- Future Business Index remains at long term average

- One in two businesses are focused on growth over cost management – the highest on record

- Profit and revenue expectations rise amongst businesses

Confidence among Australia’s mid-market businesses remained steady in the September quarter, but a record one in two businesses are now focused on growth instead of cost management, according to the Commonwealth Bank Future Business Index.

The Index also reveals more businesses are anticipating revenue growth (35 in Q1 FY15 up from 27 in Q4 FY14) and profit growth (27 in Q1 FY15 up from 16 in Q4 FY14) in the next six months.

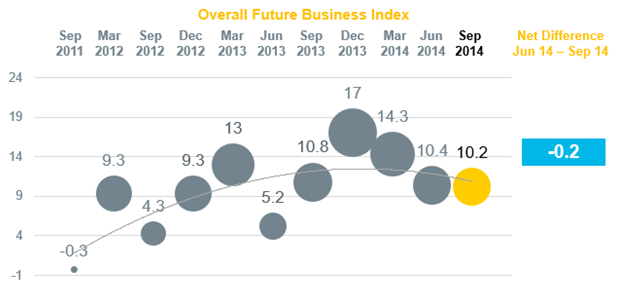

The Commonwealth Bank Future Business Index1 is based on a detailed quantitative survey of financial decision-makers in Australian companies with turnover of $10-$100 million. The September quarter (Q1 FY15)Index recorded its smallest quarterly movement since it was launched in 2011, declining by 0.2 from the June quarter (Q4 FY14) to 10.2.

Despite optimism around profit and revenue expectations, fewer businesses are well prepared for fluctuations in business conditions in the next six months, with only 38 per cent of businesses indicating that they are well prepared, down by seven percentage points over the last three months.

According to the Index, the primary opportunities for the mid-market over the next six months include new/expansion markets, new clients/business and increasing sales/demand. Businesses cited domestic competition and maintaining profitability/cash flow amongst the top challenges over the next six months.

Mid-market businesses are continuing to position themselves to take full advantage of emerging growth opportunities, said Michael Cant, Executive General Manager Corporate Financial Services, Commonwealth Bank.

“Half of the firms surveyed said they are focused on growth initiatives instead of cost management, which had been the focus in previous surveys. The Future Business Index also revealed that a significant number of the firms indicated they would be pursuing new markets and clients. This is more evidence that growth is factoring heavily into the business outlook,” Mr Cant said.

“Despite business decision-makers expecting conditions and revenue to improve, they are still uncertain about competition and financial performance, citing ‘maintaining profitability and cash flow’ and ‘margin squeeze’ among their top challenges in the next six months.”

Michael Blythe, Chief Economist, Commonwealth Bank, said, “We have seen an improvement in the harder-edged indicators relating to business conditions and revenue flowing through to improved risk appetite, capital spending plans and labour hiring intentions for the next six months.

“The significant improvement in the retail sector suggests that post-budget fears of softening consumer confidence were misguided. Most mid-market businesses still appear to be unfazed by fluctuations in the Australian dollar, as businesses have adjusted to the higher exchange rate in the past two years, which in itself is a considerable achievement.”

About the Future Business Index

The Commonwealth Bank Future Business Index (FBI) is based on a detailed quantitative survey of 424 financial decision-makers in public and private companies throughout Australia with turnover between $10 million and $100 million. The September quarter survey was conducted between the 26th August 2014 and the 16th September 2014.

Conducted by ACA Research, the FBI is an indicator of what the business landscape will look like over the next six months, based on business confidence, predicted future activity and an organisation’s ability to manage fluctuating business conditions. The survey sample includes businesses from a range of sectors including Retail, Business Services, Construction, Health & Education, Information Media & Telecommunications, Manufacturing, Mining, Transport & Logistics and Wholesale Trade. The data has been weighted to reflect the latest Australian Bureau of Statistics Business counts.

The Index seeks to identify:

- The level of confidence in business conditions over the next six months.

- The challenges and threats businesses face over the next six months.

- How prepared businesses are to navigate volatile conditions.

- The use of financial facilities and risk planning.

- Expected sources of growth and opportunities.

How the FBI is calculated

The FBI has been calculated by taking a net balance of future business conditions, net revenue and risk as indicated by businesses with an annual turnover of $10 to $100 million.

- Net Business Conditions is a net balance of those that indicated that business conditions will improve minus those who predict business conditions will decline.

- Net Revenue is calculated by taking those companies that see an increase in revenue over the next six months minus those that foresee a decline.

- Net Well Preparedness is a net balance of those that are ‘well prepared’ minus those that are ‘somewhat’ and ‘not well prepared’.

About ACA Research

ACA Research is a full-service market research consultancy, with particular expertise in customised business-to-business thought leadership, executive research and syndicated multi-client studies throughout Australia, New Zealand and Asia. Through a high level of business and research experience, industry expertise and focus on high-quality outputs, ACA Research effectively supports business thought leaders in their decision-making activities.

For a full copy of the report visit commbank.com.au/futurebusinessindex