Highlights of 2014 Result

- Statutory net profit after tax (NPAT) of $8,631 million – up 13 per cent on prior year;(1,2,3)

- Cash NPAT of $8,680 million – up 12 per cent;

- Return on equity (cash basis) of 18.7 per cent an increase of 50 basis points (bpts);

- Fully franked final dividend of $2.18 per share, taking total for the year to $4.01, a 10 per cent increase;

- Group cost to income ratio improves 70 bpts to 42.9 per cent as productivity initiatives deliver tangible outcomes;

- Strong organic capital growth increases both Common Equity Tier 1 (CET 1) Capital, on an APRA basis and on a fully harmonised Basel III basis by 110 bpts, to 9.3 per cent and 12.1 per cent respectively;

- Strong Balance Sheet growth with Average interest earning assets up $52 billion to $705 billion;

- Customer deposits up $34 billion to $439 billion – now represents 64 per cent of the Group’s total funding; and

- The Group continues to invest in the future ($1.2 billion in the 2014 financial year) with particular focus on technology and productivity.

(1) Except where otherwise stated, all figures relate to the full year ended 30 June 2014. The term “prior year” refers to the full year ended 30 June 2013, while the term “prior half” refers to the half year ended 31 December 2013. Unless otherwise indicated, all comparisons are to “prior full year”.

(2) For an explanation of, and reconciliation between, Statutory and Cash NPAT refer to pages 2, 3 and 15 of the Group’s Profit Announcement for the full year ended 30 June 2014, which is available at www.commbank.com.au/shareholders.

(3) Comparative information has been restated to conform to presentation in the current period.

The Commonwealth Bank of Australia (the Group) today announced its results for the financial year ended 30 June 2014. The Group’s statutory NPAT was $8,631 million, which represents a 13 per cent increase on the prior year. Cash NPAT was $8,680 million, up 12 per cent. Return on equity (cash) increased 50 bpts to 18.7 per cent.

The Board declared a final dividend of $2.18 per share – an increase of 9 per cent on the 2013 final dividend. Total dividend for the year was $4.01 – an increase of 10 per cent. The cash dividend payout ratio for full year was 75.1 per cent of cash NPAT, which is in line with the prior year and within the Board’s target range of 70 to 80 per cent. The final dividend will be fully franked and will be paid on 2 October 2014. The ex-dividend date is 19 August 2014.

The Group’s Dividend Reinvestment Plan (DRP) will continue to operate, but no discount will be applied to shares issued under the plan for this dividend. Given the Group’s high level of CET 1 capital, the Board has decided to neutralise or minimise the dilutive impact of the DRP through an on-market share purchase and transfer to participants. The Group is also considering the issue of a Tier 1 capital instrument to replace PERLS V should markets remain receptive.

Commenting on the result, Group Chief Executive Officer, Ian Narev said: “This result benefits a wide range of stakeholders, and we are proud of the role we have continued to play in building a strong Australia. During this financial year, we lent over $130 billion to Australian households and businesses, held $26 billion more deposits, and increased the investments we helped manage by over $20 billion. Our Australian-based shareholders, comprising nearly 800,000 households who own our shares directly and millions more who own them through their pension funds, received over $6.4 billion in dividends, and saw the value of their investment in the Commonwealth Bank increase by over $19 billion. We paid over $5.4 billion to more than 50,000 people whom we employ, continuing our commitment not to offshore Australian jobs. We spent $4 billion with local partners and suppliers, including hundreds of small businesses. We were one of Australia’s largest tax payers, paying around $3.4 billion in State and Federal tax. And we made significant contributions to support individuals, charities, sporting organisations and communities’ right across Australia.”

“And as a 102 year-old company, we are always keeping an eye on the future. This year we have again struck a balance between the Group’s short term and long term priorities. At the same time as delivering a 12 per cent increase in cash earnings, and a strong return on equity, we reinvested $1.2 billion into the business, most of which was targeted at our long term strategic priorities – people, technology, strength and productivity. We have also continued investment in our capability-based strategy outside Australia.”

Key components of the result include:

- Continuing with the success of the customer focus strategy, the Group retained (for a period of 18 months) its position as number one in customer satisfaction (relative to peers) in its Australian retail banking business, while maintaining its leadership position in business customer satisfaction;

- Group net interest income and other banking income increased by 8 and 4 per cent respectively in the banking businesses, with average interest earning assets up $52 billion to $705 billion and retail and business average interest bearing deposits(1) _ up $29 billion to $412 billion;

- Net interest margin (NIM) increased by 1 bpt to 2.14 per cent year on year with the positive impacts of a change in portfolio mix offset by a number of factors including an increase in liquid assets and increased pressure on lending and deposit pricing;

- Wealth Management’s earnings grew as average Funds Under Administration (excluding Property(2)) increased by 19 per cent and 84 per cent of funds outperforming their respective three year benchmarks;

- Cash earnings grew in New Zealand (including ASB Bank) and Bankwest by 19 and 21 per cent respectively;

- Continuing progress was made in Indonesia and China;

- The Group improved its cost to income ratio by 70 bpts, achieved in large part through the Group-wide productivity focus, which delivered savings of $280 million over the past twelve months;

- In a benign credit environment, the ratio of cash loan impairment expense (LIE) to gross loans and acceptances improved 4 bpts (to 16 bpts) due to favourable loan loss experience and a reduction in individual provisioning requirements;

- The Group invested $1.2 billion in long term growth through a tightly managed set of initiatives that focused primarily on technology, and productivity;

- Conservative provisioning was maintained, with total provisions of $3.9 billion, and the ratio of provisions to credit risk weighted assets at a conservative 1.35 per cent. This included collective provisions of almost $800 million and an unchanged economic overlay;

- On-going organic capital generation delivered a Basel III CET1 (Internationally Harmonised) ratio of 12.1 per cent, up 110 bpts. The Group’s CET 1 (APRA) also increased 110 bpts to 9.3 per cent; and

- The Group remained one of only a limited number of global banks in the ‘AA-’ ratings category.

Strong deposit growth during the period has seen the Group satisfy a significant proportion of its funding requirements from customer deposits, with deposits now providing 64 per cent of total Group funding. During the year the Group took advantage of improving conditions in wholesale markets, issuing $38 billion of long term wholesale debt in multiple currencies.

Despite the continued benign credit environment and the improving macro-economic outlook, the Group remains cautious, maintaining a strong balance sheet with high levels of capital and provisioning. Liquidity portfolio was $139 billion as at 30 June 2014.

Turning to the future, Ian Narev said: “We are cautiously positive about the outlook for the 2015 financial year. Whilst business and consumer confidence levels have remained fragile, the levels of underlying activity confirm the strong foundations of the Australian economy. Lower interest rates have been positive for the housing and construction sectors, where increased activity has gone some way to offset the impacts of the anticipated reduction in investment in the resources sector. And although investment in the resources sector has tapered off as predicted, the fruits of previous investment are showing up in increased production of iron ore and LNG, as new projects move into the production phase.”

“The past twelve months have also been a period of relative stability in the global economy although downside risks remain.”

“If the stability in global markets continues, gradual increases in consumer spending and demand for credit from businesses over the next year are likely, as long as budget discussions are progressed and there is a clear understanding of Australia’s medium to long term economic direction.”

“In terms of our own business settings, and economic policy, it is critical to take a long term view of the Australian economy. We will continue our focus on the future and building our priority capabilities: people, technology, productivity and strength. We will also actively support policies designed to build a sustainable Australian economy over the next decade.”

(1) Includes transactions, savings and investment average interest bearing deposits.

(2) During the year the Group successfully completed the internalisation of the management of CFS Retail Property Group (CFX) and Kiwi Income Property Trust (KIP), and the Group has ceased to manage the Commonwealth Property Office Fund (CPA). The Group also sold its entire proprietary unit holding in CPA and KIP, and part of its proprietary unit holding in CFX. As such, these Property transactions and businesses have been excluded from the calculation of certain financial metrics and comparative information.

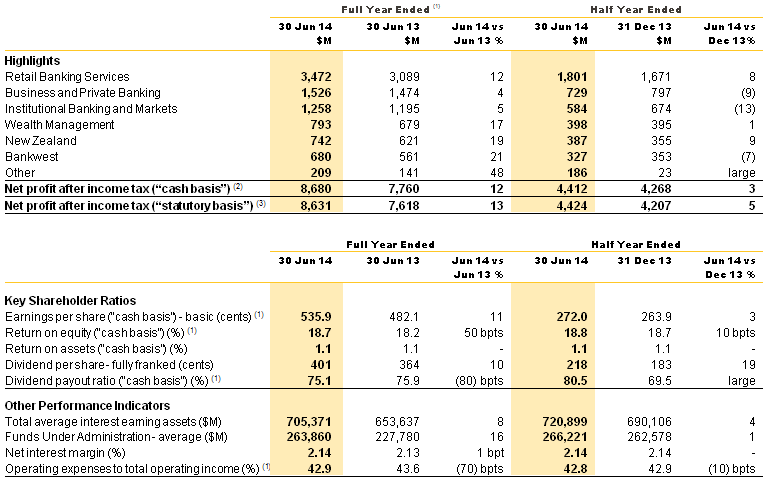

Appendix: Summary table of key financial information

(1) Comparative information has been reclassified to conform to presentation in the current year.

(2) Net Profit after income tax (“cash basis”) – represents net profit after tax and non-controlling interests before Bankwest non-cash items, the gain on sale of management rights, treasury shares valuation adjustment, Bell Group litigation and unrealised gains and losses related to hedging and IFRS volatility. This is Management’s preferred measure of the Group’s financial performance.

(3) Net Profit after income tax (“statutory basis”) – represents net profit after tax and non-controlling interests, Bankwest non-cash items, the gain on sale of management rights, treasury shares valuation adjustment, Bell Group litigation expense and unrealised gains and losses related to hedging and IFRS volatility. This is equivalent to the statutory item “Net profit attributable to Equity holders of the Bank”.