when a customer has recently booked accommodation, is due to check-in, or has already checked in.

If you have received a message or email that does not seem genuine or includes an urgent call to action, remember to Stop, Check and Reject. Don’t click the link or share personal information if you are unsure. Ask someone you trust or contact the organisation directly through a contact number provided on their official website.

We’ve been alerted to scammers operating on WhatsApp, targeting individuals with investment or romance scams. Never send money to someone you haven’t met in person or to any investment platform they introduce you to.

There is the chance that some customers may receive an SMS from the National Anti-Scams Centre advising those they believe may have been targeted by this scam to contact their financial institution immediately. While this is a legitimate message, always remain cautious when receiving any SMS with a link.

Protect Yourself:

Avoid clicking on links in SMS messages.

If an SMS requests payment or personal details, verify it independently—visit the official website by searching for it yourself or use an authenticated app.

If you suspect a scam, report it immediately and visit CommBank Safe for more tips on staying secure.

We are aware of a phishing email scam where criminals are impersonating AIA Australia to trick recipients into sharing personal information, including credit card details. Always question any SMS or email that has a link as scammers use clever tactics to trick you into clicking on links and providing personal details, so take your time to review the message. If the message is asking for payment or personal details, verify the request on an authenticated platform, like the company’s genuine website you search yourself or an authenticated application

If you (or someone you know) is a CommBank customer and has been targeted or lost money as a result of being scammed, contact us.

With the Australian Open finals approaching, scammers are taking advantage of the high demand for tickets by promoting fake offers, often on social media. To protect yourself only purchase tickets from official sources, avoid deals that seem too good to be true, and never share personal or financial information with unknown sellers.

If you suspect a scam, report it immediately and visit CommBank Safe for more tips on staying secure.

We have been made aware of South Australian Seniors being targeted by a scam website, www. Theseniorsassistant .com, which falsely claims to assist with Seniors Card applications for a fee.

The official SA Seniors card is always free, and applicants are never required to provide financial details such as your bank or PayPal information. The official SA Seniors Card website is www.seniorscard.sa.gov.au. Applicants should look for the official Government of South Australia and Seniors Card logos to ensure they are accessing the correct website before applying for membership.

If you (or someone you know) has been targeted or lost money as a result of being scammed contact your financial institution immediately, and report it.

We urge you to stay vigilant as scammers are targeting individuals, particularly the elderly, and visiting their homes, pretending to represent trusted organisations such as banks or government officials.

Typically, these scammers initiate contact by phone and convince unsuspecting victims to hand over their bank cards and/or cash - either by leaving it in the mailbox or giving them directly - along with their PINs and passwords. They claim this is necessary to prevent scams or assist in an ongoing investigation. Once in possession of these items, the scammers swiftly access victim bank accounts, stealing funds.

Please be aware that no legitimate organisation will ever request your card, cash or passwords in this manner. Always verify the identity of anyone who contacts you by reaching out to the organisation directly using a trusted number.

If you suspect you’ve been targeted, please contact us.

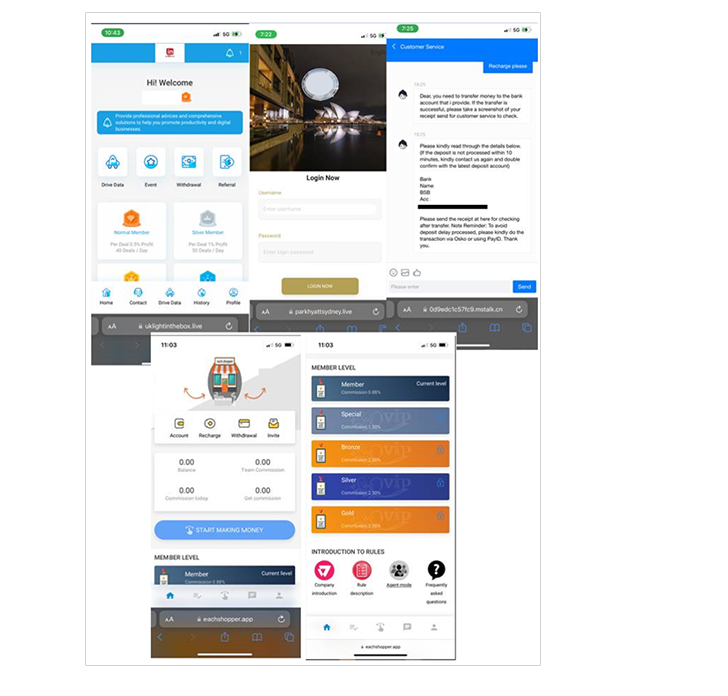

Be aware of Facebook ads that lead into WhatsApp groups where you can "learn to trade" with a "mentor" to build your trust. You may even be offered small incentives to participate.

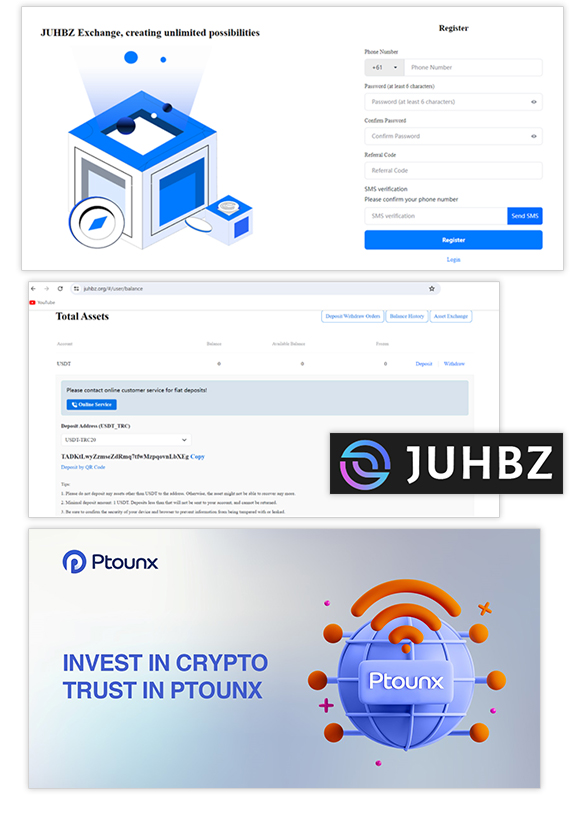

Victims are instructed to sign up to a known scam website such as JUHBZ and PTOUNX using a referral code. Scammers will encourage you to “deposit money to buy cryptocurrency or invest” by transferring money to a specific bank account.

This is fake and the money cannot be withdrawn in full.

Scammers may initially provide genuine investment advice to build trust, before then instructing you to invest in the scam. However, it is important to always Stop and be suspicious of ‘investment opportunities’ offering high returns with little to no risk. Check and research reviews before committing to anything. And Reject if you are being pressured to make a decision about your money or investments.

We are aware of scammers posing as representatives from the National Anti-Scam Centre (NASC), calling victims and claiming their phone number is being used in a scam in China.

They offer to help 'clear your record' and work hard to earn your trust, only to steal your money and personal information. These scams can be difficult to detect as the calls often appear to come from legitimate numbers. Remember, the National Anti-Scam Centre will never ask for money, financial, or personal information, nor will they threaten you.

If you think a call claiming to be from NASC or any other organisation is not genuine, remember to Stop, Check, and Reject and if you are ever unsure, please ask someone you trust or contact the organisation the call claims to be from on a trusted number - do not engage with the scammer.

We are aware of an increase of investment scams posing as legitimate Term Deposit offerings being promoted through fake Term Deposit comparison sites.

Victims will be asked to provide their contact details and are then offered Term Deposit or bond rates from a range of financial institutions and banks. These Term Deposits and bonds are fake.

CommBank urges potential investors to contact any financial institution directly if they are offered any investment product to check whether it is genuine.

Remember to Stop, Check, and Reject if you come across an investment opportunity that appears to be an investment scam. If you’re ever unsure, please contact us.

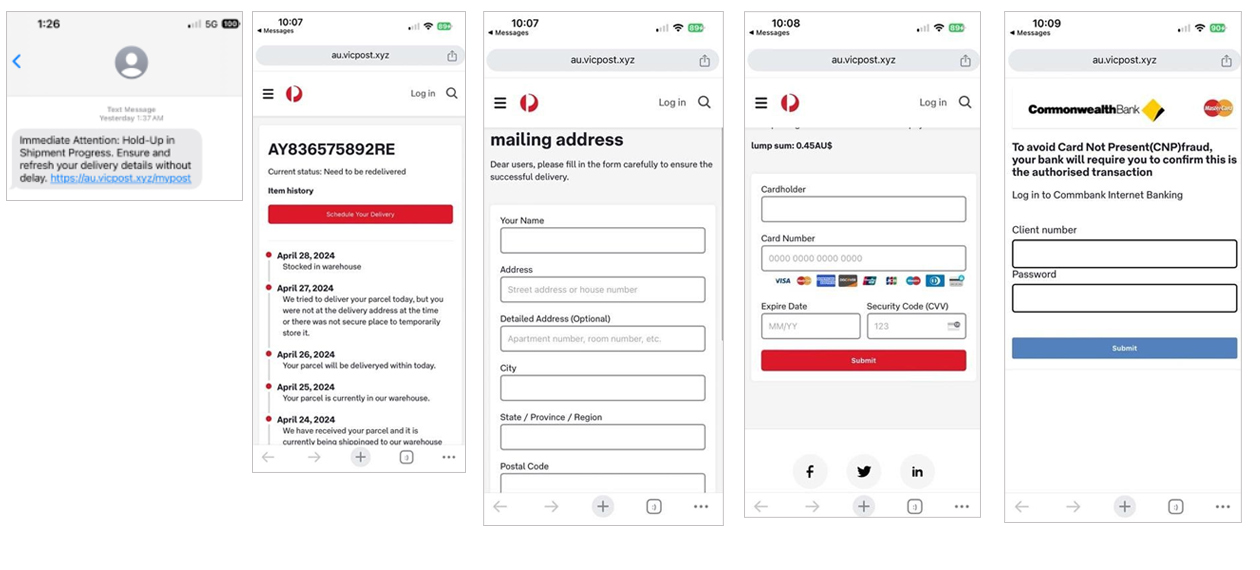

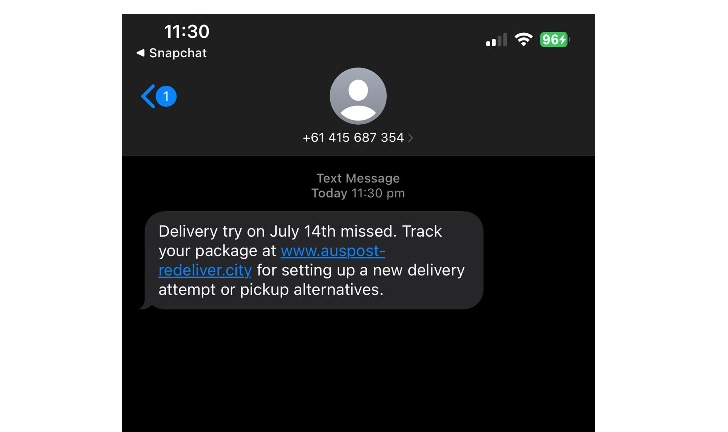

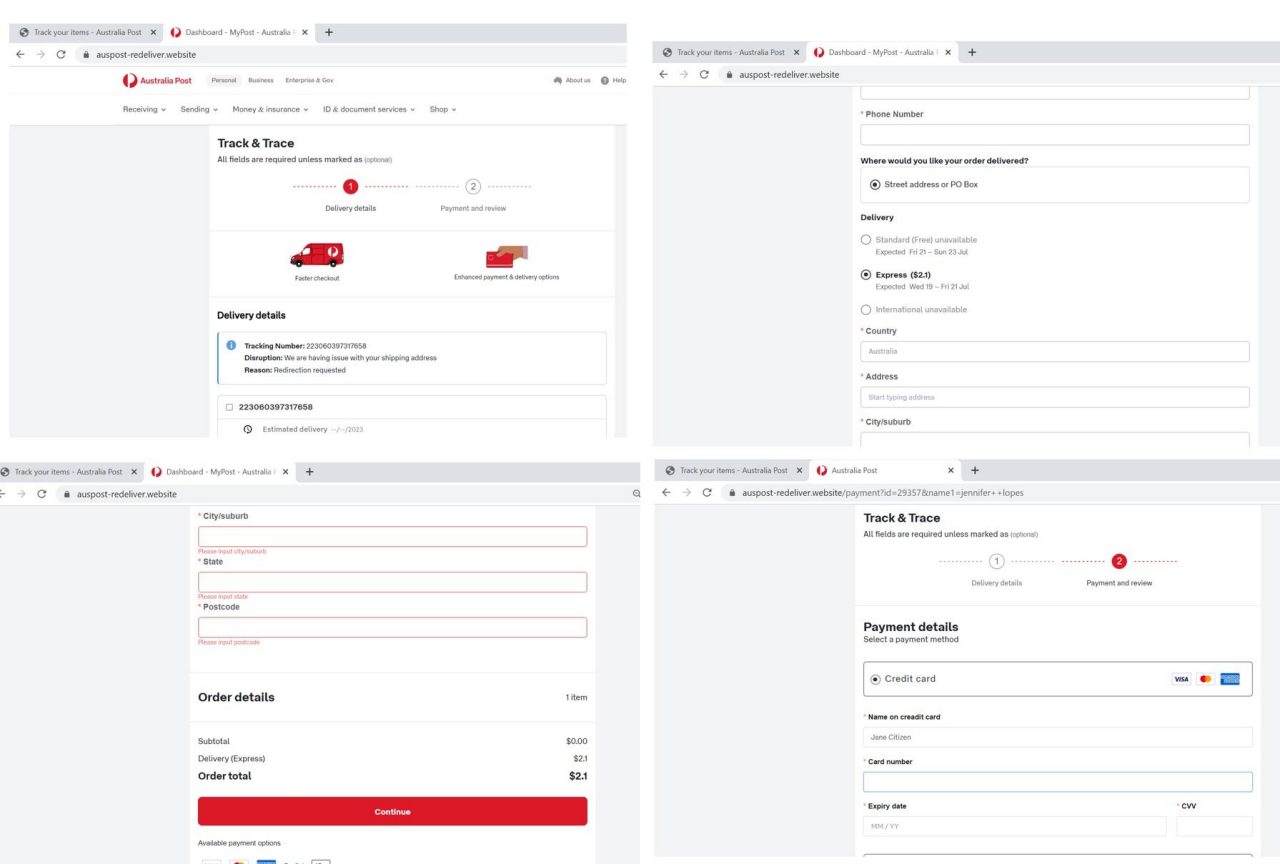

We are aware of postal delivery service scams targeting customers through text messages.

If you receive a message claiming to be from a postal delivery service that requests for you to click on a link for an undelivered package or to rearrange delivery, do not click on any links and delete the text. These messages contain links to websites impersonating postal delivery, however clicking them will lead to false websites that steal personal and financial information.

To keep yourself safe from these sorts of scams, don’t click the link or share your personal information. Instead, if you need to check the status of a delivery you have requested, use alternative methods such as the secure app provided by your postal delivery service or refer to their website for more information.

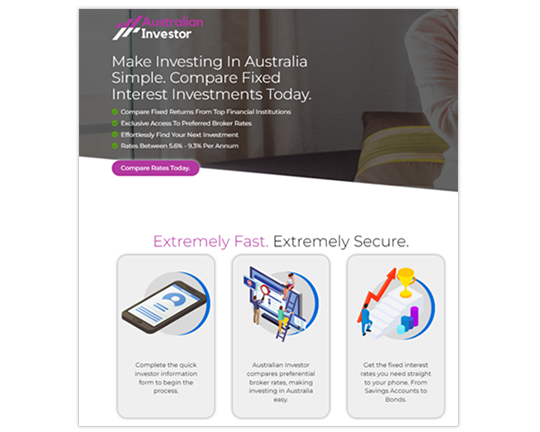

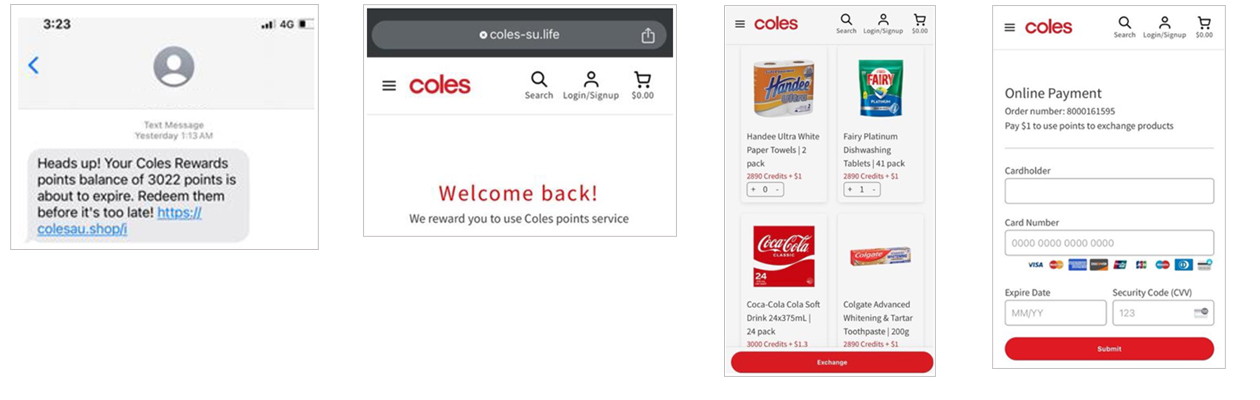

We are aware of a surge in phishing scams impersonating well known organisations, such as Auspost, Coles, and Linkt, in an attempt to deceive customers into disclosing sensitive banking information such as your NetBank ID, password, card details and NetCodes.

These scams involve deceptive emails or text messages that lead recipients to fake websites, and are designed to appear legitimate, often using convincing logos, branding, and language to trick unsuspecting individuals. These sites will urge victims to input their personal information under the guise of claiming a prize, resolving an issue with their account, or confirming a delivery.

To protect yourself from falling victim to these scams, it's important to remain cautious of unexpected emails or messages requesting sensitive information. If you receive a suspicious message or email with an urgent call to action, remember to Stop, Check, and Reject. Avoid clicking links or sharing personal information if uncertain. And consult the organisation directly or reach out to somebody you trust.

We're aware of a number of SMS messages impersonating the Australian Tax Office (ATO) to attempt to deceive customers into disclosing banking credentials.

The message states that a refund is due but needs to be processed manually by updating details. The link in the phishing SMS leads to a fake ATO website that requests which bank you are with, which then links to a fake Netbank login screen.

These sites are fake and designed to harvest your credentials.

Be suspicious of any message that asks you for sensitive information, or to complete tasks like updating software, or giving remote access via email or text.

We have been made aware of a new phishing scam that impersonate the Australians Communications and Media Authority (ACMA).

The link takes the recipient to a website that impersonates the ACMA and asks the recipient to choose their financial institution and follow the prompts

The text of the scam specifically encourages the recipient to click on the link by claiming that the recipient has been the victim of a data breach. This exploits the concerns that recipients may have about recent data breaches. Whilst this specific campaign involves the impersonation of ACMA, it is important to note that the same technique can involve the impersonation of other government agencies as well.

If you have received a message or email that does not seem genuine or includes an urgent call to action, remember to Stop, Check and Reject. Don’t click the link or share personal information if you are unsure. Ask someone you trust or contact the organisation directly through a contact number provided on their official website.

We’re aware of a new type of investment bond scam purporting to be supported by the Australian Securities and Investments Commission (ASIC).

The scam claims the bond can be cancelled after 90 days, and is being offered over corporate and treasury bonds.

In addition to naming a number of other entities, it names CommBank.

ASIC has also published an Imposter bond investment scams page to warn people of this scam.

Remember to Stop, Check, and Reject if you come across an investment opportunity that appears to be an imposter bond investment scam. If you’re ever unsure, please contact us.

There have been reports of a new phishing scam targeting users of accommodation sites, such as Booking.com. Reports claim users receive a message from official website email addresses such as ‘noreply@booking.com’ or from the messaging function within the booking app.

The message claims that a booking will be cancelled if customers do not input credit card details through a provided link. The message or email is typically received when a customer has recently booked accommodation, is due to check-in, or has already checked-in.

If you have received a message or email that does not seem genuine or includes an urgent call to action, remember to Stop, Check and Reject. Don’t click the link or share personal information if you are unsure. Ask someone you trust or contact the organisation directly through a contact number provided on their official website.

AUSTRAC has issued a news release regarding scams impersonating AUSTRAC and FIU. There have been reports of scammers calling members of the public, posing as AUSTRAC or FIU investigators. The scammers state that the individual’s bank account was used for money laundering and is now under investigation. The scammers advise that AUSTRAC will put a hold on their account and asks them to transfer their money into another account for ‘safe-keeping’.

AUSTRAC will never tell you we are putting a hold on or freezing your bank account. These scams attempt to trick you into moving or paying money, or giving out your personal information. Scammers often pretend to be from trusted organisations like AUSTRAC.

If you think a call claiming to be from AUSTRAC or any other organisation is not genuine, remember to Stop, Check, and Reject and if you are ever unsure, please ask someone you trust or contact the organisation the call claims to be from - do not engage with the scammer.

For further information you can visit: Be aware of scams impersonating AUSTRAC and FIUs | AUSTRAC

If you receive a message claiming to be from a postal delivery service requesting you click on a link for an undelivered package or to rearrange delivery, do not click on any links and delete the text.

Scammers are sending texts that appear to be from postal delivery services. These messages contain links to websites impersonating postal delivery services and ask you to input information such as your NetBank ID, password, card details and NetCodes to pay for a redelivery fee. If you receive a message like this, don’t click the link or share your personal information. If you need to check the status of a delivery you have requested, you could instead use the secure app provided by your postal delivery service or refer to their website for more information.

We’ve seen an increase in scams where scammers claim to be from a government organisation and/or the police and advise victims that they’ve been involved in illegal activity such as money laundering. Scammers create a sense of urgency by making threats of arrest, police investigation or other serious penalty. Often, scammers will specifically target overseas nationals in Australia, and may threaten deportation or visa cancellation. As well as seeking money, scammers will often attempt to obtain passports, visa numbers, and other forms of ID. Scammers will falsely provide ID numbers for cases and transfer to fake government organisations to support the legitimacy of the scam. Scammers then demand the victim to transfer money to international bank accounts and other unusual methods such as cryptocurrencies like bitcoin, cardless cash, cash deposits, international money transfers and gift cards/store cards for their bail. Often, these scammers create fear through ensuring the victim has regular contact with the scammer to track their actions, whereabouts and who the victim is talking to. Victims can also be made to contact relatives overseas and fake their kidnapping in order to obtain more funds.

If you receive a message like this, don’t click any links or share your personal information. Hang up, delete the message and stop contact with the scammer. View more information on threat and penalty scams and download our threat and penalty scam factsheet (PDF)

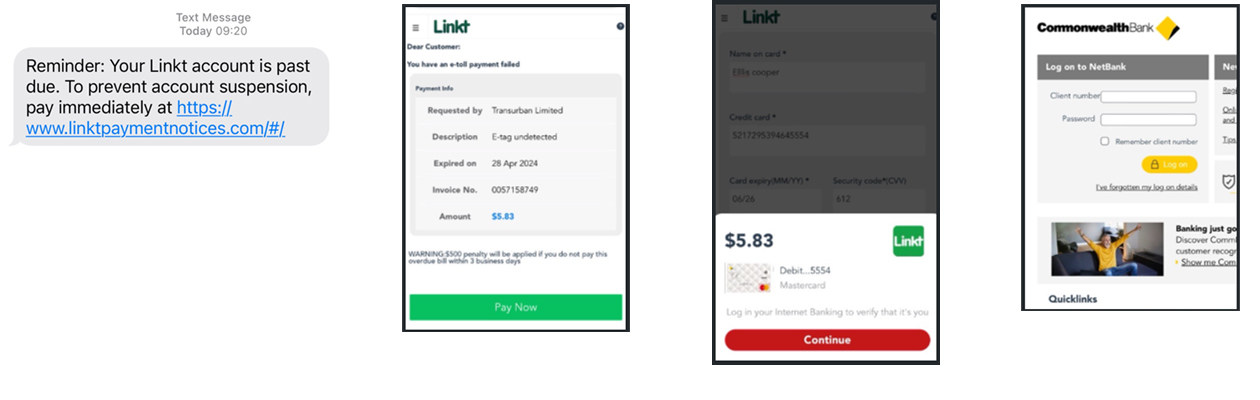

If you receive a message claiming to be from Linkt toll services requesting payment for an overdue bill or to fix an issue with your account, do not click on any links and delete the text.

Scammers are sending texts that appear to be from Linkt toll services. These messages contain links to fake websites and ask you to input information such as your NetBank ID, password, card details and NetCodes. If you receive a message like this, don’t click the link or share your personal information. Delete the message and contact linkt.com.au directly to check whether the message is legitimate.

Currently, people who are selling items on Facebook marketplace or gumtree are being targeted by scammers requesting payments to be made to “PayID” to settle fake overpayments, “upgrade” or “unlock” their accounts.

PayID will never contact you directly. If you encounter any issues with PayID please contact your bank.

Signs it’s a scam:

You receive an email claiming to be from PayID advising you have been paid, but no money appears in your bank account.

You are asked to pay money in order to settle an overpayment or to “unlock” or “upgrade” your account.

You are contacted by someone claiming they cannot pick the item up themselves and will have a family member do so on their behalf.

You are asked to receive payment via PayID, but also asked for your email address or other irrelevant contact information.

There are a number of websites popping up which claim that you can earn money by completing tasks on that website. The tasks involve the victim using their own money to purchase products and services to boost seller’s visibility and/or ratings. Some examples are writing reviews for hotels or purchasing products from an alleged amazon or eBay seller. Payments for these products/services are to a BSB and account number provided. The idea is the victim will be paid a commission however, this may never come or very little will be received, but what is clear is you will not receive what is promised.

Scammers are reaching out to unsuspecting victims via WhatsApp and Telegram however, there are also advertisements circulating on Instagram and Facebook. Remember if something seems too good to be true, it often is. If you are approached or come across an advertisement that sounds like the above, remember to Stop, Check, and Reject and if you are ever unsure, please ask someone you trust or contact the organisation the message claims to be from.

Ceba can help you lock your card or securely connect you to a specialist in the CommBank app.

Fast-track your call, see expected wait times and connect with a specialist in the CommBank app.

Send us a copy or screenshot if you receive a hoax email or SMS.