The highly anticipated 26th Conference of the Parties (COP26) has wrapped up, after bringing together thousands of delegates and heads of state to accelerate global action on climate change. World leaders were urged to ramp up their commitments in key areas including global carbon trading, emission controls and green finance.

“COP26 reinforces that momentum will continue to build because the urgency to act has not lessened,” says CommBank Senior International Economist and Currency Strategist, Kim Mundy. “Concrete progress on all – or even some – of these issues has the potential to change the global economic landscape.”

Key takeaways from COP26

The main objective of COP26 was to give national governments the opportunity to update their climate plans in line with the targets set by the 2016 Paris Agreement. These updates are designed to ensure the global economy continues to move towards lower emissions through ongoing structural change.

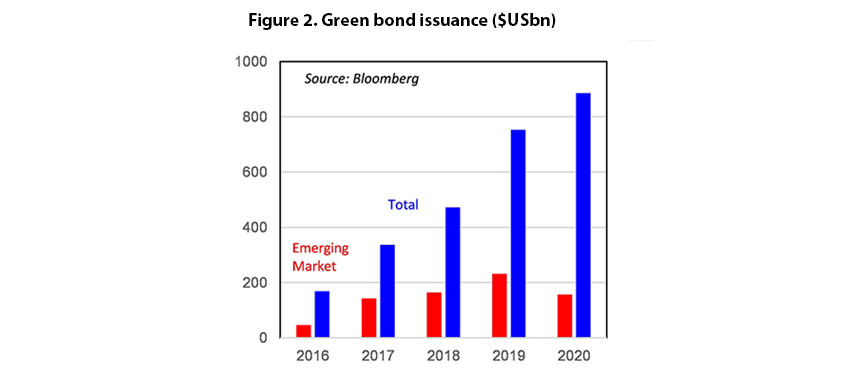

However, Mundy says the conference also reinforced the importance of the private sector in transitioning to a decarbonised future – especially if governments are slow to act.

“COP26 highlighted that the private sector can play a vital role in progressing the transition to net zero,” Mundy says.

“We expect the private sector to progressively adopt more ambitious emissions reduction targets, with an increasing focus on moving to a net zero emissions economy by at least 2050. COP26 reinforced that the private sector, and the finance sector in particular, is not necessarily waiting for governments.”

An orderly transition?

Mundy says that COP26 has seen a modest, rather than ground-breaking, increase in commitments to combat climate change. Notable outcomes of the conference included:

- Several governments unveiled new net zero targets – including, India which pledged to reach net zero emissions by 2070; Vietnam and Thailand, which each pledged to reach net zero by 2050; and Nepal, which bought forward its target from 2050 to 2045.

- Over 100 countries, representing 70 percent of the world economy, signed the Global Methane Pledge to reduce methane emissions from human activity by at least 30 percent in 2030, compared to 2020 levels.

- Over 100 countries committed to end deforestation by 2030 – with the signatory countries accounting for more than 85 percent of the world’s forests.

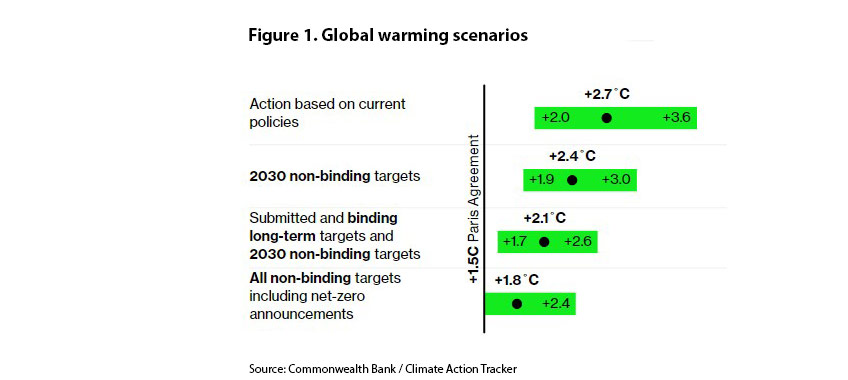

Despite the progress, Climate Action Tracker notes that projected emissions still remain well-above levels needed to reach the Paris Agreement’s goals.

“The inconsistencies between short- and long-term plans suggest two possible outcomes,” says Mundy. “First, net zero targets may not be met and warming will increase beyond the Paris Agreement’s goals. Second, the transition to net zero could be disorderly because it will have to occur within a very short timeframe.”

“Meaningful private sector-driven decarbonisation in the near term can limit the need for a more disruptive transition later if governments move too slowly.”