Help & support

Eligible customers belong to one of CommBank Yello’s benefit sets. Each benefit set provides relevant, tailored benefits and offers. You can check your eligibility status in the CommBank Yello hub within the latest version of the CommBank app. We assess eligibility every month, typically on a day within the first week of each month. Read examples of eligibility journeys.

Eligibility

Benefits

Eligibility

Benefits

Eligibility

Benefits

Download or update the latest version of the CommBank app. Log onto the app and tap ‘CBA Yello’. If you’re eligible, you’ll unlock access to CommBank Yello. We assess eligibility at the start of each month. Additional steps may be required. View eligibility requirements.

Already an eligible customer? Tap ‘CBA Yello’ then ‘View all’ to discover your offers. You must be opted in first.

Explore our range of everyday transaction accounts, to begin your journey with CommBank Yello. Discover more about everyday accounts

Sometimes, CommBank customers may have more than one customer record with us (for example, if you applied for different products at different times and the products weren’t linked). If this is the case, you may not qualify for certain CommBank Yello benefits or may experience a delay in receiving them, as we consider each customer record as a separate customer.

If you can’t see all your CommBank products and services under the one login or think you may have missed out on receiving benefits, please contact us.

View the CommBank Yello Terms and Conditions (PDF) and third party provider terms and conditions alongside this summary.

How to be eligible

You’re eligible for the Everyday benefit set if you are an account holder of at least one individual or joint eligible transaction account. Plus, you’ve made at least 5 eligible, completed outbound transactions from your eligible transaction account or eligible credit card account, in the previous month or the month before that.

Eligible completed transactions made on a joint eligible transaction account or eligible credit card account, contribute to the eligibility of all joint account holders and cardholders.

Eligible transaction accounts:

Eligible credit card accounts:

You’re not eligible for CommBank Yello benefits if:

We assess eligibility every month, typically on a day within the first week of each month. Read examples of eligibility journeys.

For further information on the Everyday benefit set eligibility criteria, refer to Clause 4.1 in the full CommBank Yello Terms and Conditions

Free Kit Membership for 12 months

If you’re a CommBank Yello customer, you can receive a free Kit membership for 12 months. Kit is an earning-and-learning, mindfully-spending, money-mastering app for children. Kit is built by x15ventures, which is wholly owned by CommBank.

The Kit membership covers both “Single child” and “Multi-child” plans. It’s available to new and existing Kit customers. New Kit customers will need to apply the code when setting up an account with Kit through the Kit app. Existing Kit customers will be able to apply their code via settings in the Kit app.

Eligible customers can access their unique promotional code in the CommBank Yello hub within the CommBank app.

Any changes to your CommBank Yello eligibility will not affect the Kit membership once you have redeemed. Your unique promotional code cannot be redeemed wholly or in part for cash or cash equivalents in the event you cancel your Kit membership part way through your 12-month membership fee period. If you do not wish to use your code, you can choose to gift your code to someone else. Your code can only be redeemed once for its entire value. To be eligible to redeem the Kit offer, you require a valid Australian residential address.

Kit is a brand of CBA New Digital Businesses Pty Ltd ABN 38 633 072 830 (CBA New Digital Businesses Pty Ltd) trading as HEY KIT. CBA New Digital Businesses Pty Ltd is a wholly owned but non-guaranteed subsidiary of CommBank. CBA New Digital Businesses Pty Ltd is not an Authorised Deposit-Taking Institution for the purposes of the Banking Act 1959 and its obligations do not represent deposits or other liabilities of CommBank or its subsidiaries, and therefore, you may be exposed to investment risk including possible delays in repayment and loss of income and principal invested, as relevant.

CBA New Digital Businesses Pty Ltd has been appointed as an authorised representative (001296799) of Hay Limited (ABN 34 629 037 403 AFSL 515459), who is the issuer of the Kit Account and associated Kit Cards.

More mobile plans

If you’re an Everyday customer, you could receive $10 off More mobile plans for 12 months. After the Offer Period, you could receive 10% off ongoing. Sign up by 30 June 2025 using a CommBank credit or debit card as your online bill payment method.

More nbn® plans

If you’re an Everyday customer, you could receive 30% off More nbn® plans for 12 months. After the Offer Period, you could receive 10% off ongoing.

If you sign up, More will be your nbn® service provider and will handle all technical enquiries, complaints and servicing. The provision of your service will be subject to More’s standard terms of service and policies, available on the More website. CommBank reserves the right to remove this offer at any time.

Amber electric welcome credit

If you’re an Everyday customer, you could receive a $120 Amber electric welcome credit, applied over six months.

Cashback from our CommBank Yello offer providers (third parties)

If you’re a CommBank Yello customer, you can receive cashback offers and other benefits from our CommBank Yello offer providers. Cashback will be paid into your most recently opened individual account, unless you have selected a different account via the CommBank app.

If you don’t have an individual account, the cashback will be paid into your most recently opened joint account - even if the joint account holder isn’t eligible for the benefit. Accounts that have been stopped (no longer permitted to make transactions) are not considered opened accounts.

For further information, refer to Clause 5.1 of the CommBank Yello Terms and Conditions. Third party provider Terms and Conditions may also apply.

How to be eligible

You’re eligible for the Everyday Plus benefit set if you are an account holder of at least one individual or joint eligible transaction accounts. Plus, you’ve made at least 30 eligible, completed outbound transactions from your eligible transaction account or eligible credit card account, in the previous month or the month before that.

Eligible, completed transactions completed by a joint or credit card account, contribute to the eligibility of all joint account holders and cardholders.

Eligible transaction accounts:

Eligible credit card accounts:

You are not eligible for CommBank Yello benefits if:

We assess eligibility every month, typically on a day within the first week of each month. Read examples of eligibility journeys.

For further information on the Everyday Plus benefit set eligibility criteria, refer to Clause 4.1 in the CommBank Yello Terms and Conditions

Bonus CommBank Smart Awards Points

If you’re an Everyday Plus customer, you can receive CommBank Awards Points to your Smart Awards credit card account. To receive bonus points, you must also:

As an Everyday Plus customer, you’ll receive 500 bonus CommBank Awards Points every month that you’re eligible.

The bonus CommBank Awards Points will be awarded to your Smart Awards credit card account. If you have opted in to earn Qantas Points, your CommBank Awards Points earnt each month are automatically transferred to your Qantas Frequent Flyer account as per the current rates. Refer to the CommBank Awards Program Terms and Conditions.

Free Kit Membership for 12 months

If you’re a CommBank Yello customer, you can receive a free Kit membership for 12 months. Kit is an earning-and-learning, mindfully-spending, money-mastering app for children. Kit is built by x15ventures, which is wholly owned by CommBank.

The Kit membership covers both “Single child” and “Multi-child” plans. It’s available to new and existing Kit customers. New Kit customers will need to apply the code when setting up an account with Kit through the Kit app. Existing Kit customers will be able to apply their code via settings in the Kit app.

Eligible customers can access their unique promotional code in the CommBank Yello hub within the CommBank app.

Any changes to your CommBank Yello eligibility will not affect the Kit membership once you have redeemed. Your unique promotional code cannot be redeemed wholly or in part for cash or cash equivalents in the event you cancel your Kit membership part way through your 12-month membership fee period. If you do not wish to use your code, you can choose to gift your code to someone else. Your code can only be redeemed once for its entire value. To be eligible to redeem the Kit offer, you require a valid Australian residential address.

Kit is a brand of CBA New Digital Businesses Pty Ltd ABN 38 633 072 830 (CBA New Digital Businesses Pty Ltd) trading as HEY KIT. CBA New Digital Businesses Pty Ltd is a wholly owned but non-guaranteed subsidiary of CommBank. CBA New Digital Businesses Pty Ltd is not an Authorised Deposit-Taking Institution for the purposes of the Banking Act 1959 and its obligations do not represent deposits or other liabilities of CommBank or its subsidiaries, and therefore, you may be exposed to investment risk including possible delays in repayment and loss of income and principal invested, as relevant.

CBA New Digital Businesses Pty Ltd has been appointed as an authorised representative (001296799) of Hay Limited (ABN 34 629 037 403 AFSL 515459), who is the issuer of the Kit Account and associated Kit Cards.

More mobile plans

If you’re an Everyday Plus customer, you could receive $15 off More mobile plans for 12 months. After the Offer Period, you could receive 10% off ongoing. Sign up by 30 June 2025 using a CommBank credit or debit card as your online bill payment method.

More nbn® plans

If you’re an Everyday Plus customer, you could receive 35% off More nbn® plans for 12 months. After the Offer Period, you could receive 10% off ongoing. Sign up by 30 June 2025 using a CommBank credit or debit card as your online bill payment method.

If you sign up, More will be your nbn® service provider and will handle all technical enquiries, complaints and servicing. The provision of your service will be subject to More’s standard terms of service and policies, available on the More website. CommBank reserves the right to remove this offer at any time.

Amber electric welcome credit

If you’re an Everyday Plus customer, you could receive a $150 Amber electric welcome credit, applied over six months.

Cashback from our CommBank Yello offer providers (third parties)

If you’re a CommBank Yello customer, you can receive cashback offers and other benefits from our CommBank Yello offer providers. Cashback will be paid into your most recently opened individual account, unless you have selected a different account via the CommBank app.

If you don’t have an individual account, the cashback will be paid into your most recently opened joint account - even if the joint account holder isn’t eligible for the benefit. Accounts that have been stopped (no longer permitted to make transactions) are not considered opened accounts.

For further information, refer to Clause 5.1 CommBank Yello Terms and Conditions. Third Party Terms and Conditions may also apply.

Prize draw

If you’re an Everyday Plus customer, you’ll automatically be entered in a monthly prize draw. You’ll have the chance to be 1 of 100 customers who receives a $300 cash prize. For the Everyday Plus Terms and Conditions, refer to Section 9 the CommBank Yello Terms and Conditions.

From time to time, you may also be automatically enrolled in other ad hoc CommBank Yello prize draws. Details about these prize draws, including their specific terms and conditions, will be published on this page (commbank.com.au/yello)

CommBank Mastercard Presale and Preferred tickets

CommBank Mastercard allows certain eligible customers access to CommBank Yello products and services. In relation to the offer of presale tickets to events the following customer rules apply:

Where there is a preferred tickets category you have the opportunity to secure preferred tickets to selected events that are available.

Tickets are allocated on the earlier basis of either:

CommBank doesn't charge an additional fee for obtaining presale or preferred tickets. Mastercard may determine its own fees and charges in relation to presale and preferential tickets.

Customers should be aware that standard handling, booking or transaction fees may apply from individual ticketing agents. CommBank Yello products and services are only eligible to CommBank Yello customers who meet the ‘Base eligibility criteria’ in the ‘CommBank Yello Terms and Conditions’. Refer to the CommBank website for more information on CommBank Yello eligibility.

CommBank does not guarantee but uses reasonable endeavours to ensure that the details contained in an offer are correct at the time of publication. CommBank will not be liable for the accuracy or completeness of any claims made by third party retailers and/or agencies concerning their goods or services nor are we liable in any way for the performance of those goods or services, except to the extent caused by our negligence, fraud, or wilful misconduct or that of our agents.

Offers are subject to terms and conditions of the relevant participating merchants or promoters providing the Offer which are available on participating merchants websites. CommBank does not provide any of the good or services relating to the Offer. CommBank does not make representations or warranties in respect of the offer, goods or services.

Relevant ticketing agencies and/or promoters are solely responsible for offer redemption and fulfilment. In the case of a cancellation, the relevant ticketing agency and/or promoter of the event are solely responsible for any refunds, exchanges or make good of the ticket purchase price.

CommBank does not alter any terms of your existing conditions of use of the Eligible Card or any other CommBank accounts. CommBank may modify or remove the Offers at any time without prior notice.

How to be eligible

You’re eligible for the Homeowner benefit set if you are an account holder of at least one individual or joint eligible transaction account and are a borrower under an eligible home loan. Plus, you’ve made a minimum of 30 eligible outbound transactions from your eligible transaction account or eligible credit card account, in the previous month or the month before that.

Eligible, completed transactions made on a joint eligible transaction account or eligible credit card account, contribute to the eligibility of all joint account holders and cardholders.

Eligible transaction accounts:

Eligible credit card accounts:

Eligible home loans:

Your home loan isn't eligible if it's:

You are not eligible for CommBank Yello benefits if:

We assess eligibility every month, typically on a day within the first week of each month. Read examples of eligibility journeys.

For further information on the Homeowner benefit set eligibility criteria, refer to Clause 4.1 in the CommBank Yello Terms and Conditions

Cashback on Home insurance

If you’re a Homeowner customer, you can receive a $10 per month cashback on each eligible Home insurance policy you hold. Home insurance is distributed by CommBank and provided by Hollard (up to $120 annually for each eligible Home insurance policy). Cashbacks are available even if you receive other Home insurance discounts or offers, including the combined policy discount.

Eligible Home insurance cover types:

To qualify for the cashback benefit, you must hold an eligible Home insurance policy on the last day of the previous month. Plus, you must continue to hold the policy until the cashback is paid.

Cashbacks aren’t available for insurance that covers portable contents as a standalone policy. Cashbacks are available per benefit, or policy, rather than per customer.

If there are multiple recipients of a single cashback benefit, for example if there is more than one policyholder, we pay the cashback to:

If there are multiple potential recipients, we will choose one.

The cashback will appear as ‘CBA Yello Insur Cashbk' in your transactions.

For further information, refer to Section 5.1 in the CommBank Yello Terms and Conditions.

Cashback on Home Loan Package fee

If you’re a Homeowner customer, you could receive $4 per month cashback on your Package fee (up to $48 annually). The cashback will be paid per Package rather than per customer. A Home Loan Package is a Wealth Package or Mortgage Advantage (Package).

You must hold a Package on the last day of the previous month to qualify for the cashback benefit in a particular month.

Cashback will be paid into your most recently opened individual account, unless you have selected a different account via the CommBank app. If you don’t have an individual account, the cashback will be paid into your most recently opened joint account. Accounts that have been stopped (no longer permitted to make transactions) are not considered opened accounts.

If there is more than one eligible Package holder, we pay the cashback to:

This will appear as ‘CBA Yello HLPckg' in your transactions.

Cashback is not available where the Package is pending or closed, or where the Package fee has been fully or partially waived.

For further information, refer to Section 5.2 in the CommBank Yello Terms and Conditions.

Cashback on Digi Home Loan

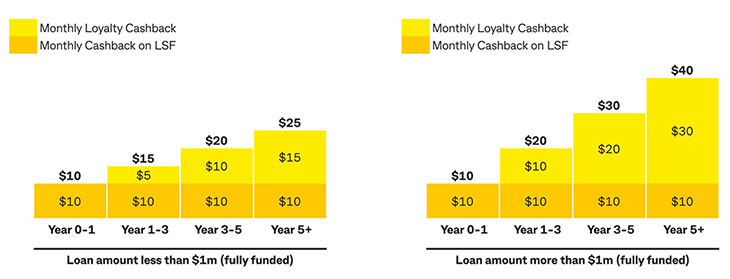

If you’re a Homeowner customer with a Digi Home Loan, you could receive a $10 monthly cashback on your Loan Service fee (up to $120 annually). Plus, you could get a loyalty cashback which increases over time once your loan has been fully funded for a year.

If you have a Digi Home Loan of less than $1 million for:

If you have a Digi Home Loan of more than $1 million for:

The cashback will be paid per Digi Home Loan, rather than per customer. Your Digi Home Loan must be open on the last day of the previous month to be eligible for the cashback benefits.

If there are more than one eligible Digi Home Loan account holder, we pay the cashback to:

Eligibility is typically assessed monthly and customers must also meet the CommBank Yello Homeowner eligibility criteria.

There may be tax implications in receiving cashback benefits. You should check with your accountant or tax adviser for further information.

Cashback for investing with CommSec

If you’re a Homeowner customer, you could receive a $5 monthly cashback for investing Australian Shares with CommSec.

You’ll need to settle one trade over $1,000 with an Individual CommSec Share Trading Account to a Commonwealth Direct Investment Account (CDIA). The trade must be settled by the last day of the previous month.

You must be eligible for the CommBank Yello Homeowner benefit set. We typically check eligibility at the start of the month.

The cashback will be paid per customer and is limited to one payment per month. The cashback will be paid into your most recently opened individual account, unless you’ve selected a different account in the CommBank app. Accounts that have been stopped (no longer permitted to make transactions) aren’t considered opened accounts.

The cashback will appear as ‘CBA Yello Invest Cshbk’ in your transactions.

The cashback is not available to customers with a joint, company or trustee CommSec Australian Share Trading Account, and to customers trading through CommSec Pocket, International Shares, Exchange Traded Options or Margin Loans.

There may be tax implications in receiving the cashback. You should check with your accountant or tax adviser for further information.

Bonus CommBank Smart Awards Points

If you’re Homeowner customer, you could receive CommBank Awards Points to your Smart Awards credit card account. To receive bonus points, customers must also:

If you are a Homeowner customer, you’ll receive 1,000 bonus CommBank Awards Points every month that you’re eligible.

The bonus CommBank Awards Points will be awarded to your Smart Awards credit card account. If you have opted in to earn Qantas Points, your CommBank Awards Points earnt each month are automatically transferred to your Qantas Frequent Flyer account as per the current rates. Refer to CommBank Awards Program Terms and Conditions.

Property reports

If you’re a Homeowner customer, you could receive a property report generated by our service provider. Your property must be classified as residential, defined as dwellings used for domestic occupation; and have a valid and up-to-date address recorded in our system (to allow our service partner to match against their records). Plus, there must be enough information on that address for our service partner to generate a report.

Property reports are available twice a year through the CommBank app. You’ll be able to view or access each report for six months from the date the report was generated. If we don’t have a record of your full address, you may receive a Local Area Snapshot. A Local Area Snapshot focuses on your suburb, rather than your specific property.

If you sell your property, refinance to another financial institution and/or close your home loan, you’ll no longer receive property reports for that property, but you may continue receiving them for other eligible properties.

If you haven’t received a property report, or only received a Local Area Snapshot, please message us in the CommBank app or visit your local branch to provide us with your full address details. This will help ensure you receive a property report when next eligible.

The information contained in each report is general in nature and based on data about your property, the suburb or region your property is situated in or the real estate market that is available to our external data provider. This information is not specific advice and cannot be relied upon for mortgage lending purposes. All information contained in the property report is publicly available.

For further information, refer to Section 5.3 in the CommBank Yello Terms and Conditions.

Free Kit Membership for 12 months

If you’re a CommBank Yello customer, you can receive a free Kit membership for 12 months. Kit is an earning-and-learning, mindfully-spending, money-mastering app for children. Kit is built by x15ventures, which is wholly owned by CommBank.

The Kit membership covers both “Single child” and “Multi-child” plans. It’s available to new and existing Kit customers. New Kit customers will need to apply the code when setting up an account with Kit through the Kit app. Existing Kit customers will be able to apply their code via settings in the Kit app.

Eligible customers can access their unique promotional code in the CommBank Yello hub within the CommBank app.

Any changes to your CommBank Yello eligibility will not affect the Kit membership once you have redeemed. Your unique promotional code cannot be redeemed wholly or in part for cash or cash equivalents in the event you cancel your Kit membership part way through your 12-month membership fee period. If you do not wish to use your code, you can choose to gift your code to someone else. Your code can only be redeemed once for its entire value. To be eligible to redeem the Kit offer, you require a valid Australian residential address.

Kit is a brand of CBA New Digital Businesses Pty Ltd ABN 38 633 072 830 (CBA New Digital Businesses Pty Ltd) trading as HEY KIT. CBA New Digital Businesses Pty Ltd is a wholly owned but non-guaranteed subsidiary of CommBank. CBA New Digital Businesses Pty Ltd is not an Authorised Deposit-Taking Institution for the purposes of the Banking Act 1959 and its obligations do not represent deposits or other liabilities of CommBank or its subsidiaries, and therefore, you may be exposed to investment risk including possible delays in repayment and loss of income and principal invested, as relevant.

CBA New Digital Businesses Pty Ltd has been appointed as an authorised representative (001296799) of Hay Limited (ABN 34 629 037 403 AFSL 515459), who is the issuer of the Kit Account and associated Kit Cards.

More mobile plans

If you’re a Homeowner customer, you could receive $20 off More mobile plans for 12 months. After the Offer Period, you could receive 10% off ongoing. Sign up by 30 June 2025 using a CommBank credit or debit card as your online bill payment method.

More nbn® plans

If you’re a Homeowner customer, you could receive 40% off More nbn® plans for 12 months. After the Offer Period, you could receive 10% off ongoing. Sign up by 30 June 2025 using a CommBank credit or debit card as your online bill payment method.

If you sign up, More will be your nbn® service provider and will handle all technical enquiries, complaints and servicing. The provision of your service will be subject to More’s standard terms of service and policies, available on the More website. CommBank reserves the right to remove this offer at any time.

Amber electric welcome credit

If you’re a Homeowner customer, you could receive a $180 Amber electric welcome credit, applied over six months.

Cashback from our CommBank Yello offer providers (third parties)

If you’re a CommBank Yello customer, you can receive cashback offers and other benefits from our CommBank Yello offer providers. Cashback will be paid into your most recently opened individual account, unless you have selected a different account via the CommBank app.

If you don’t have an individual account, the cashback will be paid into your most recently opened joint account - even if the joint account holder isn’t eligible for the benefit. Accounts that have been stopped (no longer permitted to make transactions) are not considered opened accounts.

For further information, refer to Clause 5.1 of the CommBank Yello Terms and Conditions. Third Party Terms and Conditions may also apply.

CommBank Mastercard Presale and Preferred tickets

CommBank Mastercard allows certain eligible customers access to CommBank Yello products and services. In relation to the offer of presale tickets to events the following customer rules apply:

Where there is a preferred tickets category you have the opportunity to secure preferred tickets to selected events that are available.

Tickets are allocated on the earlier basis of either:

CommBank doesn't charge an additional fee for obtaining presale or preferred tickets. Mastercard may determine its own fees and charges in relation to presale and preferential tickets.

Customers should be aware that standard handling, booking or transaction fees may apply from individual ticketing agents. CommBank Yello products and services are only eligible to CommBank Yello customers who meet the ‘Base eligibility criteria’ in the ‘CommBank Yello Terms and Conditions’. Refer to the CommBank website for more information on CommBank Yello eligibility.

CommBank does not guarantee but uses reasonable endeavours to ensure that the details contained in an offer are correct at the time of publication. CommBank will not be liable for the accuracy or completeness of any claims made by third party retailers and/or agencies concerning their goods or services nor are we liable in any way for the performance of those goods or services, except to the extent caused by our negligence, fraud, or wilful misconduct or that of our agents.

Offers are subject to terms and conditions of the relevant participating merchants or promoters providing the Offer which are available on participating merchants websites. CommBank does not provide any of the good or services relating to the Offer. CommBank does not make representations or warranties in respect of the offer, goods or services.

Relevant ticketing agencies and/or promoters are solely responsible for offer redemption and fulfilment. In the case of a cancellation, the relevant ticketing agency and/or promoter of the event are solely responsible for any refunds, exchanges or make good of the ticket purchase price.

CommBank does not alter any terms of your existing conditions of use of the Eligible Card or any other CommBank accounts. CommBank may modify or remove the Offers at any time without prior notice.

Opting out of CommBank Yello

You can choose to opt out at any time in the CommBank app or by visiting a branch. To opt out of CommBank Yello program:

If you opt out of the CommBank Yello program, you’ll lose access to benefits and offers like cashback and discounts.

To opt out of the CommBank Yello offers only:

If you opt out of CommBank Yello offers but remain eligible, you can still access benefits like Smart Awards Bonus points, Home Loan cashback and more (subject to your benefit set).

Opting in

You can opt back in at any time by messaging us in the CommBank app or by visiting your local branch. It could take over a month before you can access benefits again.

For further information, refer to Clause 4.7 in the CommBank Yello Terms and Conditions

We take no responsibility for the accuracy, currency, reliability, and correctness of any information regarding CommBank Yello which is included in material created, provided, or managed by third parties (including third party websites). These external information sources are outside our control, and it is therefore your responsibility to make your own decisions about the accuracy, reliability and correctness of information found via these third-party sources.

1 The CommBank Yello Cashback Offers program (‘CommBank Yello Cashback Offers’) rewards you with cashback after you activate (where required) an offer presented to you via the CommBank app and you make a purchase in accordance with the Terms and Conditions of that offer. Cashback is typically received within 14 business days of a qualifying purchase, but in some cases may take longer. If you are not already enrolled, you can enrol if you are at least 18 years old, hold an eligible CommBank credit Mastercard or debit Mastercard, Business credit Mastercard or StepPay digital card, and meet the ‘Base eligibility criteria’ in the ‘CommBank Yello Terms and Conditions’ (latest version available on our website at commbank.com.au/commbank-yello) (‘CommBank Yello’). Your participation in CommBank Yello Cashback Offers is governed by the full Terms and Conditions available in the CommBank app.

^ Streamline Basic and Business bank accounts are not eligible transaction accounts for CommBank Yello.

If you win a prize draw, we’ll need to publish your first initial, surname and state (e.g. A. Citizen, NSW) on our website.

If you don’t use the CommBank app, you’ll still be entered into the prize draws and receive CommBank product cashbacks e.g. home insurance, Home Loan Package, Personal Loan cashbacks (if eligible).

Any CommBank product cashbacks (e.g. home insurance, Home Loan Package, Personal Loan cashbacks) and prize draw winnings will be paid into a joint account if you don’t have an eligible single account, unless you have selected the account your cash benefits are paid into.

To opt out of CommBank Yello, go to CBA Yello and tap the Settings icon. You can also visit your local branch.