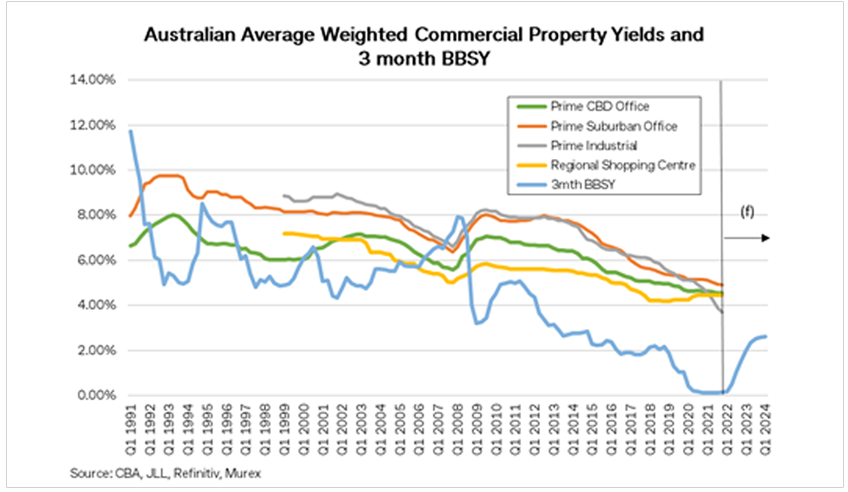

History highlights a positive relationship between the cost of funding debt, investment yields and cap rates applied to commercial property valuations. With interest rate rises factored in for this year, it’s expected to have flow-on effects for commercial property.

Strong investor demand through the pandemic has compressed commercial property yields to record lows, particularly industrial, which in turn has increased values to record highs. For the first time, the Australian average weighted Prime industrial yield (3.71%) has moved clearly below Prime CBD office (4.53%), as at Q4 2021.

However, rising funding costs may impact the market in a number of ways, challenging these high prices and values. First, it may reduce the amount investors can borrow and therefore bid for properties. A reduced number of bidders and the lower competition this creates may in itself be enough to ease trading activity and price growth.

This is likely to be particularly the case for smaller, secondary assets in the first instance, whose buyers tend to rely more on a higher share of debt. Buyers with access to a deeper pool of equity may be able to continue to bid up prices for larger-scale, prime grade assets, creating a division in the market.

Looking back at the six previous cycles from the early 1980s (each of them very different), the rate of yield de-compression has tended to increase, culminating in the GFC, where yields softened at a rate of 120 basis points per annum. Using current projections of the expected increase in the cost of funding as a guide implies cap rates may need to soften from later in 2022.

At the same time, property income is expected to start to increase in the short- to medium-term, as the economy rapidly rebounds from the impacts of COVID. Driving this will be a reduction in vacancy rates as well as from a more general lift in inflation. Projections for increasing inflation would feed through to rents reviewed to the CPI over the next couple of years.

So softening yields or cap rates may, at least in part, be compensated by this potential rise in property income over the next 1-2 years, as the driver of price and value switches from cap rate compression to income growth.

Property valuers will wait for evidence of any change in property prices emerging from trading activity, before applying new valuation metrics. For sufficient evidence to emerge across markets and sectors may take at least 3-6 months in the larger capital cities and longer in Regional Australia locations.

So although market interest in commercial property remains high, particularly for prime-grade assets, a period of softening in cap rates is likely as rising cost of funds impacts transaction feasibility. Lower valuations, however, may yet be compensated by a lift in income over the short to medium term, driven by market improvements or a lift in CPI.

Your trusted partner

At CommBank, we’re dedicated to supporting the commercial property sector.