Help & support

*Digi Home Loan (Investment Principal & Interest) for new borrowings with Loan to Value ratio of up to 60%, when compared to CommBank’s other advertised investment loan rates. Min. new borrowings of $100,000. Comparison rate warning.

For a limited time earn up to 300,000 Qantas Points with a CommBank Digi Home Loan. Available online only. Conditions apply+.

Successful investing starts with choosing a property that aligns with your strategy and financial goals. This video explores the value of thinking strategically and how your CommBank Lending Specialist can help guide your search, giving you access to a broad range of options.

Successful investing starts with choosing a property that aligns with your strategy and financial goals. This video explores the value of thinking strategically and how your CommBank Lending Specialist can help guide your search, giving you access to a broad range of options.

Get the most from your home loan application process and book time with a Home Lending Specialist at a time and place that suits you.

Start your home loan or refinance application online and if eligible receive a conditional approval in minutes.

It’s important to do your research and understand the goals and strategies behind successful property investment. Think about things like:

We’ll guide you through the application process so you can choose an investment home loan that’s right for you, know how much you can afford to borrow and set a budget. You’ll need to provide us with:

Once approved, you can then review and sign your loan contract.

You can take advantage of your new loan’s features and benefits right away once your investment home loan is set up.

Regularly review:

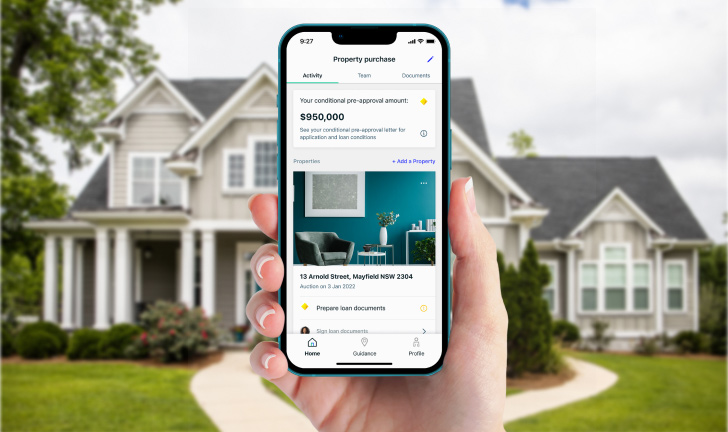

You can easily manage your investment home loan through the CommBank App and NetBank.

CommBank has partnered with Home-in, your personal home buying concierge, to help simplify your property investment purchase. Helping you at every step, from pre-approval to shortlisting properties, conveyancing and settling on your loan.

Use your income and expenses to estimate how much you may be able to borrow for a home loan.

Work out how much your home loan repayments might be.

Estimate the other costs of buying a property, including government costs, stamp duty, and fees.

Once you have saved for your deposit, calculated your borrowing power with our easy-to-use calculator, chosen your investment strategy and researched property options, you can apply online or with one of our Home Lending Specialists.

Buying an investment property is a decision predominately based on financial considerations, unlike purchasing a home to live in. Property investors have strategies in mind behind purchasing that can impact the type of property to buy as well as goals that they want to achieve.

Get help from Ceba in the CommBank app or connect with a specialist who can message you back. You’ll need CommBank app notifications turned on so you know when you’ve received a reply.

Was the information on this page useful?

Book instantly to speak to a Home Loan Specialist at a time that suits you.

Redraw, change your repayments or loan type to better meet your needs and more.

Fast-track your call, see expected wait times and connect with a specialist in the CommBank app.

Get instant help from our virtual assistant or chat to a specialist.

+ To be eligible for this offer, a loan must meet the following criteria (Eligible Home Loan):

The Qantas Frequent Flyer member nominated to receive Qantas Points cannot have earned Qantas Points on a CommBank Digi Home Loan offer previously. A member can have multiple CommBank Digi Home loans, including joint applications, however they will only be eligible for Qantas Points once.

If the above conditions are met, Qantas Points will be awarded as follows:

The Qantas Points will be credited to the nominated member’s Qantas Frequent Flyer account within 30 days of settlement and will appear on the nominated member’s Points Activity Statement as ‘CommBank Digi Home Loan’. Qantas Points will not be awarded if the loan is in arrears or default, or any of the borrowers are receiving financial hardship relief or assistance at the time of crediting the points.

This offer cannot be used in conjunction with any other advertised or promotional offer. We reserve the right to close or vary this offer at any time.

Home loans issued by Commonwealth Bank of Australia ABN 48 123 123 124 AFSL and Australian credit licence 234945. Commonwealth Bank of Australia pays Qantas for Qantas Points issued in relation to this offer. Approval and loan limit are subject to Commonwealth Bank of Australia’s credit assessment criteria. Information, including interest rates and fees, are subject to change. Terms, conditions, fees, charges, lending and eligibility criteria apply. The target market for this product will be found within the product's Target Market Determination, available at commbank.com.au/tmd.

1 To apply for a Wealth Package, you must have an eligible home loan or line of credit with an initial package lending balance of at least $150,000 at the time of your application. Package lending balance is the sum of the account balance of eligible home lending accounts and the credit limit of Viridian Line of Credit accounts that you have with us at the time you apply for Wealth Package. Eligible home loans include: Standard Variable Rate home loan, Fixed Rate home loans and Viridian Line of Credit. A non-refundable annual fee of $395 is payable in advance. The package can be established in the name of one or two individual’s name/s, or in the name of a corporate entity. It cannot be established in the name of a business or family investment trust. Please refer to the Wealth Package Fact Sheet and Package Terms and Conditions for full details.

2 Rate/s apply to new lending only and may include a margin below or above the applicable reference rate. The current reference rates can be found here.

3 At the end of the fixed rate period, the interest rate converts to the applicable Standard Variable Rate relevant to your loan purpose and repayment type at that time, less any applicable package discount specified in your Loan Contract.

8 You can link one Everyday Offset account to each eligible Digi Home Loan and up to two Everyday Offset accounts to each eligible Simple Home Loan. An offset feature fee will apply, see ‘Fees we charge for consumer mortgage lending products'.

^ 2019 ABA Winner for New Product Innovation in The Australian Brand Awards 2019.

* Comparison rate calculated on a $150,000 secured loan over a 25-year term. WARNING: Comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate. Comparison rates for variable Interest Only loans are based on an initial 5-year Interest Only period. Comparison rates for fixed Interest Only loans are based on an initial Interest Only period equal in length to the fixed period. During an Interest Only period, your Interest Only payments will not reduce your loan balance. This may mean you pay more interest over the life of the loan.

~ We charge the Rate Lock Fee when we process your request. It is therefore important that you have sufficient funds in your nominated account. The Rate Lock feature only applies to new Fixed Rate home loan and Fixed Rate Investment home loan applications. Rate Lock does not apply to Home Seekers, switching, splitting, top-ups, loan purpose transfers or repayment changes.

# You can choose to pay Principal and Interest weekly, fortnightly, or monthly. Only monthly payments are available for Interest Only. The maximum Interest Only payment period over the life of a loan is 15 years for Investment Home Loans and 5 years for Owner Occupied Home Loans, so long as there is at least 5 years remaining on the Contracted Loan Term. We have different rates that apply, depending on whether you are making Interest Only payments or Principal and Interest repayments. During an Interest Only period, your Interest Only payments won't reduce your loan balance unless you choose to make additional repayments. At the end of an Interest Only period, your repayments will increase to cover Principal and Interest components.

Information provided (including interest rates) are subject to change.

Calculations are estimates provided as a guide only and are not a loan approval. They assume interest rates don’t change over the life of the loan and are calculated on the rate that applies for the initial period of the loan. They do not take into account fees, charges or other amounts that may be charged to your loan (such as establishment or monthly service fees or stamp duty). Interest rates referenced are current rates and may change at any time.

Lenders' Mortgage Insurance or a Low Deposit Premium may apply to your loan depending on the size of your deposit; security, applicant and loan attributes. This is a one-off cost and will be added to the loan amount. Any of these additional amounts will increase repayments under the loan.

We have different rates that apply, depending on whether you are making Interest Only (IO) payments or principal and interest repayments. During an IO period, your IO payments won't reduce your loan balance. At the end of an IO period, your repayments will increase to cover principal and interest components.

Applications are subject to credit approval, satisfactory security and minimum deposit requirements. Conditions apply to all loan options. Full terms and conditions will be set out in our loan offer, if an offer is made. Fees and charges are payable. Interest rates are subject to change. As this advice has been prepared without considering your objectives, financial situation or needs, you should consider its appropriateness to your circumstances before acting on the advice. You should also read our Financial Services Guide.

^^$0 establishment fee offer is available on Simple Home Loan applications submitted between 2 August 2025 and 31 October 2025 inclusive through CommBank’s proprietary channel. Applications submitted outside this period or via non-proprietary channels are not eligible for this offer.

This offer is only available to CommBank customers who meet the following criteria:

(a) All borrowers must be First Home Buyer/s; and

(b) All borrowers must be individuals. Applications from trusts or companies are not eligible; and

(c) Application must be submitted through CommBank’s proprietary channel, it is not available to customers that submit an application through Bankwest, Unloan or a broker channel.

(d) The loan must be for one of the following eligible products:

- Simple Home Loan

- Simple Investment Home Loans.

If your application does not meet the eligibility criteria, the standard establishment fees: $300 for non-off-the-plan purchases and $800 for off-the-plan purchases, will apply.

CommBank reserves the right to withdraw or amend this offer at any time without notice.