Help & support

Manage your money, your way

-

Whether it’s making a major purchase, splitting large payments into four, or accessing money before your pay day, our interest-free credit products help you manage your expenses your way.

Financial support

Benefits finder

You may be eligible for benefits, rebates and concessions that could help you save money and help your business with cash flow.

Cost of living support

A range of measures to support your business including deferring your business loan and reducing your rates and fees.

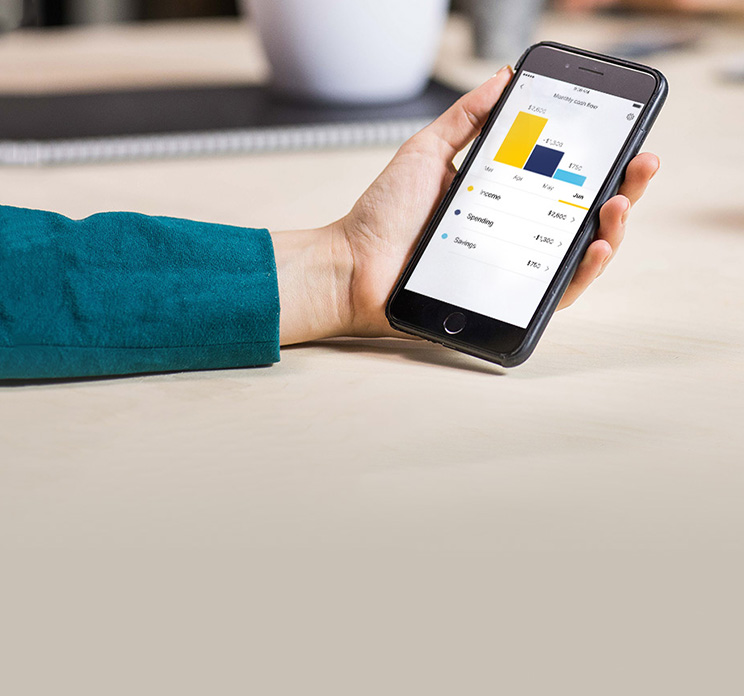

The CommBank app can help you stay in control of your money

- Use Bill Sense to predict and manage regular payments and subscriptions

- Categorise your transactions with Spend Tracker, so you can see what, where and how much you're spending each month

- Get notified when your credit or debit card is used to make a transaction