Are you counting down the days until an invoice is due from the moment you hit send? Does the thought of a 30-, 60- or even 90-day payment period fill you with dread – leaving you wondering how you’ll stretch your finances to cover bills and expenses until then? Invoice financing could help you out of the pressure cooker, giving you access to unlock the cash you’re owed.

Read on to learn about the different types of invoice financing and how to make it work for you and your business.

What is invoice financing?

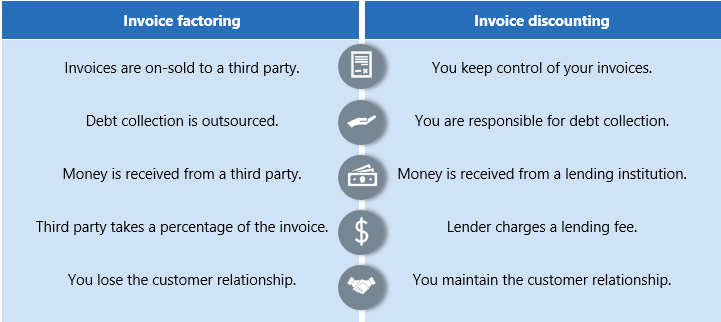

Invoice finance gives businesses access to the value of invoices that have been issued to customers, but not yet paid. There are several types of invoice finance on the market – including invoice factoring and invoice discounting.

Invoice factoring

Invoice factoring is when your unpaid invoices are on-sold to a third party, which then takes responsibility for collecting the outstanding funds. You might choose to use invoice factoring if you want to outsource your debt collection, while obtaining immediate funding for the unpaid invoices. You’ll likely sacrifice a percentage of the invoice as payment to the factoring company. You’ll also lose control of the customer relationship at this point, with the third party chasing your customers to pay.

Invoice discounting

While invoice discounting is similar, you are still responsible for collecting the accounts receivables, while the lending institution provides funding based on the unpaid invoices you submit to them, less a lending fee. Many invoice discounters will require you submit your entire receivables ledger as collateral so they can assess the creditworthiness of your clients.