The retail sector has had some stormy conditions to navigate over the past 18 months, a time when structural changes already underway were accelerated. But some sub-sectors have performed better than others, creating a wider divergence in performance and outlook.

Neighbourhood shopping centres and large format retail, with their more non-discretionary retail offering, have fared better than regional and even sub-regional shopping centres, as well as CBD retail.

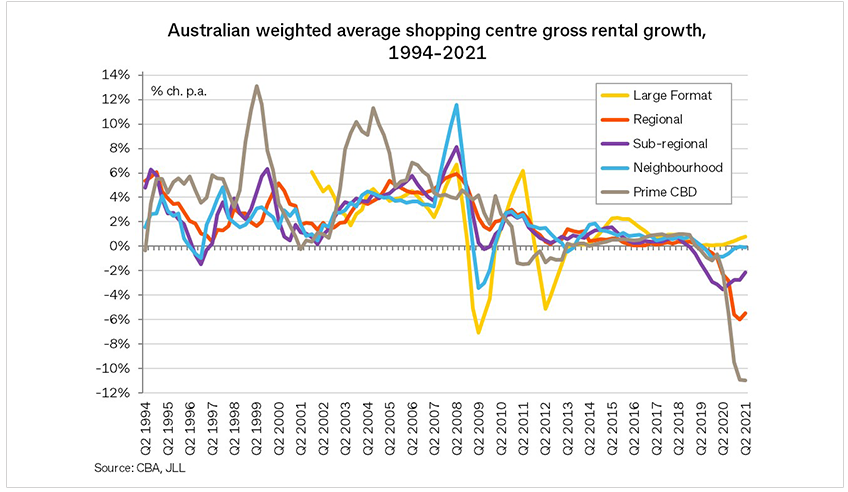

The divergence is most apparent in the movement of rents, but also evident in yields and in vacancy relative to long-run averages.

For regional shopping centres, average gross rents fell in the last quarter in assets in every capital city, with the Australian weighted average change down 6% over the last four quarters. Falls have been recorded for the last 11 consecutive quarters. Average Australian regional shopping centre specialty vacancy was measured at 3.8% in Q2 2021 against a long-run average of 1.5%.

Naturally, CBD retail nationally continues to suffer from the lack of tourists and office workers, although unlike regional shopping centres, before COVID-19 it had been performing strongly.

The Australian weighted average prime CBD rents fell over the last quarter and are now down 11% over the last four quarters. Average Australian CBD specialty retail vacancy was measured at 12.5% in Q2 2021, more than double that of its long-run average of 5.1%. Sub-regional centres have also experienced rental falls, although to a lesser extent, and vacancy levels remains above the long-run average.

Rents are holding up better in the large format retail and neighbourhood sub-sectors, supported by vacancy levels. Vacancy for large format retail was 3.6% nationally in Q2 2021, below its long term average of 4.7%, and neighbourhood centres at 6.3% is very close to its long-run average vacancy of 6.0%.

For average yields across the sub-sectors, not surprisingly large format retail and neighbourhood centres continue to compress. For large format retail, a compression of around 20 basis points in Q2 2021 resulted in the Australian weighted average yield reaching below 6.0% for the first time. The Australian weighted average neighbourhood centre yield is now around 5%.

For the other sub-sectors, yields most recently have been stable after softening slightly through 2020.

Investors are starting to weigh into the retail sector once again, looking through the current challenges or prepared to take on the risks. In 2021, retail property sales to date are the highest they’ve been since 2018, with over $5.0 billion of major transactions already concluded and another $3.2 billion on the market for sale.

Of the sales which have concluded to date in 2021, about a third each, by dollar volume, are sub-regional shopping centres (31%), neighbourhood centres (27%) and large format retail (26%).