The Commonwealth Bank Business Sales Indicator (BSI) for April shows economy-wide spending rising for the fifteenth consecutive month in trend terms. Growth was driven by a lift in mail and telephone orders, up 1.2 per cent – its biggest jump since December 2015 – as well as increased spending on hotels and motels, retail stores and service providers, all up 0.7 per cent.

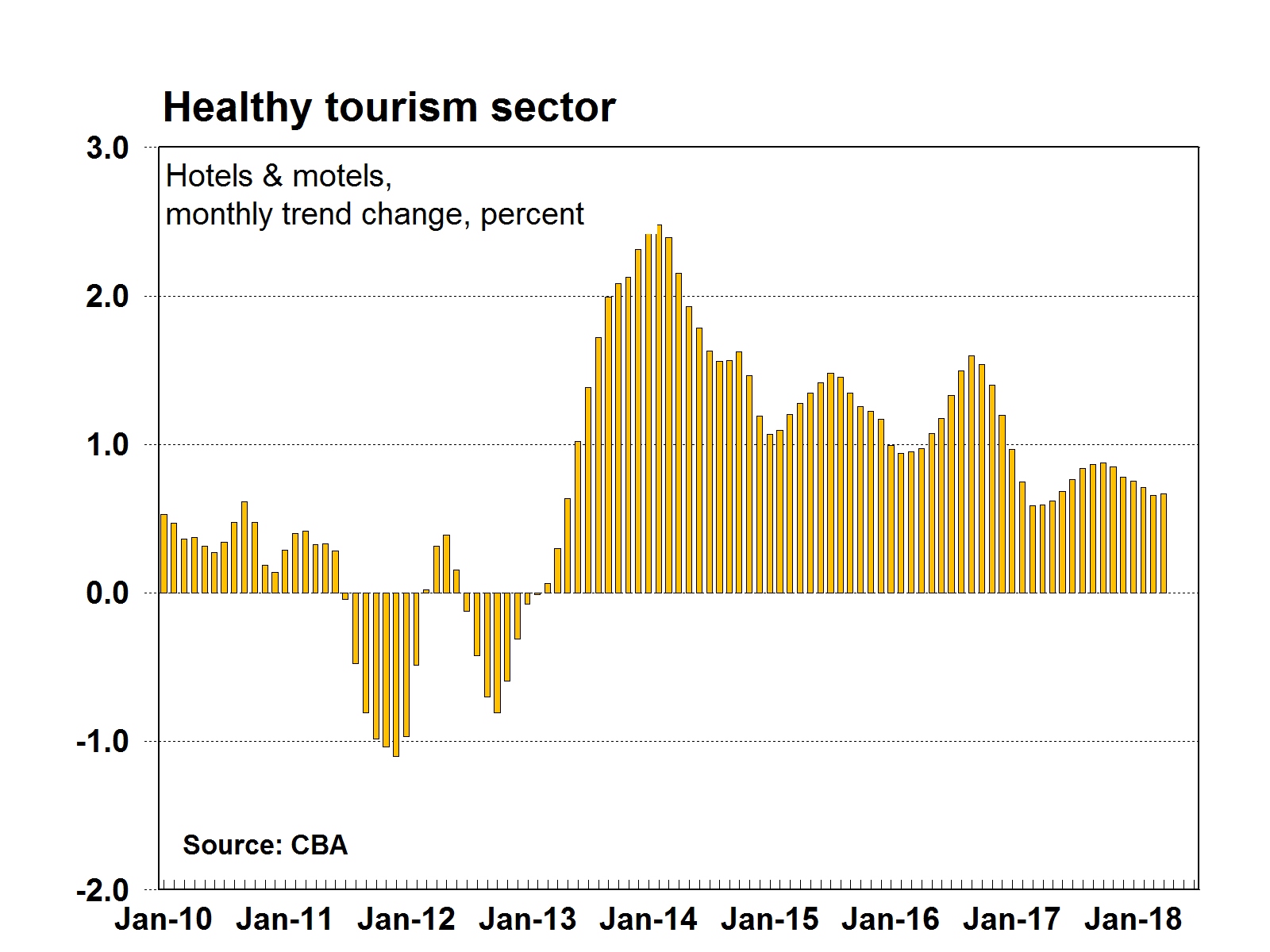

“We have seen spending at hotels and motels rising between 0.7 and 0.9 per cent a month for almost a year. Spending on this type of tourist accommodation has not fallen for the past five years, highlighting the strength of domestic and international travel,” CommSec Chief Economist Craig James says.

Sales at combined retail and clothing stores lifted by 0.6 per cent in April – a year ago sales were falling. Retail and clothing stores account for 40 per cent of the BSI, so strength in these sectors strongly influences economy-wide spending.

The BSI, which reflects the condition of national and state economies, has now risen by between 0.9 and 1.0 per cent a month for the last five months.

Sectors with strongest annual growth in April included Retail Stores (up 15.3 per cent), Transportation (up 10.3 per cent) and Hotels & Motels (up 9.5 per cent).

Spending eased across five sectors

Sales fell in five of the 19 industry sectors in April. Transportation-related sales fell the most and were down for a second month, decreasing by 0.5 per cent in April.

“High gasoline prices represent the main inflationary threat in Australia and higher petrol prices may be starting to affect those in the transportation sector, such as couriers and truck and taxi drivers,” says Craig.

Sales also fell for clothing stores (down 0.2 per cent), utilities (down 0.1 per cent) and airlines and repair services (both down by less than 0.1 per cent).

“Clothing stores have seen sales fall for the last six months, with warmer weather potentially delaying demand for winter gear,” says Craig. “The warmer weather may also be impacting utilities sales, now down for three consecutive months.”

State-by-state breakdown

Across all states and territories in April, sales were stronger. Victoria experienced the strongest growth (up 1.2 per cent) followed by ACT (up 1.1 per cent); NSW and Queensland (both up by 0.9 per cent); Tasmania (up 0.8 per cent); South Australia (up 0.5 per cent); Western Australia and Northern Territory (both up 0.4 per cent).

In annual terms all states and territories had sales above a year ago. Strongest growth was in Queensland (up 10.8 per cent); Western Australia (up 8.8 per cent); Victoria (up 8.5 per cent); Northern Territory (up 8.2 per cent); South Australia and the ACT (both up 7.8 per cent); Tasmania (up 7.6 per cent); and NSW (up 6.9 per cent).

Read the latest Commonwealth Bank Business Sales Indicator.