Strong purchaser demand for industrial assets has seen this sector’s yields continue to compress. However, the story is brighter than just the weight of money as the fundamentals for industrial property remain solid, including increased income via rental growth and supportive economic conditions in Australia.

Industrial property sales are accelerating. So far this calendar year, c$5.7 billion of industrial assets have transacted. This equates to 47% of core commercial property sales, substantially higher than the average share of the past 20 years (18%).

Certainly, boosting this sales total was the recently reported $3.8 billion sale of the 45 properties in Blackstone’s Milestone Logistics portfolio, however, sales generally have been strong. For example, it was reported a Best & Less warehouse in Sydney’s west sold on a very tight yield of 3.62% for $130.1 million.

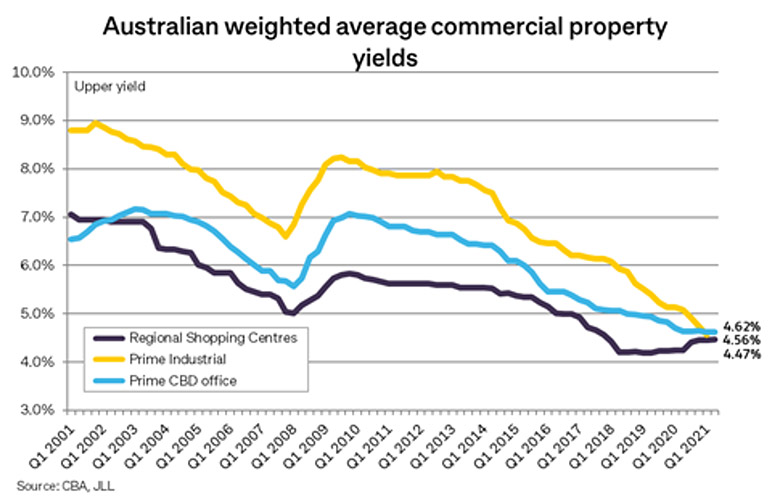

Looking at the Australian weighted average yields highlights the industrial market strength. Yields for industrial property have continued to compress, with the prime industrial average weighted yield down a further 19 basis points (bps) in Q1, 2021 to 4.56%. As this chart shows, at this level, it has fallen below that of the Prime CBD office average weighted yield, for the first time since monitoring.

And it’s not just the prime end of the market. Secondary industrial assets have also experienced notable yield compression with the Australian secondary industrial average weighted yield down a further 35 bps in Q1, 2021 to 5.46%.

Underpinning the sector’s recent investment performance has been strength in occupier demand and subsequent increase in rents. Occupier demand has been strong, in particular for warehouse and logistics space. As the pandemic led to further expansion in online retailing, the result has been higher demand for larger industrial space capable of incorporating new levels of materials handling automation. Occupier demand is boosting rents for prime- and secondary-grade industrial property.

New supply also remains in check, despite elevated completion levels later in 2020. Currently, there appears to be a lull in construction activity with completions down 52% in Q1 2021, compared to the quarterly average (square metres) of the past 10 years. Completions were driven by projects in Melbourne during the first quarter. Also, less speculative development is being undertaken with pre-commitments sought prior to commencement.

Investor interest in industrial property is not expected to wane any time soon, supported by solid industrial property fundamentals including the current economic conditions. This will likely translate into Australia’s weighted average industrial property yield compressing further in Q2, 2021 and beyond, with the impact more widespread throughout Australian submarkets.