Help & support

Even if you’re bill savvy, Bill Sense helps you plan and stay ahead, leaving you to focus on saving.

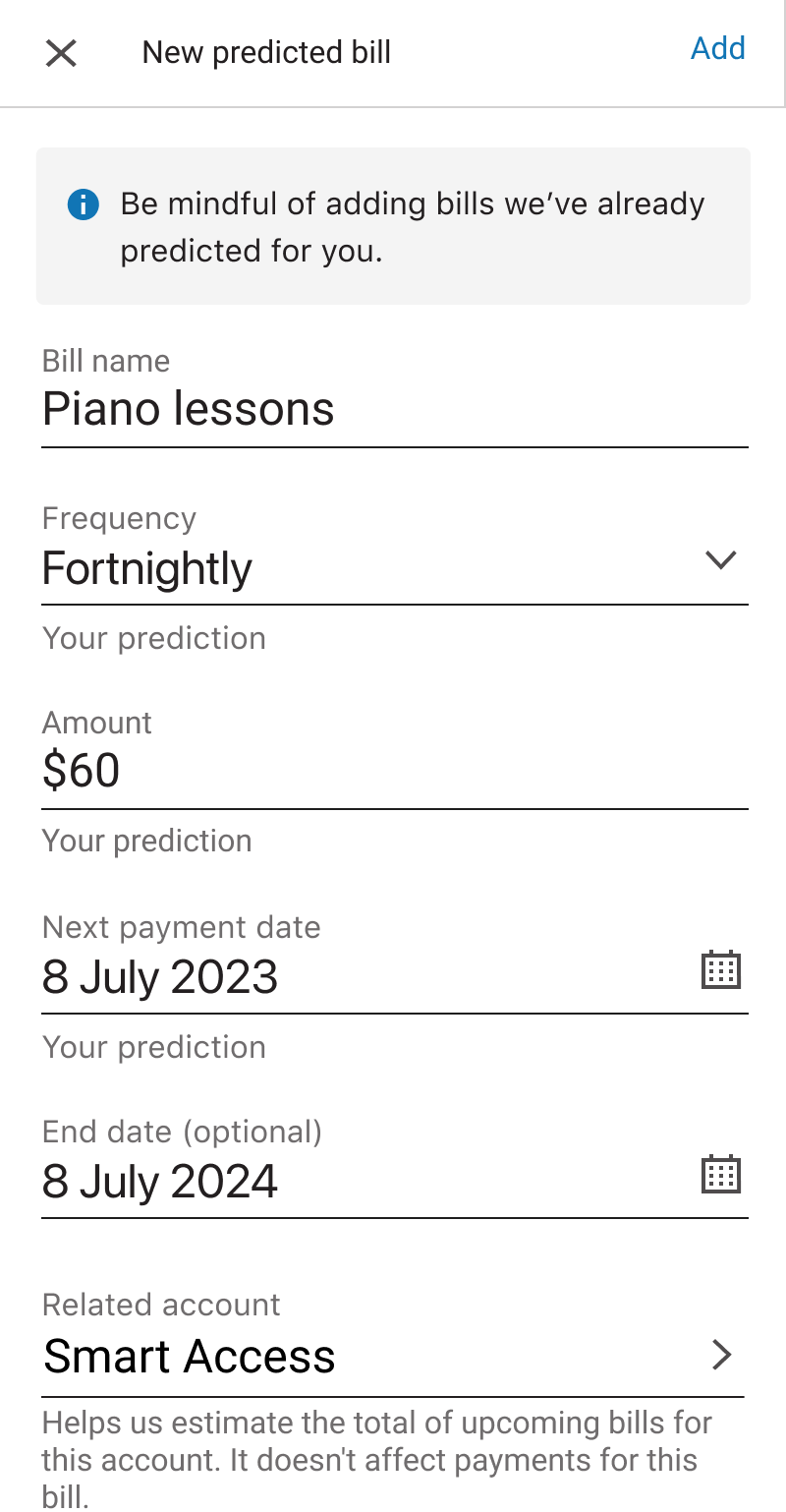

Bill Sense predicts your upcoming bills, but you can also manually add a new bill so you can easily manage all your bills in one place.

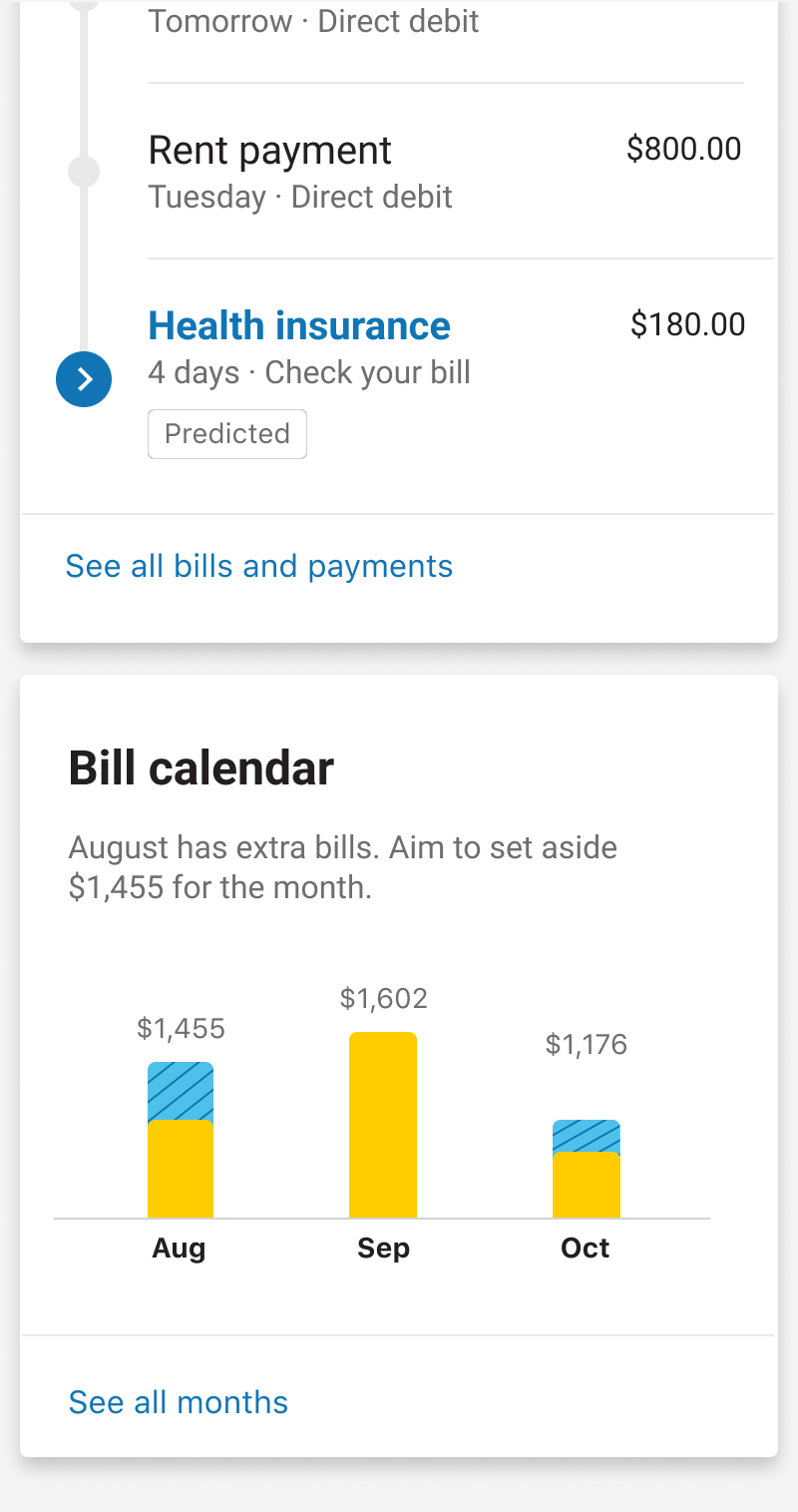

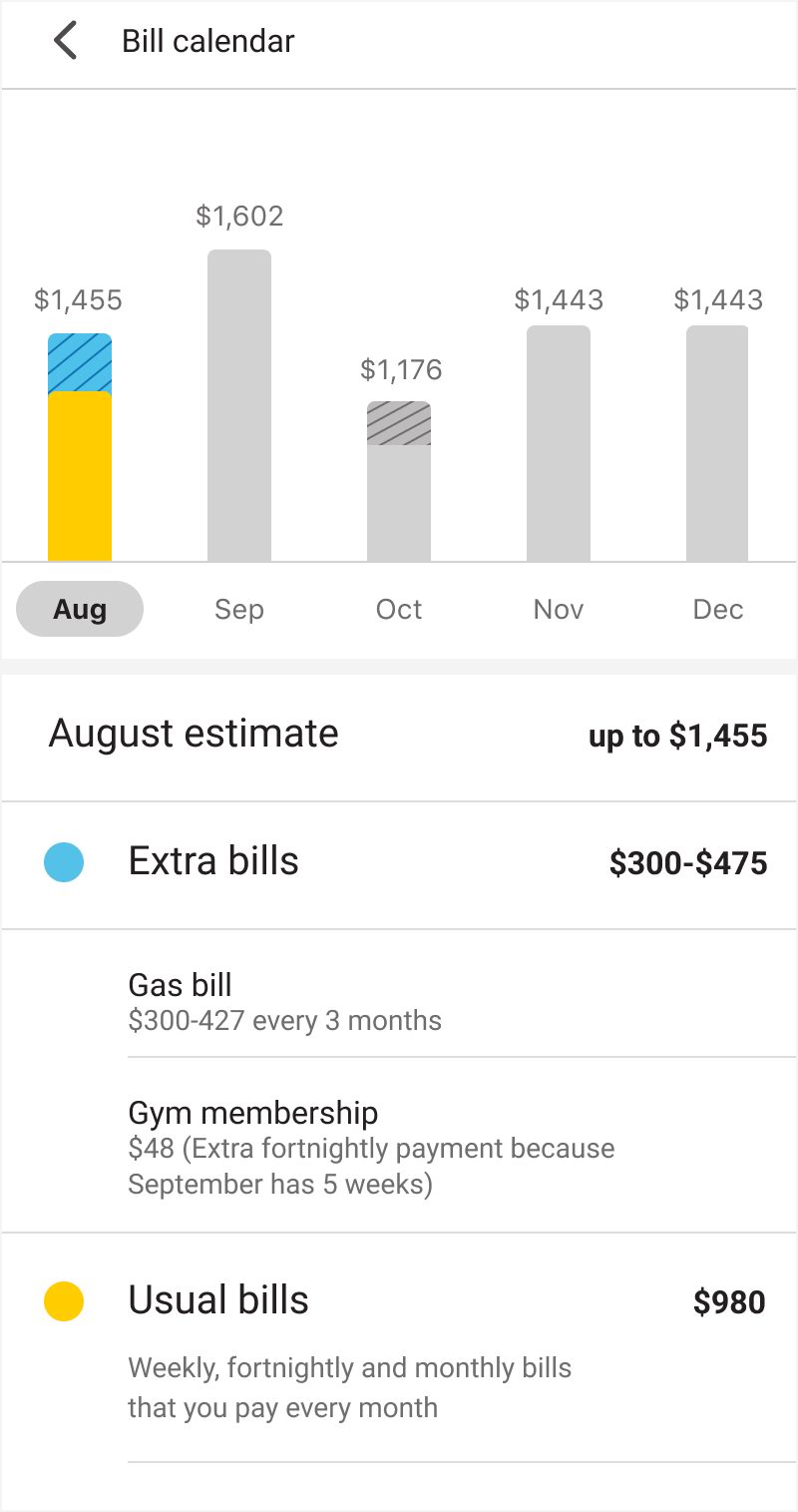

You can see how much you’ll need to set aside for your bills – up to 12 months in advance – and even break it down to see the total amount you’ll need over the next 3 months using Bill Calendar.

To make sure you’re prepared, you can set up notifications too, so you get reminders before your bills are due.

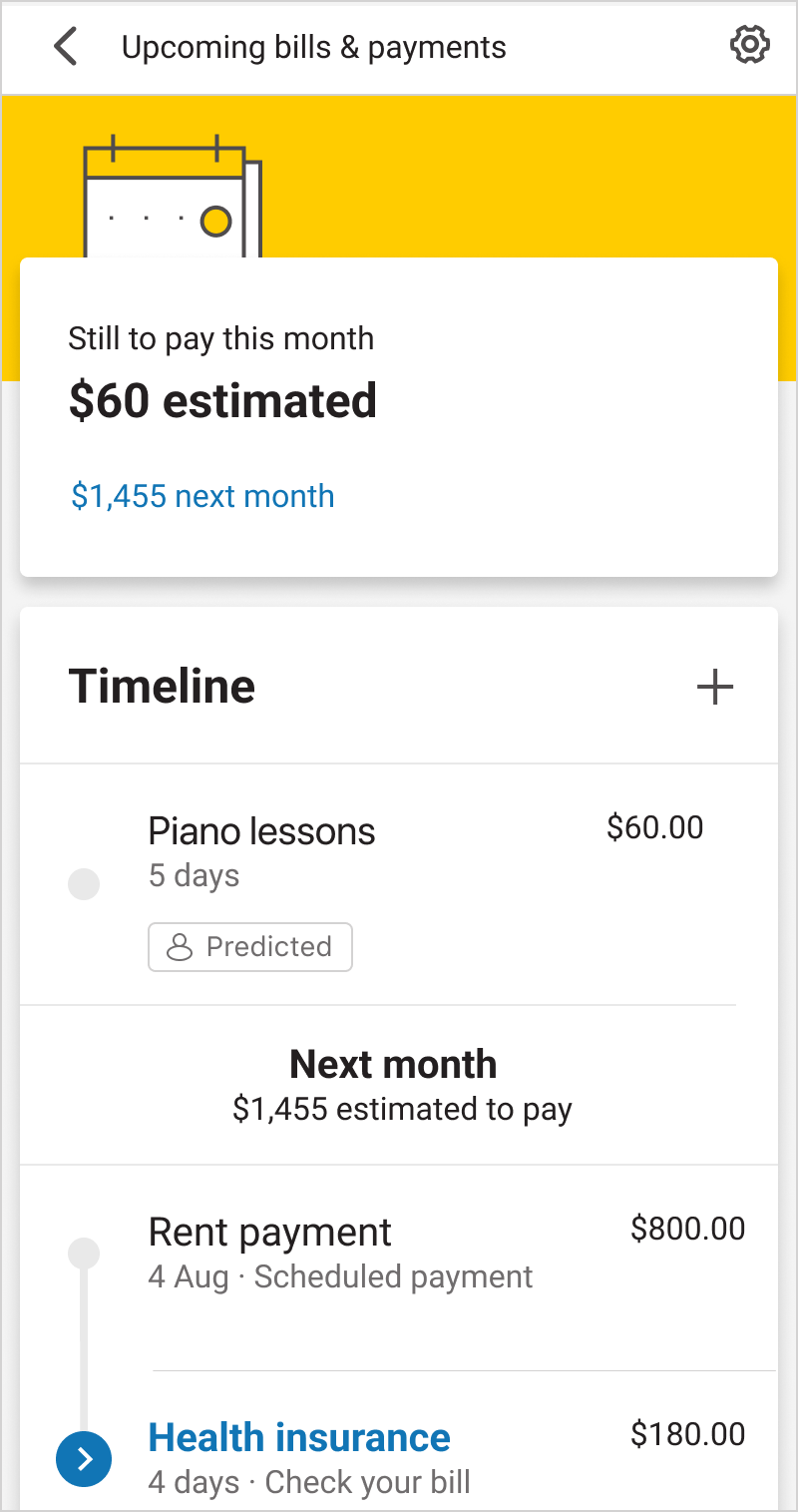

It helps you prepare for times when bills arrive all at once, so you don't get caught out of pocket.

Bill Sense can predict your upcoming bills. A predicted bill is our estimate of an upcoming payment (e.g. your electricity bill).

We don’t talk to your billers – instead your past transactions help us predict your upcoming bill payments.

Our prediction may be different from your actual bill if you’ve changed your payment amount or frequency with your biller, or if you tend to pay bills early or late. But you can fine tune and edit the details on your bills timeline, giving you the most accurate view of what’s due.

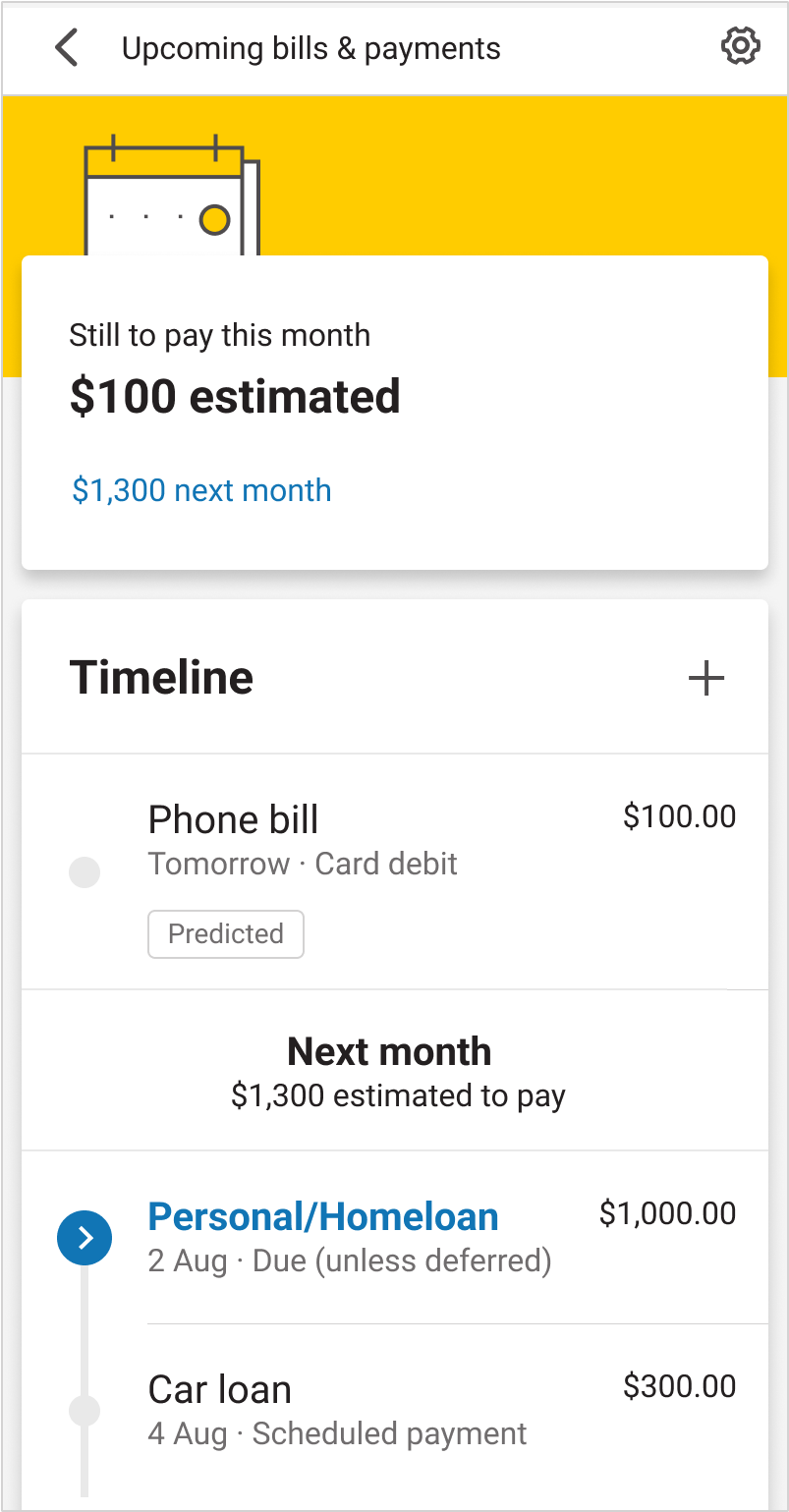

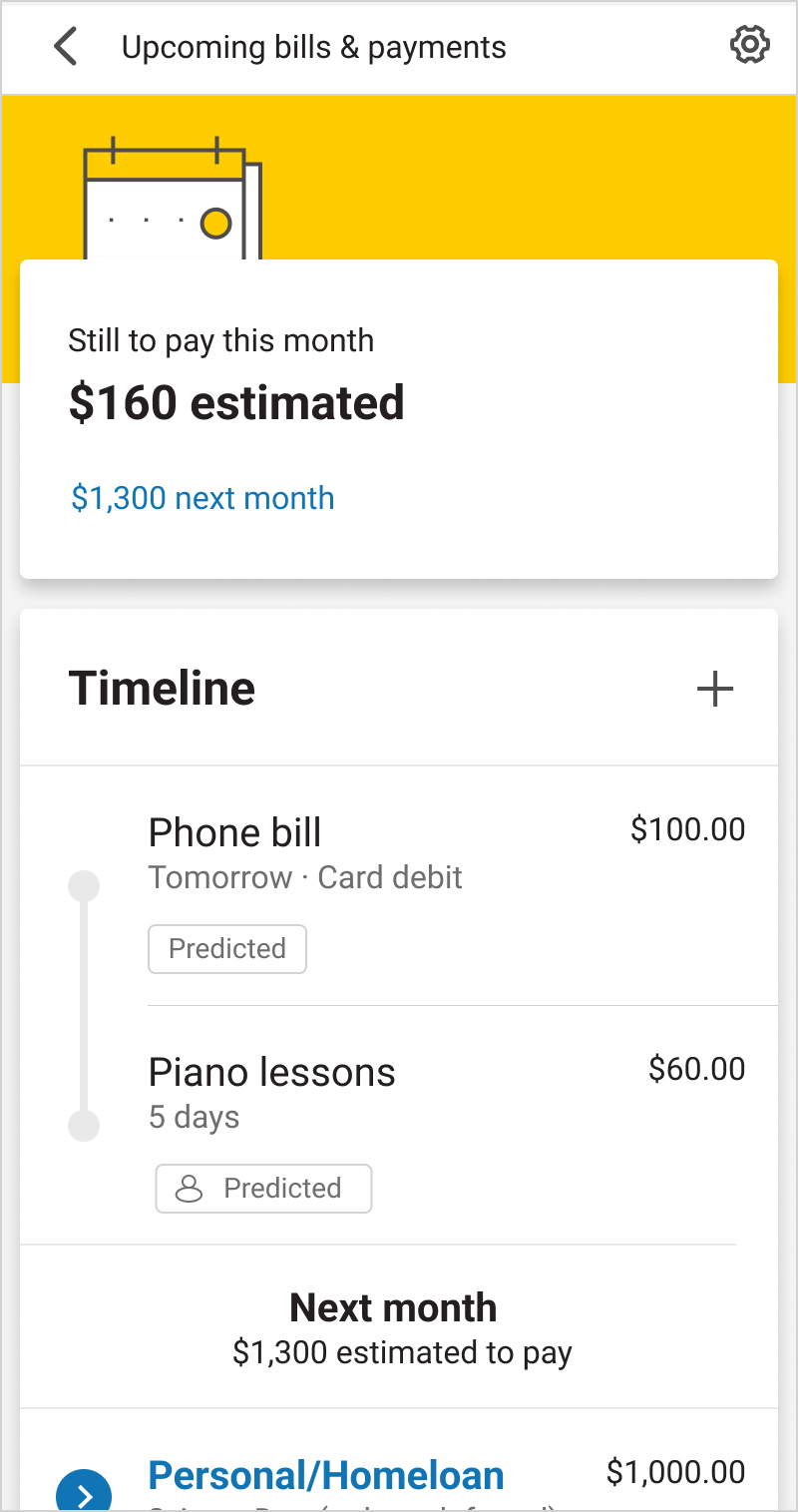

Your timeline (pre-populated with known, predicted and manually-added upcoming bills) will appear. You can add, edit and pay bills. You can also confirm if any irregular payments we flag are actually bills.

If you’re new to CommBank, you may need to use your everyday account first before we can start predicting bills and payments.

Since we predict your bill amount and due date using your past transactions, our prediction may be different from your actual bill. Check your bills before you pay them.

With BPAY View, you can get bills sent straight to NetBank. We’ll tell you when a new bill arrives and remind you when a payment’s due.

Log on to the CommBank app, tap ‘Accounts’ & choose 'Upcoming bills and payments'

We’ll search past transactions, find regular payment patterns and create bill predictions.

We’ll confirm how many predictions we’ve found and add them to your timeline.

If we find new predicted payments, we’ll ask you to confirm possible bills (now or later) before adding them to your timeline.

You can also review any possible matching bills we’ve found before adding your manual bill to avoid duplicating bills

You can edit or delete your manual bills anytime

Log on to the CommBank app, then tap ‘Upcoming bills and payments’ to reach your bills timeline. Scroll down to see the bill calendar.

The bill calendar predicts the total amount you’ll need to cover bills for the next 3 months.

Tap ‘See all months’ to look closely at each month. We’ll highlight variable bills – weekly, fortnightly, monthly bills for the next 12 months. We’ll also flag any extra bills, plus how much you’ll need that month to cover them, so you’re in control of your money. Extra bills include bills that fall outside of the usual bill payment pattern (e.g. quarterly utility payments).

Go to your bill timeline and select the Settings cog on the top-right of the page

Tap ‘See notification settings’ and select ‘Predicted bills’

Select the app notifications you’d like to receive and tap ‘Save’

Your bill notifications will appear in the app under ‘Notifications’

Turn Transaction Notifications on in the CommBank app and we'll instantly alert you when you pay using your CommBank debit or credit card, and when you receive money into your everyday account.

Spend Tracker categorises every debit and credit card transaction, making it easier to see the impact your spending decisions have on your everyday finances.

Cash Flow View gives you the complete picture of your income, spending and saving habits, as well as how you’re trending month-to-month.

Smart Savings looks at your income, bills, spending and transfers to identify potential spare cash each pay cycle. You can choose how to use this money - whether it be to grow your savings, pay off debit or invest.

We’ll protect you from losses due to unauthorised transactions on personal and business accounts when you take the necessary steps to stay safe online.

1 We predict your bills based on patterns in your transactions, how much you pay and when. We may not predict all of your bills. Our prediction date and amounts may be different from your actual bill. Check your bills and due dates to avoid late fees or paying an incorrect amount. See 'Bills and payments' in the CommBank app Terms and Conditions for full details.

2 Bill Sense only includes Principal and Interest Home Loans in the bill calendar and timeline

Smart Savings is available in CommBank app versions 4.38 or above. Terms and conditions as well as important disclosures apply to Smart Savings and will be provided during the set- up process, and can also be found in the ‘Things you should know’ section of the Smart Savings webpage.

The CommBank app is free to download, however your mobile network provider charges you for accessing data on your phone. Terms and conditions are available on the app. NetBank access with NetCode SMS is required. Find out about the minimum operating system requirements on the CommBank app page.